Lexful Goes God-Mode on AI

The documentation startup aims to be the MSP world’s ultimate system of record for the age of AI. Plus: AI incrementalism from N-able and AI immaturity in the channel, according to IDC.

Few if any of my readers, I’m guessing, will disagree with the following:

In AI, data is gold.

More data means more gold.

More gold means more wealth.

For an AI-related vendor, therefore, amassing data is a great way to amass wealth.

That logic, I’d argue, is the best way to understand what they're up to at Lexful, an AI-native documentation startup launched earlier this week with big ambitions.

How big? Well, as truly obsessive Channelholic readers will recall from Lexful’s cameo appearance in a post last November, CEO Pinar Ormeci sometimes (mostly, though not entirely, in jest) refers to what the company is creating as a “God-mode” service that knows everything an MSP has ever done and provides instant, accurate answers based on that knowledge.

To put it differently, Lexful aspires to provide a single source of truth for running a managed services practice. That sets it apart from the other AI-native startups I’ve written about in recent months, which are building agentic systems of action using data in PSA records to automate otherwise manual work. Lexful, by contrast, is quite explicitly building an MSP system of record for the age of AI designed not so much to replace today’s legacy system of record—the PSA solution—as to turn it eventually into a handy little source of ticketing data for something more comprehensive, more powerful, and far more strategic.

Documentation is the starting point for that journey. The solution Lexful unveiled this week copies data from an MSP’s PSA, RMM, and other solutions into its own database.

“We’re basically migrating with zero risk from their existing tools, and we’re restructuring and transforming that data such that AI can bubble up the right context instantly,” Ormeci (pictured) explains.

That alone, she adds, is pretty valuable. “One of the longest-standing challenges MSPs have had is the quality of their data,” Ormeci says. “There’s a lot of stale data, partial data, out-of-date data that didn’t get updated with new information.” As a result, she notes, the only place a technician can go for the facts they need to close a ticket is often another technician.

“There’s a lot of tribal knowledge that lives in the heads of MSPs,” Ormeci says. “You’re literally pinging other people all the time.”

