SaaS is Hot. Vertical SaaS is Hotter.

It’s customer service, not AI. Plus: a newcomer to the world of AI software for MSPs and why vertical SaaS is heating up.

When last we discussed the market for SaaS solutions, conditions were thoroughly meh. Spending in aggregate was rising but at a declining rate, and retention was proving to be a major struggle.

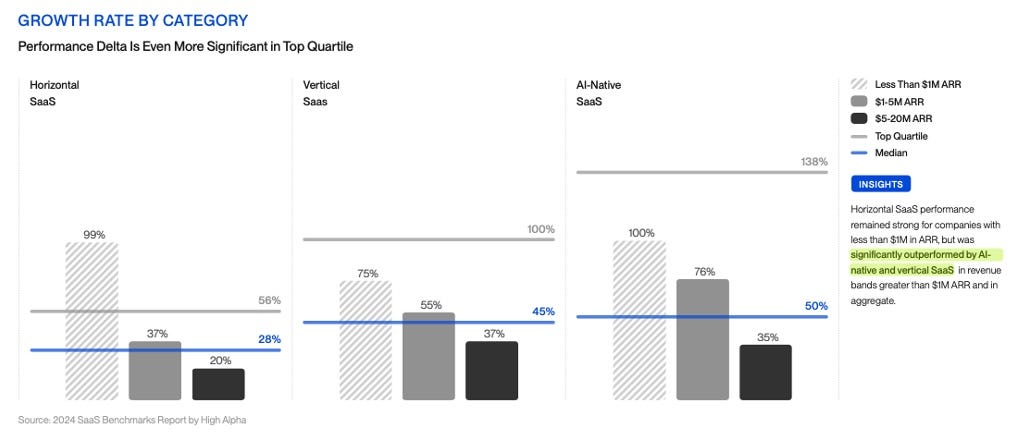

Six-ish months later, with 2024 now in the rearview mirror, the picture looks much better, and especially so for one particular category of SaaS solution. While sales of horizontal SaaS apps rose a very healthy 28% on average last year, according to this report, sales of vertical SaaS climbed 45%.

Tracy Woo, a principal analyst at Forrester, isn’t surprised by that gap. Most businesses have industry-specific needs, she notes. “They’re looking for understanding of the market or of the regulatory pressures.” Cross-industry solutions typically provide neither.

And while financial and CRM solutions are in widespread use pretty much everywhere at this point, a lot of businesses have yet to deploy vertical line-of-business solutions. Take law firms, for example.

“They’re using pen and paper and Excel,” says Lisa Del Real, VP of channel partnerships at legal SaaS vendor Clio. Covid and remote work began changing that, propelling Clio along the way toward a $900 million Series F funding round last year that valued it at $3 billion, but there’s plenty of remaining room for upside.

“Two-thirds of law firms in the U.S. don’t even use a legal practice management system,” Del Real (pictured) says. “It’s an industry ripe for modernization.”

It’s also a giant opportunity for MSPs, she continues, especially at a time when ecosystems are growing increasingly complex and profitability is increasingly associated with specialized skills.

“I think that’s going to be a huge growth lever for a lot of these MSPs as they start thinking about the verticalization of their business and the added services that they can offer,” Del Real says.

It’s those added services, rather than resale margin on software licensing, that makes Clio and vertical SaaS more generally a potential growth engine. “The industry specificity that you can get requires a lot of customization,” Woo observes. “The cloud providers really lean on consultancy services to be able to provide that.”

Learning how to provide that consulting isn’t necessarily a steep climb either. Clio, like most vertical SaaS vendors, offers plenty of free training and certification resources. “On average, we’re seeing MSPs close their first deal within six months, which is pretty impressive seeing as they’re not coming in with deep expertise,” Del Real says.

Besides, she adds, if you don’t help clients with industry-specific requirements, the people who keep their books or manage their lead gen might.

“We’re seeing more and more partners deciding to have different business units, a business unit that focuses on accounting or that focuses on marketing and then offers IT consulting as well,” Del Real observes. Keeping those interlopers away from their customers is all the motivation cautious MSPs should need to start thinking vertically.