NinjaOne’s Old-Fashioned Secret to Success

It’s customer service, not AI. Plus: a newcomer to the world of AI software for MSPs and why vertical SaaS is heating up.

Let’s be clear on one thing upfront: No one need fear for AI’s long-term viability as a business technology.

72% of C-level executives plan to integrate it in daily operations this year, employees everywhere else are secretly using it anyway, AI-related job growth is surging, and AI-related venture funding is too.

On the other hand … there’s a lot of disappointment with AI generally and Microsoft Copilot specifically among early adopters, a lot of AI proof of concepts fail (per earlier reporting), and there’s at least some evidence that highlighting AI in product marketing can do more harm than good.

Maybe, in other words, the business and IT worlds aren’t quite as ravenous for AI just now as some folks say.

NinjaOne’s success certainly suggests as much. At a time when AI figures prominently on roadmaps everywhere from Atera and ConnectWise to Kaseya and Syncro, Ninja is both one of the industry’s hottest makers of managed services software and not focused overmuch on AI.

“A lot of the time when we hear about AI and we kind of pop the hood and look underneath it to see what that specific vendor is talking about, they’re actually talking about automation,” says Erzan Uygur (pictured), NinjaOne’s vice president of business and corporate development, adding that Ninja has been rolling out automation functionality for years. “We see that as a core part of our platform versus something that we need to advertise about.”

In fact, according to Uygur, Ninja doesn’t rely much on advertising as a growth strategy, period. “We can try to have a sales-driven approach, but a customer success-driven approach is a much better way of approaching that from our perspective,” he says.

Which raises a question: could it be that customer success-driven approach, rather than cutting-edge functionality or the kind of crazy-low pricing Kaseya offers these days, that accounts for NinjaOne displacing N-able as number three in market share for RMM/PSA software following 54.1% year-over-year revenue growth, per recent data from Canalys?

That’s the explanation Uygur, at least, prefers. “I think it really comes down to that simplicity of taking care of your partners, listening to them, and delivering them actionable feedback,” he says. “We’ve grown substantially over the last few years especially, but we’ve done a few things from our side to ensure that our growth does not come at the cost of our ability to engage with customers and partners.”

Those include investing heavily in core customer- and partner-facing operational functions. “We spend 3x more dollars on customer success and support than the industry average for SaaS businesses,” Uygur says, adding that they’ve got a 98.5% customer sat score too. “We’ve always prioritized keeping our customers-to-support ratio and customers-to-account management ratio pretty fixed throughout our growth to ensure that the CSAT scores, response times, and the way we engage with our customers remain constant.”

User input continues to drive the company’s roadmap too. “We strive to build a heterogeneous kind of ‘meeting our partners where they are’ approach to product development,” Uygur says.

Which is why the product Ninja bought for $252 million recently was a cloud-to-cloud backup solution. “For the past year as we engaged with our partners and asked for their feedback to help us determine what could add the most value to their technicians and their customers, SaaS backup has come up over and over from our customer base as an absolute priority,” Uygur says. Customers even influenced which SaaS backup vendor Ninja opted to buy.

“Dropsuite came up as the most common answer when we asked who they trust the most and who they like to work with the most,” Uygur says.

There’s probably a lot more to it than this in reality, but it would be nice if NinjaOne’s impressive rise proves that good old-fashioned customer service matters a bit more to MSPs than who’s first to market with this or cheapest to market with that.

“We prioritize every customer as if they’re our only customer,” Uygur says. “We want to continue doing that.”

Following the money

One more thing about NinjaOne buying Dropsuite: As I noted in a video a couple of weeks ago, a curious thing about that $252 million transaction is that it came almost exactly a year after Ninja’s most recent funding round, a Series C worth $231.5 million. Hard to imagine the company sitting on that bundle for 12 months, so where did the money for the Dropsuite deal come from? There is, apparently, an answer to that question, but according to Uygur we’ll have to wait a while to learn what it is.

“We do plan to share more details as the deal finalizes and we secure regulatory and shareholder approval,” he says.

Assuming there are unspent funds remaining at that point, where might the company invest next? By this point, you can guess Uygur’s response to that question.

“Any kind of expansion or growth of the platform is always going to depend on what our MSP partners are giving us in terms of feedback,” he says. Per my speculation in that video, though, sounds like the next big move could have something to do with security.

