It Takes a Village to Retain a SaaS Customer

SaaS NRR numbers are down. Partners, if incentivized right, are the answer. Plus: NinjaOne’s contrarian growth strategy, multi-vendor PRM from Unifyr, and a new marketing show for MSPs.

We shared some bad news for SaaS vendors here a few weeks ago. Sales growth, while still in double-digit territory for plenty of well-known brands both in and out of the SMB channel, is slowing.

Some of that, as we wrote before, stems from IT spending cuts spurred by modest (and possibly declining, after this week’s interest rate cut) fears of an approaching recession. Some of it is a sort of pandemic hangover, as businesses that crammed several years’ worth of SaaS buying into 18 frenzied months of investment in hybrid work technology cut back purchasing. And some of it, frankly, is the cloud app rocketship finally, inevitably, coming back to earth.

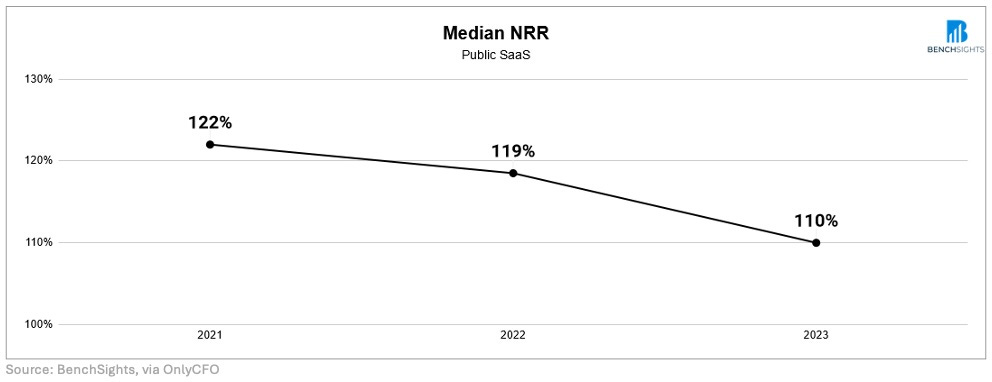

But some of it as well is another issue my previous post didn’t address. SaaS vendors aren’t just struggling to acquire customers. They’re struggling to keep them too. Net revenue retention (NRR), like net new sales, is dropping.

Now, folks familiar with the dynamics of NRR probably won’t shed tears of sympathy for cloud software makers based on that chart. NRRs over 100% mean that companies are not only preserving the revenue they already have year over year but expanding it through cross-sales and upselling. The problem is the trend line above has apparently extended into 2024, according to recent data from ChartMogul. Indeed, from startups with less than $300,000 of ARR to high-flyers like Salesforce and ServiceNow, no segment of the SaaS market collectively recorded 100% NRR or better in the first half of 2024.

This is even worse news than it might appear if it persists, according to friend of the blog Janet Schijns, CEO of channel consultancy JS Group.

“For a SaaS company, and I will stake my reputation on this, the most important metric is net revenue retention,” she says.

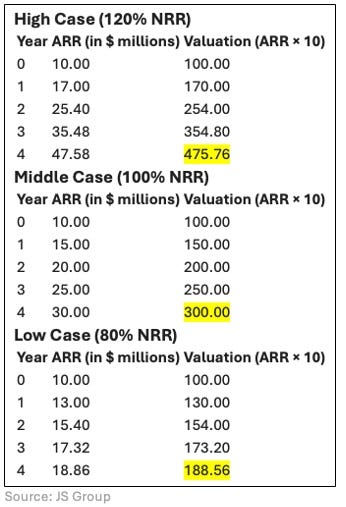

Some hypothetical numbers she worked up for me illustrate the point. Imagine a vendor with $10 million in ARR adding a steady $5 million worth of net new logos annually. At 120% NRR, it’s top line will have grown over $375% to $47.58 million four years later. At 80% NRR, by contrast, revenue will have climbed a little under 90% to $18.86 million by the same date, even though the vendor sold $20 million to new clients.

“The company is hemorrhaging 20% of its existing revenue annually due to churn,” Schijns says. “It’s a classic case of running to stand still.”

There are at least three reasons a lot of vendors appear headed in that unenviable direction, beginning with the fact that the SaaS world doesn’t know much about retention, in large part because it didn’t really need to before.

