Shield Technology Partners Is Building Something Totally New in Managed Services

It fuses software, services, and a ton of venture capital under one roof. Plus: Pia’s careful progress toward agentic AI for MSPs and more reasons to get serious about quantum computing.

If you’re curious about Thrive Capital, a New York-based venture capital firm with eight- and nine-digit investments in OpenAI, Stripe, and GitHub, among many others on its résumé, you’ll probably enjoy this recently published profile of its founder, Joshua Kushner.

If you’re curious why you should be curious about Thrive Capital, allow me to introduce you to Shield Technology Partners, an MSP platform on the receiving end of a $100 million investment from Thrive (or more specifically its Thrive Holdings unit, which launched earlier this year) and ZBS Partners. Like Titan, another venture-backed rollup I wrote about a few weeks back, Shield is very young, extremely well capitalized, and on the vanguard of a new approach to managed services success built atop leading-edge AI prowess.

But not just leading-edge AI prowess. The Kushner profile I linked to above emphasizes that “taste in other people,” versus an eye for promising investment targets, may be his defining genius, and you see some of that people-first orientation in Shield, which scrutinizes all the usual financial metrics when evaluating acquisitions but looks above all else for MSPs with great leaders, strong teams, and loyal clients.

“The best partners are growth-oriented, believe in their people, value their customer relationships, and are committed to long-term growth,” said Casey Botts (pictured), Shield’s co-founder and COO, in an interview conducted via email. They also, he adds, almost but not quite as an afterthought, “see the benefit of pairing that with technology and support to thrive in a changing industry.”

That combination of culture, tech, and capital is the crux of the strategy Thrive and ZBS are pursuing with Shield, which involves a fusion of each firm’s core competency. For ZBS, that’s expertise in scaling services businesses. The company has made over 250 acquisitions to date across six platforms (four of which are valued at $1 billion or more) in veterinary, HVAC, accounting, and other services, including IT services now via Shield. In each case, on top of funding, ZBS provides hands-on operating assistance designed to help well-run and staffed businesses grow further and faster.

Thrive, meanwhile, contributes leading-edge technical expertise through an AI development team staffed by veterans of Ramp and Palantir and led by Mayank Jain, a former Palantir product lead who’s now Shield’s general manager of technology.

“We believe new technologies now make it possible to deliver services that are personalized, always-on, and future-ready,” he says via email. “Our goal is to reshape traditional industries by pairing the scale of modern technology with a human-first approach, giving MSPs the ability to better serve their customers and grow with confidence.”

The modern technology in question, to be clear, is mostly homegrown. “As technology becomes core to businesses, MSPs need tools that go beyond the one-size-fits-all solutions that dominate the market,” Jain explains.

It’s a model Botts calls “bringing frontier technology to MSPs,” and it entails tailoring Shield’s custom AI tools to the specific requirements of the companies it buys. “We take a partnership approach, meaning that we closely align technology with the unique needs of each business to accelerate growth and future-proof MSPs for what is next,” he says.

Which will eventually include not just using AI to gain productivity but selling AI to grow revenue as well. “Our role is to help give our partners early access to emerging AI technologies, context on what is real and what isn’t, and the tools to deliver AI-enabled solutions to their customers,” Botts says. “Over time, we see MSPs evolve beyond the help desk to become trusted AI advisors for their clients.”

Shield’s tool stack, however, isn’t the only thing that’s drawn the interest of the mostly smaller MSPs it’s currently courting. They also appreciate the opportunity to get in on the AI opportunity without selling to a private equity firm or rollup that will erase their culture and brand.

“What differentiates us most is our ownership model: we typically acquire 60-90% of a business but encourage meaningful ownership for local owners,” says ZBS co-founder Jake Sloane via email. “Paired with Thrive’s technology expertise, it’s a model that really resonates with owners who want to grow without losing their independence.”

As does Shield’s “patient capital” investing philosophy, which emphasizes scaling for the long term over chasing short-term value, adds Botts.