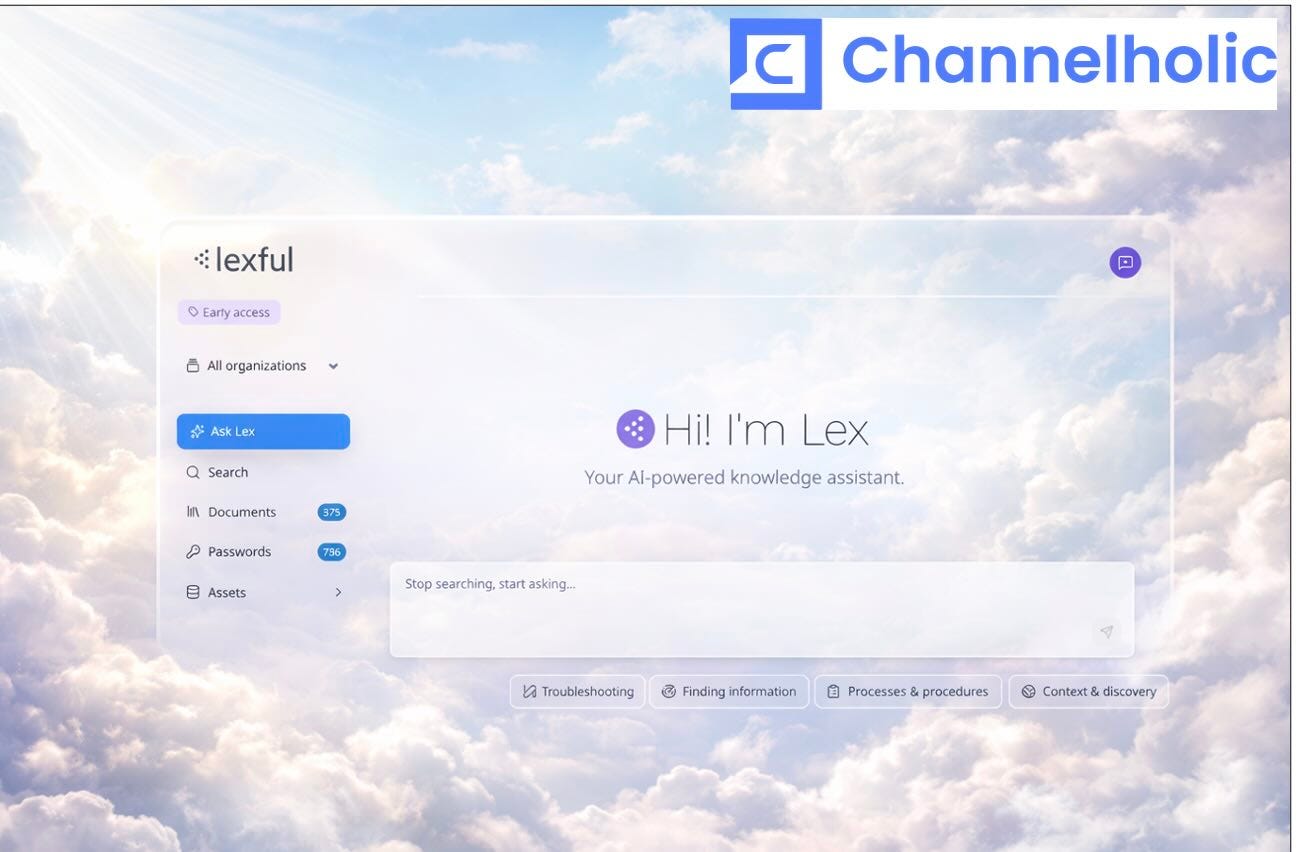

Lexful users can ping Ask Lex, the company’s AI-powered chatbot, instead. “You get instant contextual answers from anywhere you search for it,” Ormeci says.

But search is just the initial issue Lexful is addressing, she adds. Over time, as the system collects more data from more sources and gets more intelligent about proactively spotting and closing gaps in that data, it will become the ultimate repository of an MSP’s institutional knowledge. That’s a role PSA software can’t perform, according to Ormeci, because all it knows is tickets.

“Ticketing is just ticketing, RMM is just RMM, but where does all of the client information live?” she asks.

Lexful is designed to be the answer. “We’re creating a master system of record where you have all your clients’ assets, networks, relations, context, and passwords,” Ormeci says.

And could there be anything more strategic to create for an MSP? Data, Ormeci notes, “affects their revenue growth, it affects the satisfaction of their customers, and ultimately it affects their margins.” If it’s outdated and scattered all over, it’s useless to AI, which makes AI, in turn, useless to MSPs.

“Our whole goal is to help MSPs, whether they’re small or large, accelerate their AI journey,” Ormeci says. “We want to be the de facto AI operating layer that’s going to feed everything the MSP is doing for operational efficiencies.”

Feed everything, mind you, not do everything, like an MSP’s agentic automation tools. “They have AI agents, but AI agents only work as good as the data they’re feeding on,” Ormeci says. Lexful aims to be the place systems of action go for good, complete information.

“Our goal is to get integrated to all the other vendors out there,” she says.

Lexful has a lot of trust-earning and brand-building to do before it realizes its ambitions, of course, and a lot of very well-capitalized competitors to outflank as well (Kaseya, for example, fully appreciates the strategic value of data). But if it pulls all that off, “God-mode service” may actually be an accurate description of what it will have built in the process.

The little things add up on AI at N-able

N-able’s AI ambitions are a little less lofty than Lexful’s.

“We’re not trying to make an AI revolution,” says Mike Adler, the vendor’s EVP and chief technical and product officer. “We’re trying to use AI to deliver capabilities that speak to the individual needs of our customers.”

Which is why you rarely hear about AI updates from the company, despite the fact that it’s been making them for a while.

“It’s not about AI the keyword, the big bang, the press release,” Adler (pictured) says. “It’s really about how are organizations able to use AI? How are we able to deliver features that use AI to make them more resilient and make the technicians more effective and efficient?”

That said, N-able did issue a press release last week listing a number of AI-related enhancements to its suite, some of which it introduced before without fanfare (but that you’ve read about here anyway). Individually, Adler notes, none of that is earth-shattering.

“Brought together, it talks,” he says.

And what it says very much by design, according to Adler, is that in N-able’s view the best way to embrace AI is incrementally.

“AI’s going to have these little influences that are going to grow to have larger impacts on a mid-market IT firm or an MSP as we move forward, because it’ll start showing up in all these little ways that make you more efficient and make you more resilient,” he says.

Two of the little efficiency boosters in that recent press release, both newly launched, are an AI-powered developer portal designed to ease integration of N-able’s unified endpoint management solutions with third-party tools and an AI-assisted scripting and automation tool for UEM users.

“There’s a bunch of even more interesting stuff coming down the line,” Adler says, hinting that “coworking type capabilities” will be among them.

Sounds Anthropic-esque. Is it? We’ll all have to attend N-able’s 2026 Empower conference in Fort Lauderdale two months from now to find out. If the company stays true to the AI MO it’s following so far, though, I can safely predict the unveiling won’t be flashy.