“Nobody cared if any of these startups that became a big SaaS player made money,” Schijns says. “It was just get more subscribers, get more subscribers, get more subscribers.”

A related and arguably bigger problem is lots of those new subscribers failed to get value from the software they purchased. Tiffani Bova (pictured), who recently became chief of strategy and research at The Futurum Group, saw it happen repeatedly during her prior stint as senior vice president and global growth evangelist at Salesforce.

“People are logging in, but they’re not using the technology,” she says. “They don’t see the productivity improvements, they don’t see efficiency, they don’t see their promoter scores go up.”

And they never get what they really wanted in the first place, which wasn’t a product but a solution. Buying SaaS apps, direct from a vendor or via a hyperscaler marketplace, is easy. What comes next isn’t.

“They have absolutely no idea how to bring it together, how to integrate it, how to take advantage of a multi-cloud solution,” Bova observes.

Channel partners, on the other hand, do. Contrary to some champions of self-serve, partner-free, product-led growth, it takes a village to build a healthy customer base.

“That’s where I think most SaaS companies are missing it. They think they have a single chain to the customer and SaaS created it,” says Schijns. “Then they don’t understand why it keeps breaking.”

It’s breaking because while most cloud software makers have partners, they’re rewarding them for net new sales instead of NRR, notes Schijns, who would like to see them base compensation on customer satisfaction measures like net promoter score instead, or adopt commission structures that escalate the longer a subscription endures.

Some NRR-oriented enablement would be helpful too, she continues, noting that few cloud app makers teach partners a “disciplined, methodical approach” to retaining customers approaching a renewal anniversary.

“What feature should I be showing them that they’re not using?” she says. “How should I think about their usage that indicates a risk to churn? How do I get them excited about or train them on the solution so that more users are excited about it and using it?”

Now is a particularly bad time to neglect such questions, or neglect to give partners the resources they need to act on the answers. As we’ve written before (and as Channel Program CEO Kevin Lancaster eloquently explains in the latest episode of the podcast I co-host), partners have more vendors to choose from than ever, yet want fewer vendor relationships too. Collaborate with them on NRR and you’ll earn their loyalty. Fail to do so and you’ll lose them—and their clients—to one of your competitors.

“ABC Co. is not going to stop billing with the MSP,” Schijns says. “They’re just going to stop billing with you.”

NinjaOne’s contrarian path forward

I recall writing a story for ChannelPro about NinjaOne seven years ago when the company landed its 1,000th partner, about 18 months after its RMM solution reached market. I also recall discovering over breakfast with two Ninja executives six months later that they were already at 1,600 partners, and then learning they were past 2,000 just three months after that.

These days the company has more than 17,000 customers (counting both partners and corporate IT departments) and is officially a unicorn, thanks to a $231.5 million Series C funding round in February that valued it at $1.9 billion.

Ninja’s selling to bigger MSPs as well as more of them lately too. Sal Sferlazza (pictured), the vendor’s founder and CEO, recalls celebrating 100 device deals back in 2015. Last year, the company signed an agreement with IT franchiser TeamLogic IT (a former Kaseya customer) involving 110,000 endpoints, and it signs an MSP with twenty to forty thousand nodes almost every month.

“We’ve had a lot of success moving up to some of the largest MSPs,” Sferlazza says.

In the interest of extending that success, NinjaOne introduced a migration service for new partners earlier this week. Open to anyone, it’s targeted at rollups, mega MSPs, and other large users with complex environments.

“It’s going to be a big unlock and allow us to close more MSPs faster than we already are,” Sferlazza predicts.

The company also announced a new endpoint warranty tracking service this week and a pricing update that gives users three free licenses to the company’s documentation.

“There’s aggressive packaging beyond that where people can enjoy it at a low cost,” Sferlazza explains. The warranty tracking tool, by contrast, is free for everyone. Sferlazza points to that app and the documentation system alike as representative examples of NinjaOne’s platform expansion strategy.

“Products like warranty and documentation have finite road maps,” he says. “Once they’re built, they kind of work.”