“We have evergreen capital on our balance sheet, which means that we can think in decades rather than in years,” he says. “Just as importantly, our incentive structure enables partners to share meaningfully in the upside of what they build.”

As of last month, five MSPs had found that value proposition appealing enough to become part of Shield, which is eager to add a lot more in the months ahead.

But let’s talk about what’s really new about Shield and Titan

It’s worth noting that Shield is far from the only MSP platform with custom-coded AI tools. New Charter and XTIUM, among others, have AI dev teams too.

Nor is Shield alone in deploying patient capital. Evergreen Services Group has a similar buy-and-hold strategy.

Yet what Shield and Titan alike are building, I’d argue, is unlike anything the managed services space has seen before, and not just because they’re funded by venture capital rather than private equity. At first glance, both firms look like big, sophisticated managed service companies with in-house AI software units. But what if they’re actually AI software companies with in-house MSP units?

Or to put it differently, what if they’re the first examples I at least am familiar with of managed services software makers that buy MSPs rather than partner with them? It’s a question first brought to mind by something Titan co-founder David Heffernan says during an interview that will air this Friday on the podcast I co-host.

“What’s the best way to actually go and enable MSPs to enact this AI wave and enact this AI change?” he asks. “We think the only way to really do that is combine both into one—combine a software company, combine an MSP, under the same roof.”

Any RMM/PSA vendor reading this, I’m sure, can see the appeal right away. If ConnectWise, say, adds a new feature to one of its products it has to make all its partners aware of it, persuade them to implement it, teach them how to use it, and then hope they employ it to its fullest effect. Shield and Titan, by contrast, don’t have to hope anything, because their MSP users are all equity-owning stakeholders of the very same company that built the new feature. All they have to do, just as a corporate IT department would, is roll the thing out.

Along the same lines, pretty much every vendor that sells to and through MSPs will tell you, accurately, that they only grow if their partners grow. Well, what better way to ensure your partners follow proven growth-accelerating best practices in sales, marketing, service delivery, and everything else than to own a majority interest in those partners?

I don’t expect NinjaOne and N-able to start making bids on MSPs, mind you, but I will be deeply interested to see if the bet Shield and Titan (and their giant VC backers) are placing on a deeply unconventional approach to managed services pays off.

Want to hear about Titan straight from its co-founders?

Like I said, they join my co-host and me on our podcast, MSP Chat, this coming Friday. In the meantime, you’ll find a live recording of the panel session we hosted at the Autotask Community Live conference-within-a-conference during Kaseya’s DattoCon show recently right here.

Pia takes MSPs to the couch on agentic AI

While Shield and Titan build radically new software/services hybrids, Pia is bringing AI to MSPs the old-fashioned way. How they’re going about it—slowly—and why are both very interesting.

To be clear at the outset, Pia could be most of the way toward selling fully autonomous agentic AI (a la Atera) to MSPs right now if it wanted to. It just doesn’t think there would be a lot of buyers.

“From a psychological perspective, the technology has progressed significantly faster than humans are ready for,” says David Schwartz (pictured in black), the company’s CEO on an interim basis since February and permanently since June. “So we put things in place that ultimately kept the technician heavily involved, knowing that we actually didn’t necessarily need to do that, but it was what allowed technicians to feel comfortable and the C-suite to feel comfortable as well.”

Though Pia’s SmartForms feature, introduced nearly two years ago, can handle a limited range of tasks entirely on its own, most automations diagnose issues, determine how best to respond, and then present the results to a technician. “By the time they get to the ticket, everything’s prepped, ready to go with a recommendation of what needs to be done,” Schwartz says. All they have to do is click an approval button.

“Where we’re going,” Schwartz adds, “is if an MSP decides to not have a technician in the middle or a human in the loop, we can remove that functionality.”

Pia’s partner success managers and developers, who spend a lot of time talking with users to gauge their readiness for that fully agentic future, are detecting signs of movement in that direction. “Just in the last six months, we’ve seen a notable shift,” Schwartz says. “MSPs are finally looking at and understanding that the need to do something is more important than ever before.”