“Our partners are going from focusing on endpoints—literal physical endpoints—to looking at individuals and people as endpoints,” Uygur says. “We need to protect the user wherever they might be, whether it’s a laptop, whether it’s a desktop, or whether it’s their SaaS applications.”

zofiQ takes on the hyperautomation big boys

That a sizeable, rapidly growing software maker like NinjaOne isn’t prioritizing AI is good news for a newcomer to the world of managed services that I stumbled across recently, because AI for MSPs is almost all it does.

Named zofiQ (pronounced ZOH-fick), the company officially launched its solution two weeks ago, very roughly three years after CEO and co-founder Lee Silverstone (pictured) caught the agentic AI bug and two years after he quit his job at a venture capital firm to pursue that passion. Shortly afterward, an acquaintance sent him a research deck about the MSP market.

“My jaw was on the floor,” Silverstone recalls. “How had I never heard of the space before?”

The crash course he subsequently gave himself, by cold calling MSPs and picking their brain, quickly led him to conclude they were the perfect fit for the kind of product he wanted to build, partly because help desk work is painful and expensive and partly because so much of it can be done (unlike in plumbing or gardening, say) by software rather than humans. The clincher, though, was the realization that the RMM and PSA systems MSPs use are packed with the thing AI needs above all else: data.

“The data lakes that exist at MSPs are so rich,” Silverstone says. “We were like, this is it. This is the space where you can have a massive impact.”

That was some 18 months ago. Since then, zofiQ has built a solution and recruited about a dozen test users, mostly through word of mouth. “We’d meet an MSP, they’d buy the product, and then they would introduce us to someone else,” Silverstone says.

Now he’s selling to everyone, but selling against a whole lot of companies too. As we noted earlier in this post, most of the big names in managed services suites have hyperautomation functionality, as do AI-for-MSP specialists like Pia and RPA vendors like Rewst. zofiQ believes it has three advantages over all of them, however:

It’s easier to deploy. The system connects to PSA software from ConnectWise, Kaseya’s Datto unit, Halo, and others in five minutes, Silverstone says, and is ready for use in a half hour.

Unlike RPA software, it doesn’t require manual configuration.

AI is all the company does, unlike bigger vendors such as Kaseya and ConnectWise that do a lot.

“It’s hard to be a traditional software vendor and all of a sudden become an agentic AI company with a large code base and a large product to maintain,” Silverstone says. “Historically, that’s why startups have built amazing products and won markets. They’re able to be very fast and iterate quickly.”

Already, according to Silverstone, zofiQ can do things none of the RMM/PSA makers can match, like read and act on screenshots attached by end users to their tickets or draw on data from multiple vendor knowledge bases.

OK, but is zofiQ really agentic?

Only partly, I’d say, for now.

“We don’t ask MSPs to define business logic for our agents,” Silverstone says. “Our AI is smart enough to go learn from their historical tickets.”

That’s an important qualification for agentic status, but only one. For the most part, zofiQ’s software is more like a Microsoft- style copilot than an Atera-style autopilot—for now. Fully autonomous functionality, which is already in use on a custom-coded basis for a few especially large customers, is presently in the works for everyone else.

Pricing for the system (a topic we’ve written about at length in regards to agentic AI) is per agent per month. “If you want the triage agent, it costs x. If you want remediation for NOC tickets, it costs y,” Silverstone says. Just like human technicians, he adds, each agent has a daily maximum capacity for tickets processed.

“Once you cross above that threshold you need to hire another,” Silverstone says. “We basically think about them as almost like employees.”

SaaS is hot. Vertical SaaS is hotter.

When last we discussed the market for SaaS solutions, conditions were thoroughly meh. Spending in aggregate was rising but at a declining rate, and retention was proving to be a major struggle.

