The Goldilocks Strategy for Managed Services M&A

Evergreen Services Group seeks a “just right” path between rollups and solo MSPs. Plus: why MSP360 zigs where other managed service software makers zag.

I’m not a Berkshire Hathaway shareholder, except perhaps through an index fund or two. Yet I read the company’s annual report, including the one published just shy of two weeks ago, within hours of publication every year.

Berkshire, and its chairman/CEO Warren Buffett, are famous for buying great companies with great brands and great managers, helping them get even better, and then hanging onto them pretty much forever. Ramsey Sahyoun and Jeff Totten, co-founders of MSP holding company Evergreen Services Group (which you’ve read about here before), found that model appealing from the moment they began studying it roughly a decade ago while working at private equity firm Alpine Investors.

“We liked that combination of decentralized operations and this kind of permanent time horizon where you’re not buying companies, putting them together, and flipping them to the next buyer,” Sahyoun told me during Evergreen’s Elevate conference in Austin this week. So he and Totten flew to Omaha for Berkshire’s annual meeting. “We’ve gone every year since, except for the COVID years.”

What they learned at those gatherings, as well as from researching similar businesses like Constellation Software, TransDigm Group, and Danaher, ultimately inspired them to launch a decentralized, buy-and-hold-forever company of their own. Today it owns 80 MSPs, including about 30 it bought last year.

These aren’t words Sahyoun would likely use himself, but in an industry split between solopreneur MSPs on the one hand and centralized MSP rollups on the other, Evergreen appears to be pursuing a Goldilocks strategy aimed at finding a “just right” path down the middle.

For example, rollups (like The 20, an also fast-growing MSP acquirer we’ve written about here in the past) generally do everything one way. Stand-alone MSPs do everything their own way, but must figure that way out through trial and error. Evergreen (like New Charter Technologies, whose CEO spoke at Elevate this week) is somewhere in between.

“The acquired companies retain their brand, leadership, culture, and so on, but Evergreen is adding value and enabling those companies to grow,” says Elliott Hyman (pictured), CEO of Lyra Technology Group, the Evergreen unit that manages the company’s MSPs.

“There’s a focus on acquiring good companies, operating them independently, and empowering the leaders of those businesses to run them,” Sahyoun says. “Usually, the best leaders want that environment.”

David Birk, of Englewood Cliffs, N.J.-based MSP Network Doctor, certainly did when he and his co-founder sold the company (which had 130 employees and a roughly $30 million top line at the time) to Evergreen in 2022. “If something’s working, change for the sake of change doesn’t make a lot of sense to me,” he says. “We like running it the way we want.”

The value Evergreen adds to that autonomy comes in three main forms, beginning with the procurement efficiencies, access to vendor executives, and other advantages that come with scale. Lyra has sister units offering ERP, telco, internet, and incident response services too, and plans to add more.

“We’re going to continue to build out adjacencies so that we can be that one-stop shop, with the MSP being the quarterback for the client into the full breadth of tech services,” Hyman says.

Lyra offers best practices guidance in areas like hiring and pricing too. Birk has found the budgeting discipline it’s learned from Evergreen, which like other private investors monitors the financials of acquired companies carefully, especially valuable.

“That actually has been the biggest shift in our business,” he says. “It’s allowed us to run leaner and more insightfully and then also use some of that money that you save to give back to the really valuable employees through bonuses and whatnot.”

According to Sahyoun, though, the biggest contribution Evergreen makes to its MSPs is talent. The company places a senior executive on the management team of every company it buys. “That’s probably the biggest area where we uniquely add value,” he says. “You get a check for the business and you get someone on your leadership team that’s hopefully going to make a really big impact on the company and help it grow.”

A dedicated five-person team at Evergreen HQ recruits those leaders, typically from outside the IT industry and often fresh from business school, and then trains them at a sort of in-house bootcamp. “I’m generally a believer in attributes over experience,” Sahyoun says. “We can teach someone the MSP business. We can’t necessarily teach somebody the attributes of being a leader and inspiring followership and the financial horsepower that you need to have to run an institutionally-backed company.”

Evergreen strives to retain its leaders too through programs like the “Multiplier Club,” which it formally introduced this week. “It gives the people leading our businesses, both the CEOs and their leadership team, significant upside if they’re able to multiply their business,” Hyman explains.

According to Sahyoun, bonuses like that keep managers engaged. “I think people that are highly incentivized to maximize the growth and revenue and profits of their business will just way outperform,” he says.