As a result, he continues, it won’t be long before autonomous agents will be table stakes in service desk technology. In anticipation of that day, Pia’s actively at work on an expansion to its platform that looks beyond the service desk.

“Tool sprawl is a serious challenge and obstacle,” Schwartz explains. “What we’re doing is creating the mechanism for you to bring any tool that you need to into the environment and very, very easily integrate it.”

But also automate it, without advanced coding. “Where it’s going is really an orchestration layer for MSPs,” Schwartz says.

It’ll get there soon, apparently. “We’re close. I mean, we’re very, very close,” Schwartz says. “We will be releasing it over the next few months.”

That will just be the latest step in what’s been a long journey for the company. Hard to believe now, but as recently as two years ago Pia was one of a very few vendors even beginning to put AI to work for MSPs. These days it faces competition from both platform players like ConnectWise and Kaseya and startups like Cyft, Thread, and zofiQ (not to mention Everest, Mizo, and Theo, all of which I’ll be writing about in around two weeks). Nic Ferraro, Pia’s CRO (pictured in white above), isn’t terribly intimidated.

“There’s many upstarts that now are jumping onto the bandwagon,” he observes. “We have about seven years of development in this to centralize our ethos around saving the MSP money and improving their unit economics.”

The clock is truly ticking on quantum computing

It’s been a while since I’ve written about quantum computing, but not because the field has been standing still.

To the contrary, just in the last couple of months, multiple experiments have provided the first apparently concrete proof of the long-theorized advantage enjoyed by quantum computers over classical ones. Shares of quantum computing-related stocks spiked upwards just last week after JPMorgan Chase said it plans to invest in the technology, perhaps because rival HSBC is beginning to get results using quantum processors to optimize bond trading.

Hardware maker PsiQuantum, meanwhile, recently closed a $1 billion Series E round led by BlackRock with support from NVIDIA that values the company at $7 billion, and it hardly has the market to itself.