Hey, podcast fans

Did you know that Mike Adler has been a guest of MSP Chat, the podcast I co-host, in the past along with his boss, N-able CEO John Pagliuca? Or that this week’s interview guest is Abraham Garver of FOCUS Investment Banking, the M&A guru I quoted extensively in last week’s post? Or that Pinar Ormeci of Lexful will be on the show in a few weeks?

OK, no way you could have known that last one unless you’re clairvoyant, but it’s true. More great material for you to enjoy right here.

AI is a growing business yet risky bet for channel partners

If maturity, as most parents would attest, is in the eye of the beholder, most channel partners are stuck in arrested adolescence.

Or they are when IDC does the beholding, anyway, based on the analyst’s recently published 2025 North America Partner Landscape study. When asked to characterize their AI business at present, just over 60% of surveyed partners said either ad hoc (“focused primarily on pilot projects and validation activities”) or opportunistic (“driven by business needs when requested by clients”). Only about 39%, by contrast, said repeatable, managed, or optimized.

Those numbers have barely budged in the last year too, notes Steve White, IDC’s program vice president for channels and alliances, suggesting that most of the channel is in the middle range of maturity, and stuck there.

“This is the third time we’ve asked this, and every time we think it’s going to dramatically increase and it doesn’t,” White (pictured) says. “I think it just reflects what’s been going on with AI honestly.”

Which is not, to be clear, an allusion to the flawed, rant-worthy reports of non-existent ROI we all read about last year. Indeed, AI already accounts for 13.8% of revenue now, according to surveyed partners, 81.9% of whom were projecting double-digit growth in AI revenue during 2025 when IDC collected its data last November.

So the issue isn’t that end users aren’t buying AI (78.8% of survey participants agreed there’s customer demand for it), or that partners aren’t selling it, or that those sales aren’t growing. Partners are stuck at the ad hoc/opportunistic stage of AI development because maturing past it requires a degree of certainty that few partners can hope to muster right now.

“It’s growing every day and it’s changing every day,” says White of AI. “They can’t keep up.”

They can’t figure out which solutions to adopt either. “AI kind of makes it 50 choices,” White observes. And roughly just as many pricing models, he adds, ranging from consumption-based to outcome-based and beyond.

“That’s been all over the map and everyone’s changing it all the time,” White says. Committing to this vendor or that solution offering just feels way too risky as a result, he continues, adding that AI is like a game of roulette for partners at present.

“They feel like they’re betting on 17, but they’d rather be betting on black or red,” he says. “We’re not quite there yet.”

In the meantime, White notes (in an echo of what Ingram Micro sees happening in AI these days as well), partners are making good money on the more familiar, less risky work of helping customers put AI-ready compute, storage, and networking in place.

“Without fail, most of them said the biggest opportunity here is modernization,” White says. “You need to have the right infrastructure.”

Maturity will follow eventually, he continues, just as it generally does for teenagers. “I think next year it should move up dramatically,” says White, who sees it headed in that direction already.

“Some of the bets are being made now and some of the winners are kind of appearing,” he says.

Also worth noting

GTIA is scaling generosity. The industry association budgeted $1.5 million for charitable giving last year. This year it’s $5 million.

CyberFOX’s 80-90 security strategy is working impressively enough to have attracted a nine-figure growth investment from Level Equity and others.

New integration with Malwarebytes enables ChatGPT users to assess links, emails, texts, and phone numbers for scams and malware risk directly within the AI interface.

ConnectSecure’s new unified Linux patching feature is designed to automate identification and deployment of kernel/OS patches across major distributions via one tool.

Ransomware resilience functionality from Halcyon is now available out of the box on Dell commercial PCs.

Palo Alto Networks has updated its NextWave Partner Program to prioritize profitability and outcome-based partner rewards.

Keeper Security’s 2026 MSP Partner Program features tiered partner incentives, expanded enablement, increased marketing support, and more.

1Password’s expanded global partner program is designed to give partners a clearer path to recurring revenue from identity security.

SolarWinds has unveiled a refreshed 2026 partner program featuring new tiered benefits, enablement, and demand-generation investments.

Pure Storage’s updated partner program offers deeper enablement and new program tiers.

Cavelo’s new “Flash” prospecting tool aims to accelerate pipeline and business growth for MSPs via actionable risk insights and vulnerability assessments.

The AvePoint Confidence Platform has new agentic AI governance capabilities and multi-SaaS data protection features.

There are still lots of questions, as we noted above, about AI ROI. Portal26 hopes to help with what it calls the industry’s first “AI Value Realization Solution”.

SASE vendor Cato Networks and network-as-a-service vendor Expereo are collaborating to provide a single-source, end-to-end networking and security solution.

Carl Koussan-Price is the new CMO at Syncro.

Gadi Feldman is the new chief product officer and Bob Johnson is the new SVP of global alliances and partnerships at ControlUp.