Lots of IT management vendors aim to build stuff that just works. Ninja differs from some of its peers at the top of the MSP tools pyramid in interesting ways though:

On integration: Like Kaseya, Ninja is a fervent believer that technicians and their employers prefer tightly integrated, multi-component platforms to loosely bound solutions from multiple vendors. Over 70% of NinjaOne customers end up replacing more than four tools with NinjaOne equivalents, in fact, according to analyst firm Omdia. Unlike Kaseya, though, Ninja has no intention of integrating everything an MSP needs into its solution suite.

“Having the discipline to know when to build and when to partner, I think, is part of our superpower,” says Sferlazza, who cites endpoint security as a prime example. The company relies on Bitdefender, SentinelOne, and others to fill that need and has no intention of creating its own solution in the future.

“The engineering lift to keep that product best of breed is actually quite high,” Sferlazza notes. “You’ve got to stay where you’re strong.”

On SaaS management: N-able has offered SaaS management functionality since 2022 and ConnectWise bought SaaS backup, security, and management vendor SkyKick last week. NinjaOne, which mostly manages devices at present, plans to add support for cloud solutions too, but its offering will focus less on applications like Microsoft 365 than on the people utilizing them all day.

“Managing the users along with their devices is compelling value,” Sferlazza explains. “That’s the direction we’re going to be heading in.”

On artificial intelligence: Ninja has yet to add generative AI or RPA functionality to its platform, for a reason that the folks at Syncro will appreciate.

“AI is exciting,” Sferlazza says. “New technologies like that also scare me.” Ninety percent accuracy may be just fine for chatbots, he notes, but it’s way too low for endpoint management.

As a result, while Sferlazza (who is chief product officer in addition to CEO) has AI-based end user sentiment analysis functionality in the works, he doesn’t plan to get significantly more ambitious any time soon.

“We know that some of our friends in the market have gone much faster,” he says. “We’re kind of taking our time.”

Radical transparency

Taher Hamid believes MSPs should take their time too, specifically with respect to something many think they need to start perfecting the moment they launch their business.

“Sales is hyper-important and people need to learn sales,” he says. “But if I have time to invest, I’m going invest in marketing all day long.”

Which is pretty much what he did back when he was VP of business development at Alltek Services, an MSP in Lakeland, Fla., that he helped grow from less than a million in annual revenue to $5 million, mostly by investing in lead generation.

“At the end of the day, if I have enough leads coming in, I’m going to get enough practice on those leads to get pretty damn good [at sales],” says Hamid (pictured), who today runs a lead generation service called MSP Camp built around tools and techniques he previously used himself.

MSP Camp, as it happens, is also one of two organizations (along with MSP member organization The Tech Tribe) responsible for a brand-new conference called ScaleCon in Las Vegas week after next dedicated entirely to marketing, sales, and account management. Like the podcast he hosts, Hamid says, the content will be a 100% no-fluff look at how to grow a managed services practice.

It will also, he promises, take on commonplace myths, like the widespread assertion by vendors that with the right collateral and maybe a paint-by-numbers playbook, marketing is easy.

“It’s not easy by any stretch of the imagination,” Hamid says, and pretending otherwise is counterproductive. Tell an MSP that marketing is easy enough times and when prospects fail to cascade into the sales funnel they’ll eventually assume it’s their fault and drop the whole thing.

“It’s a surefire way to get people very disengaged,” warns Hamid, who prefers to practice “radical transparency” instead. Anyone can master marketing, he frequently tells MSPs. It just takes a while.

“There’s a lot of complexity and nuance to it,” Hamid says.

Too much, in fact, for most MSP founders to handle. “If you’re truly going to find success with this you need to have a marketing coordinator,” Hamid asserts, and probably sooner than you think you can afford it.

Until then, he adds, you’ll have to do it yourself. And no, he continues in a further bit of tough love, even newcomers to the business aren’t too busy to shoulder that burden.

“Even if they have five, six, seven clients, they still probably have a lot of time on their hands given how many endpoints a technician can typically manage,” Hamid says.

It’s not too late to register for ScaleCon if you’re into hard truths like that.

Unifyr aims to unify the channel

Marketing has always been hard, of course, but it was at least a little bit easier back when most IT providers resold products from a small handful of suppliers. These days, a large and growing share of channel partners sell solutions that aggregate services, software, and hardware from a mix of vendors and probably a few other channel partners to boot.