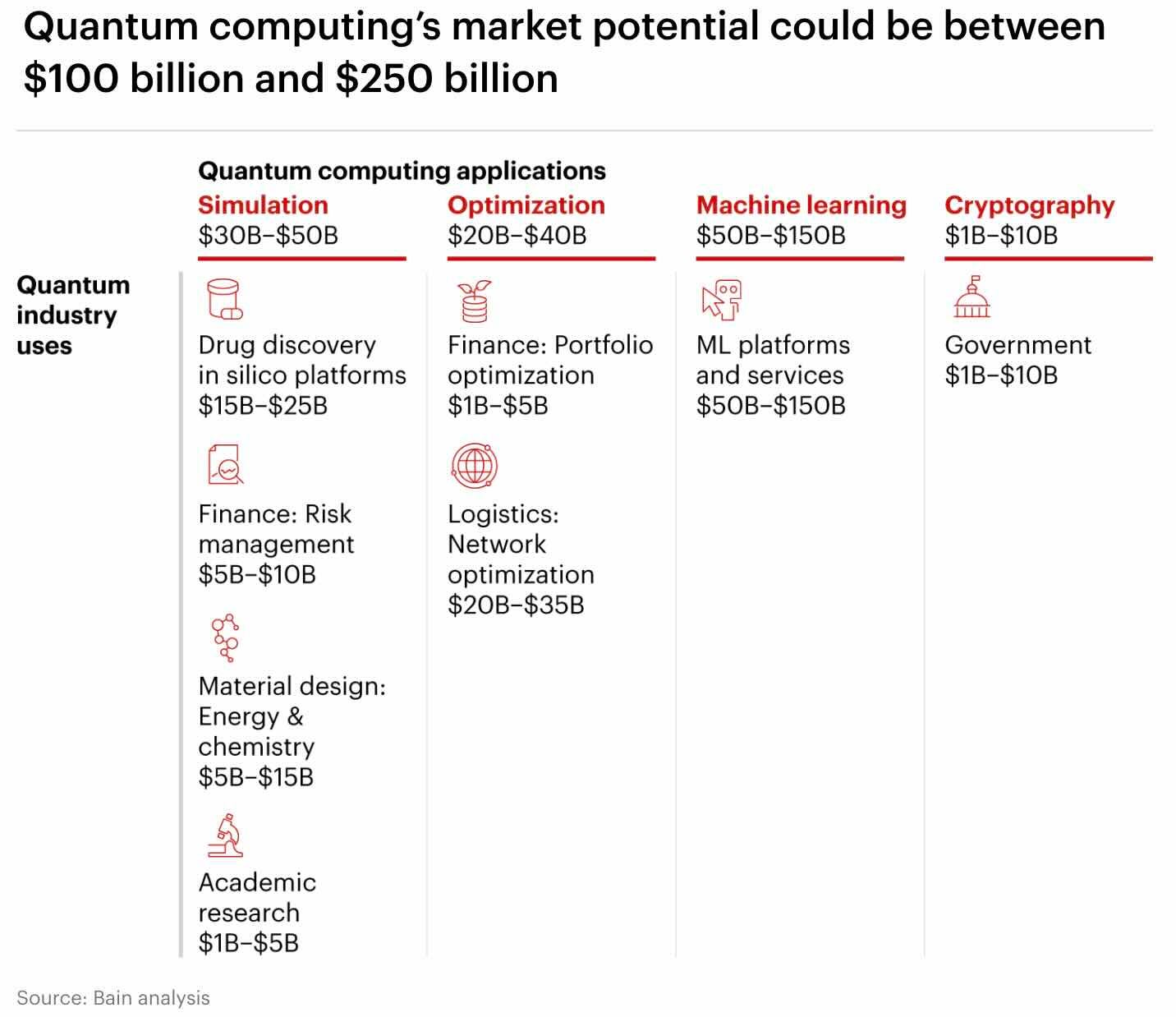

“I count 85 different companies creating quantum computing hardware,” says Dr. Bob Sutor, CEO of Sutor Group Intelligence and Advisory, who covers the industry on his Substack. Maybe 10-15 will survive, he estimates, but those that do will be well positioned to grab a share of the $100 to $250 billion of market potential Bain & Co. expects quantum computing to unlock in coming years.

Those coming years won’t start arriving in earnest until the next decade, which is why NIST won’t deprecate the RSA-2048 and ECC-256 encryption algorithms, both of which are crackable by quantum machines, until 2030 and won’t ban them outright until 2035. Yet consider this post a reminder that you do not have plenty of time to prepare for the post-quantum future.

“Never in the history of computing have we seen things slow down. There have always been cases of new innovations, new techniques, and new ideas driving timelines faster than was originally predicted,” says Tim Callan (pictured), chief compliance officer at Sectigo and vice chair of the cross-vendor Certification Authority Browser Forum. “I expect to see a similar thing here.”

In the meantime, adds encryption expert Dr. Kurt Rohloff, who’s also co-founder and CTO of secure data collaboration vendor Duality Technologies, now’s a great time for MSPs to start getting quantum-ready by educating themselves on the technology. “Can you speak intelligently about what this quantum thing is?” he asks. “Where in your company is quantum somehow going to affect you?” Answering such questions is more than practical these days, according to Callan.

“This would have been hard even a year ago, certainly two years ago, because there was much less material,” he says. “Today, not very.”

And once they know a little about quantum computing generally and post-quantum cryptography specifically, MSPs can begin sharing that knowledge with their customers. “They can give concrete advice, they can drive initiatives, they can put technology in place,” Callan says. “This is where MSPs shine.”

Those with development skills are likely to land plenty of project work eventually as well. Software vendors will add post-quantum cryptography functionality to most commercial applications, Callan predicts, but businesses will need help readying custom ones.

“What we’re anticipating is that a lot of stuff will go really smooth and then there will be a long tail of difficult things, where those difficult things involve mission-critical systems with critical secrets,” he says.