Big but not too big

The other thing Evergreen and its holdings think they get just right is size. “In our industry, you want to be big, but not too big,” Birk says. Small MSPs lack skills, expertise, and round-the-clock coverage their clients need. Rollups are too big to provide personal attention. Evergreen MSPs, Birk believes, occupy the sweet spot in between.

“Being on the larger end of that scale but not really mega big is where we are, and that’s worked well for us,” he says.

Indeed, at a time when conventional wisdom says that mega big MSPs will be hard for smaller firms to compete with, Sahyoun (pictured) isn’t all that worried about them. “There’s a lot of waste and bureaucracy in a more centralized company,” he says. “There’s just a whole layer that’s not really focused on what matters as far as serving customers and landing new customers.”

Which is why to the degree competition worries him at all, Sahyoun worries about competing with smaller MSPs versus bigger ones. “They genuinely understand their customers,” he says. And knowing your customers well matters even more now than in the past, according to Hyman, thanks to you-know-what.

“We’re going to go through a period in the next five years because of AI where there are very clear winners and losers, and it’s going to be maybe more important than it has been the previous seven that your customers love you,” he says. “You want to have a strong relationship, I think, to fall back on when you’re putting the business and the services you sell through a lot of change.”

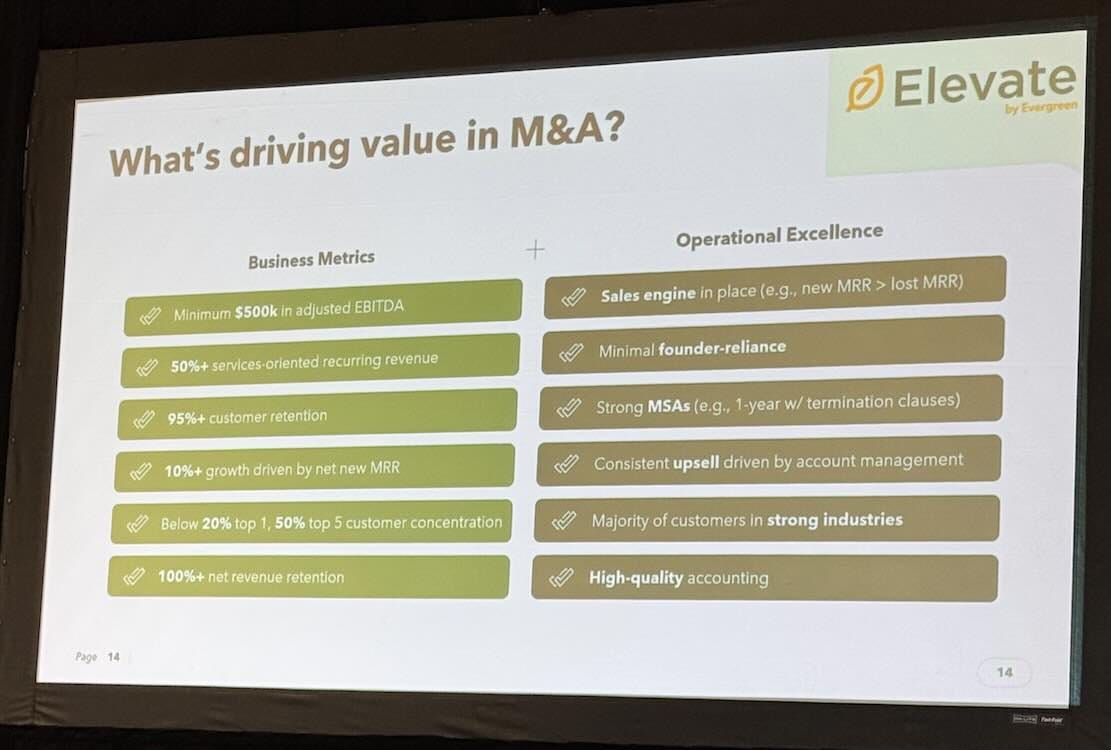

A few M&A numbers for good measure

Evergreen went out of its way to emphasize that Elevate was not an M&A show. It was a show about building a successful managed services practice.

That said, the company does have a front-row seat at the M&A derby. Here’s what they say buyers are looking for at the moment:

Blessed are the peacemakers

As I mentioned before, New Charter CEO Peter Melby was among the speakers at Elevate. Last year, in my characteristically oblivious way, I invited him and Evergreen advisor Craig Fulton to join us on the podcast I co-host for a conversation about M&A market conditions. Each of them independently replied that it was kind of a strange thing to propose given that they’re, you know, competitors vying ferociously every day for the hearts and minds of acquisition-worthy MSPs.