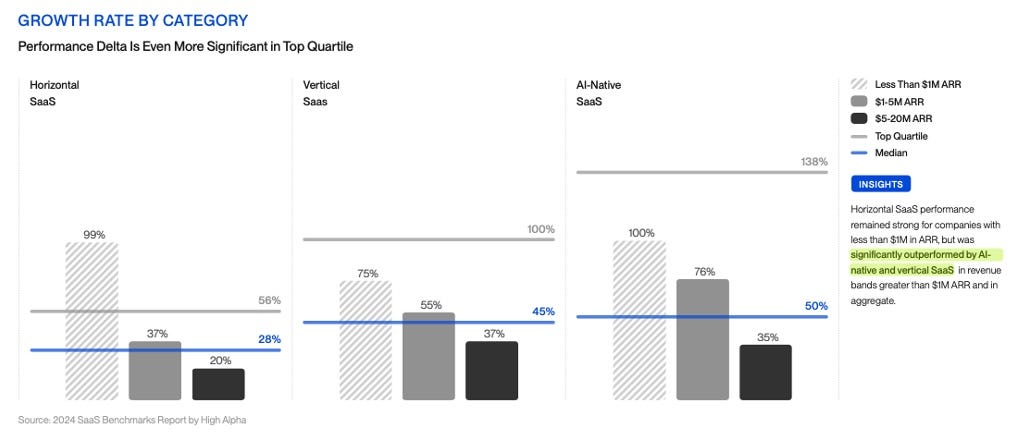

Six-ish months later, with 2024 now in the rearview mirror, the picture looks much better, and especially so for one particular category of SaaS solution. While sales of horizontal SaaS apps rose a very healthy 28% on average last year, according to this report, sales of vertical SaaS climbed 45%.

Tracy Woo, a principal analyst at Forrester, isn’t surprised by that gap. Most businesses have industry-specific needs, she notes. “They’re looking for understanding of the market or of the regulatory pressures.” Cross-industry solutions typically provide neither.

And while financial and CRM solutions are in widespread use pretty much everywhere at this point, a lot of businesses have yet to deploy vertical line-of-business solutions. Take law firms, for example.

“They’re using pen and paper and Excel,” says Lisa Del Real, VP of channel partnerships at legal SaaS vendor Clio. Covid and remote work began changing that, propelling Clio along the way toward a $900 million Series F funding round last year that valued it at $3 billion, but there’s plenty of remaining room for upside.

“Two-thirds of law firms in the U.S. don’t even use a legal practice management system,” Del Real (pictured) says. “It’s an industry ripe for modernization.”

It’s also a giant opportunity for MSPs, she continues, especially at a time when ecosystems are growing increasingly complex and profitability is increasingly associated with specialized skills.

“I think that’s going to be a huge growth lever for a lot of these MSPs as they start thinking about the verticalization of their business and the added services that they can offer,” Del Real says.

It’s those added services, rather than resale margin on software licensing, that makes Clio and vertical SaaS more generally a potential growth engine. “The industry specificity that you can get requires a lot of customization,” Woo observes. “The cloud providers really lean on consultancy services to be able to provide that.”

Learning how to provide that consulting isn’t necessarily a steep climb either. Clio, like most vertical SaaS vendors, offers plenty of free training and certification resources. “On average, we’re seeing MSPs close their first deal within six months, which is pretty impressive seeing as they’re not coming in with deep expertise,” Del Real says.

Besides, she adds, if you don’t help clients with industry-specific requirements, the people who keep their books or manage their lead gen might.

“We’re seeing more and more partners deciding to have different business units, a business unit that focuses on accounting or that focuses on marketing and then offers IT consulting as well,” Del Real observes. Keeping those interlopers away from their customers is all the motivation cautious MSPs should need to start thinking vertically.

As long as we’re on the topic of opportunities for MSPs…

You’ll find no better authority on the topic than Nigel Moore, founder and CEO of MSP community The Tech Tribe and our interview guest on the latest episode of the podcast I co-host. The number one opportunity he points to might surprise you too. Listen in here if you want to know more.

Also worth noting

AvePoint, the MSP platform builder we’ve written about recently, has rolled out a new version of its MSP platform.

JumpCloud, meanwhile, has enhanced the SaaS management features of its platform.

ConnectWise has updated its Auvik-powered network management solution.

Private equity may be coming for Trend Micro.

CrowdStrike has introduced agentic triage functionality.

Proof that WatchGuard agrees it’s all about marketplaces: its software is now available on the AWS Marketplace.

Proof that Check Point agrees that cloud security increasingly is security: it’s now partnering with Wiz.

SailPoint has IPO-ed, a move that landed it on the Canalys Cybersecurity Titans list within a matter of hours.

The newest addition to Netwrix Privilege Secure is designed to seal up VPN vulnerabilities.

Exclusive Networks has added FireMon to its lineup of network security solutions.

Curious about Zyxel’s cloud management solution for SMBs? Try it out risk free.

Joe Kilburg is the new VP of revenue at Liongard.

Avi Israel is the new CFO at Atera.

Werner Wehmeyer is the new VP of customer success at KnowBe4.

Parallels has a revamped partner program with expanded benefits and a new tier for entry-level members.