“The environment is very complicated,” observes Tobias Hartmann, CEO of the company previously known as Zift Solutions but named Unifyr instead as of earlier this week. Every vendor in that environment has its own set of tools for managing deals too, adds Janet Schijns (pictured) who you met earlier in this post.

“I may have 11 things in my stack, plus my services,” she says. “I’m not going on 11 portals and registering 11 different deals.”

The vendors behind all those portals are no happier about the situation, Schijns adds. “They’ve all crafted alliances with other suppliers and other vendors,” she says. “Everybody’s kind of struggling to keep up with the ecosystem.”

Unifyr’s mission, created with input from Schijns, is to bring everyone within that ecosystem together in one place. That’s something Zift’s partner relationship platform, which remains available, can’t do, because it’s a single-vendor solution. The newly launched Unifyr+, by contrast, is a multi-vendor, multi-partner, multi-tenant solution designed to accommodate hundreds of thousands of companies and billions of transactions.

AI, according to Schijns, makes sifting through Unifyr’s massive database relatively simple. Say you want to market a solution involving products from seven vendors to midsize banks in New York and Pennsylvania, for example. Type that into Unifyr+ using natural language and it’ll pull together all the necessary materials for you. The system will register deals that emerge from your campaign with all seven vendors on your behalf too.

And remember all those SaaS vendors with declining NRR who need a systematic approach to helping partners drive renewals? They benefit from Unifyr+ too, according to Schijns.

“None of them has a PRM and they’re not going to have a PRM, so they need this,” she says.

A second new solution unveiled this week, named UnifyrPro, rounds out the picture by giving both vendors and their partners a centralized marketplace for locating ad agencies, marketing consultants, copywriters, and other demand gen service providers.

Both that system and Unifyr+ have been in development for the better part of a year, a process underwritten by $70 million of funding supplied by Investcorp and others at the start of 2023. According to Hartmann, that same pool of funding will allow Unifyr to offer both of its new services to a carefully selected, invitation-only crop of early adopters free of charge for the next six months.

“There is no business model for Unifyr+, and there is no business model today for UnifyrPro either,” he says. But there will be when user input reveals what people like about the systems and how best to charge them for it. Hartmann’s intensely curious to see what emerges but in no rush to find out.

“I truly believe it’s going to come over time,” he says.

It’s AI agent week!

Experts like Gartner have been making big predictions about agentic AI, a form of generative AI capable of performing complex tasks autonomously, for a while. The future they predicted seems to have arrived.

Like, this week. I’ll spare you the details given the length of this post except to note that Microsoft, Salesforce, ServiceNow, and Workday all chose to introduce AI agents in the past few days. Read up about it here:

Unveiling Copilot agents built with Microsoft Copilot Studio to supercharge your business

Salesforce Introduces Agentforce Partner Network — The World’s First Agent Ecosystem

Salesforce and NVIDIA Forge Strategic Collaboration to Advance AI Agent Innovation

Workday Announces New AI Agents to Transform HR and Finance Processes

Also worth noting

SentinelOne is embedding its Singularity and Purple AI platforms in millions of Lenovo PCs.

Cynomi, the vCISO vendor for MSPs we’ve told you about before, is now listed on the Pax8 marketplace.

Not good: disaster recovery events involving Microsoft 365 domains are up 56% this year, according to N-able.

Also not good: Just 36% of organizations surveyed by Trend Micro have 24x7x365 cybersecurity protection.

Meet “LLMjacking,” yet another use case for data security posture management.

Handy, then, that DSPM and AI security posture management are both now officially part of CrowdStrike’s Falcon Cloud Security platform.

Speaking of data, Veeam has acquired AI-driven data management startup Alcion and named one of its co-founders, Niraj Tolia, its new CTO.

Granular policy controls, enhanced security and compliance features, and some nifty new tab features are among the latest upgrades to Google’s Chrome Enterprise.

HPE’s new ProLiant DL145 Gen11 server is designed for retailers, manufacturers, and others who need a rugged, compact device to deploy in small, often dusty edge locations.

James Edwards is the new senior director of engineering at Keeper Security.

The Alliance of Channel Women has a new philanthropy committee. ACW members and channel leaders Hope DeLaRosa and Jessica Duvall will co-chair it.