Rohloff foresees plenty of work for pen testing service providers too. “This could be an extension of existing lines of business where organizations could set up quantum-secure pen testing,” he says.

Sutor, for his part, urges vendors to start thinking about quantum computing as well as MSPs. “If I had software engineers on staff, I’d be saying you need to spend 5% of your time right now learning about what this quantum computing stuff is,” he says, noting that there are things you take for granted in classical coding that are impossible in quantum. Like, you know, copying data.

“If you have some data and you want to give it to me, you can do that, but it destroys your copy in the process,” he says, noting that this isn’t some thorny little hiccup we’ll figure out a fix for eventually. “It’s a fundamental part of quantum mechanics and the way the universe works.”

Which means that leveraging the massive power of quantum computing is something you’ll have to do somehow without databases. See why it’s not too early to start thinking about this stuff? Yes, it’ll be years before the promise and peril of quantum computing begin transforming IT economics the way AI is doing now, but none of us knows how many.

“It’s very hard to schedule innovation,” Rohloff says.

Also worth noting

Nerdio has introduced a new AI-automated migration feature for shifting workloads from Azure Virtual Desktop to Windows 365.

JumpCloud and Google Workspace have launched an AI-powered cloud suite combining secure productivity tools, identity, and device management.

Gradient MSP has launched MSP Studio+, a turnkey marketing platform for MSPs that automates professional content creation, rebranding, social media, and more.

New features in GoTo’s LogMeIn Resolve support secure remote access, customizable reporting, dynamic policy enforcement, and brandable support experiences.

Salesforce and Google have expanded their partnership with deeper integrations across Agentforce 360 and Gemini Enterprise.

TeamViewer has integrated its Digital Employee Experience platform, remote connectivity, and agentic AI functionality with Salesforce’s Agentforce service.

MSP360 and IDrive e2 have integrated solutions to offer high-performance S3-compatible object storage and backup management for MSPs and IT professionals.

Blumira has launched an AI-powered security investigation tool and enhanced MSP partner program.

Impartner has introduced HyperscalerGTM, a unified automation solution enabling partners to seamlessly register and transact through cloud marketplaces.

Clio has unveiled a unified AI-driven solution that integrates legal practice management, research, and operations.

The new AI enhancements to Procore’s construction vertical management solution are designed to automate workflows and increase productivity using custom AI agents.

Bitdefender’s GravityZone PHASR is now generally available as a standalone solution.

Veeam’s new Data Cloud for Managed Service Providers is designed to streamline deployment, management, and protection of Microsoft 365 and Entra ID workloads.

Trend Micro and WDH have opened Magna AI, an “AI transformation factory” that integrates AI hardware, security, and applications.

MSSP LevelBlue has acquired XDR vendor Cybereason.

Congrats to Chad Kempt, founder of Fast Computers, for being named the 2025 ASCII Group Member of the Year.

Intermedia has expanded access to its no-cost program for migrating off of aging unified communications platforms.

Apple has a new 14-inch MacBook Pro coming powered by an also new M5 chip with quantum computing-resistant security and a Neural Accelerator for AI processing.

Speaking of quantum-resistant security, HPE has unveiled next-gen AI server solutions and new NIST-compliant quantum resistant features.

NetApp has introduced a new all-flash storage system and AI data engine combining disaggregated storage with NVIDIA-powered AI management.

NetApp has also named Kristine Wedum the VP in charge of its U.S. partner organization.

Lenovo and Owl Labs are launching AI-powered Microsoft Teams Rooms solutions combining Owl’s video technology with Lenovo conferencing hardware.

ASUS is the first of two hardware makers to introduce a new “personal AI supercomputer.” GIGABYTE is the other.

Aryaka’s revamped channel program is designed to simplify partner onboarding, enhance engagement, and drive channel-led growth.

TD SYNNEX has launched a new global FinOps practice in collaboration with IBM.

Integrated Financial Technologies partners now have access to white-label, AI-powered customer service teams.