Yet both of them agreed to come on the show anyway for what turned out to be a great conversation, and they apparently enjoyed the experience so much that they’re now collaborating on conferences together.

This is the kind of miracle workers we are on MSP Chat. Only way to find out what magic will transpire on our next episode is to listen in yourself.

MSP360 goes its own way

Evergreen has no hard and fast rules about who it acquires, but they tend to be larger MSPs. “Our average company when we acquire it is $8 million in revenue and north of a million of EBITDA,” Sahyoun says.

One of those numbers looms large at managed services software vendor MSP360 too, as it happens. “Right now, we target MSPs that are around $8 million in revenue and below,” says Brian Helwig (pictured), the vendor’s CEO.

Everything MSP360 does is optimized for that ideal buyer, he continues, resulting in a company that zigs where competitors zag in interesting ways. For example, unlike Atera and ConnectWise, among others, Helwig’s team isn’t giving much thought to AI right now, because neither are its partners.

“They’re pretty skeptical if it’s going to work. They’re pretty skeptical if it’s consistent. They’re pretty skeptical whose benefit it’s working for in margin, price, product, [and] service,” Helwig says.

MSP360 is also much less interested than Kaseya, say, in building an integrated portfolio of its own solutions. The company specializes in backup, RMM, and remote access. “We’re going to focus on those three things and we’re going to let everybody else come into our ecosystem,” Helwig says. “It’s going to be partner and integrate, partner, integrate, partner, integrate from here on out.”

Backblaze, Deep Instinct, and Wasabi are a few of the company’s top integration partners. Leveraging their solutions rather than building or buying its own is part of what enables MSP360 to charge the low prices that according to Helwig MSPs below $8 million (and below $1 million especially) value way more than AI. The company’s RMM software lists for $59.99 per admin per month, for example, with remote access included at no extra charge. Desktop backup sells for a recently reduced $2.50 per admin per month.

“On top of that, you get a discount depending upon what your volume is,” Helwig says. “You can get it all the way down to almost a dollar and a quarter.”

Prepaying for a year’s worth of any MSP360 solution gets you two months free, but most partners prefer the flexibility of buying without a contract.

“MSPs that are below a million dollars tend to want to stay month to month,” Helwig says.

The larger (by MSP360 standards) partners doing a couple million or more a year now get access to a dedicated technical account manager. “Those ones want to know that when they’re going through a net new customer acquisition, they have the support and help that they need, the expertise behind them, to make the right decisions the first time,” Helwig says.

And yes, Helwig concedes, more expensive solutions have features that MSP360 lacks, but his partners don’t miss them. “If I’m a large enterprise, I probably need them all. If I’m an MSP, I probably only need 50% of them,” he says.

Charging less on more flexible terms for that 50% seems to be working. “We’re north of, I want to say, close to 70% year-over-year growth,” Helwig says.

Also worth noting

Peter Kujawa, formerly VP and GM of ConnectWise’s Service Leadership unit, is now EVP of Service Leadership and IT Nation, reporting straight into CEO Manny Rivelo. Think I might just discuss this with both of them next week at IT Nation EMEA.

NinjaOne’s software for government users is now FedRAMP Ready.

ManageEngine has turned its Log360 SIEM solution into a full-blown security analytics platform.

Apple management software vendor Jamf has inked a deal to buy IAM software vendor Identity Automation.

Addigy has rolled out a new Mac onboarding solution.

The agentic AI push continues at Salesforce, which named the new release of its Agentforce platform version 2dx in honor of the TDX event it hosted in San Francisco this week.

Microsoft has a new voice AI assistant for healthcare providers and two new AI sales agents.

Leveraging AI is about unifying data. Rubrik and Pure Storage have a plan to help.

Rubrik has a whole bunch of new security features too.

GoTo’s LogMeIn Rescue solution also has new security features, plus new AI and translation features.

The problem we wrote about before persists: women account for just 22% of the security workforce globally and an even lower 18% in the U.S., according to ISC2.

Someone’s trying to fix the problem: applications for ESET’s women in cybersecurity scholarship are now open.

eSentire has begun letting MSPs and system integrators run dedicated instances of its Atlas XDR platform.

Some 30% of business endpoints are IoT devices. Attackers are targeting them, according to Deep Instinct’s newest threat report.

CrowdStrike’s Falcon platform is now available through Arrow Electronics.

Bitdefender is now part of the AWS ISV Accelerate Program.

Brian Thomas, formerly of Malwarebytes, is now VP of global MSP sales at IRONSCALES.

Andrew Warren is the new VP of sales and marketing for North America at Exclusive Networks.