Ecosystems Aren’t Just for Vendors

They’re essential for MSPs too, per experts at this week’s Canalys Forum. Plus: Canalys confirms that services are eating the world and Sophos goes deep(er) on services with Secureworks.

I’d call the annual Canalys Forum, which I attended in Miami this week, “Woodstock for tech nerds” except that the crowd tilts more toward elite than massive and your head is more apt to be full of insights than controlled substances when you leave.

And I am indeed high on analyst insights as I write this shortly after the conference concluded. Before I share one in particular, though, I need to detour to the interview that began my week, with N-able CEO John Pagliuca.

It was about the managed services software maker’s ecosystem (N-able prefers “ecoverse”) strategy, which Pagliuca said resides somewhere in between Kaseya’s conviction that what MSPs need above all else is the productivity, and hence profitability, that can only be delivered by tightly integrated software from one company and ConnectWise’s deep belief in the partner part of “build, buy, partner.”

In stark contrast to Kaseya (number two in RMM/PSA software, according to Canalys) and significantly less stark contrast to ConnectWise (number one), N-able (number three) believes in a “gated but open” approach designed to get MSPs the best-in-class of everything they use. In categories where the company believes it has best-in-class software, like data protection, it leads with its own solutions. In other especially strategic categories it goes deep with third parties, as it’s been doing with PSA vendor Halo and RPA vendor Rewst since March. And in still other categories where it makes sense, like MDR/XDR, it’ll let MSPs pick whoever they like.

“We’re not going to limit who your endpoint security vendor is or who your firewall vendor is or what SaaS applications [you use],” Pagliuca says. “Our XDR is very much agnostic, because we recognize the hybrid nature and the heterogeneous environments that these MSPs need to secure.”

The key point is that N-able believes its best shot at leaping ahead of its top two competitors lies in building and buying into a go-to-market team of partners with complementary capabilities. And based on my conversations with the folks at Canalys this week, maybe MSPs (and the private equity firms now rolling them up) should think the same way.

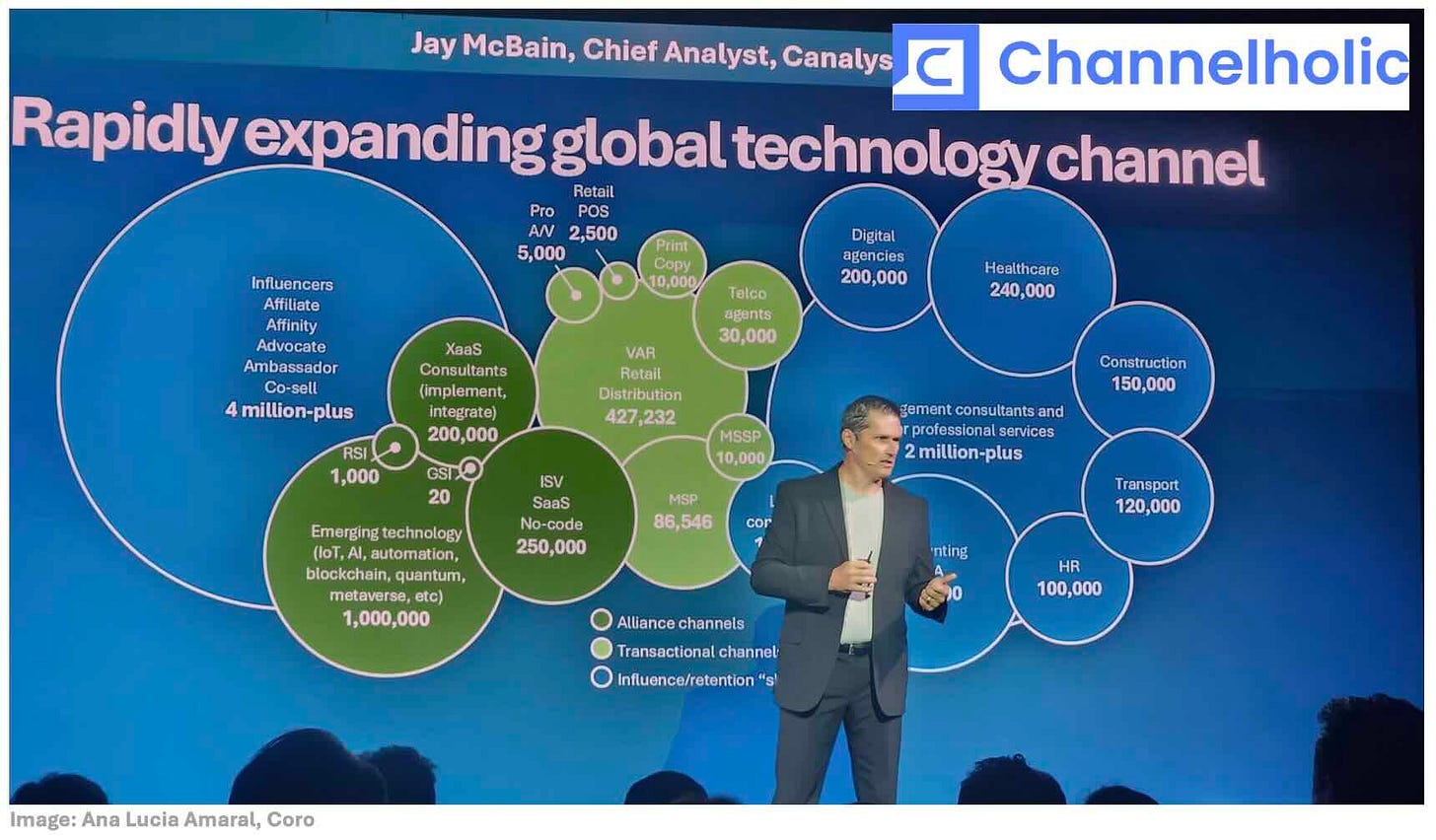

To appreciate why you must first appreciate the changing nature of who MSPs sell to. If I’m the traditional buyer of yesteryear, says Canalys Chief Analyst Jay McBain (pictured above), I desire nothing more than “a single throat to choke” when it comes to IT. But if I’m one of the millennial-aged buyers who will be negotiating the majority of technology deals by the end of this year, my wishes are entirely different.

“I want the smartest people around me giving me the best advice so that I land at the most cost-effective, best outcome I can achieve as a customer,” McBain says. “I’m only going to do that with a whole group of experts around the table.”

And I want to speak directly with each and every one of those MSSPs, software vendors, hardware makers, integrators, distributors, and other companies my would-be MSP works with.

“I just want to talk to them. I want to look everybody in the eyeballs,” McBain says. “It’s not that I don’t trust you. It’s like a trust but verify.”

Winning over millennial buyers, in short, isn’t a matter of earning “trusted advisor” status. “It’s a team sport,” McBain says.

And there is no “I” in team. To the contrary, the bigger and better your “we,” according to McBain, the faster and further you’ll grow, because your teammates will inevitably be better than you at cross-selling and up-selling their own offerings.

“That’s so important,” says another Canalys analyst, Peter Bryant. “Whether or not it lengthens the deal cycle itself, it will always expand the size of the deal.”

It won’t cost you customers either, because your teammates don’t do what you do and couldn’t replace you if they wished to. Unless, of course, you recruit an MSP onto the team because they possess a skill, know an industry, serve a location, or have capacity you lack. MSPs have been doing it successfully for years, and Devan Adams, a principal analyst at Omdia who covers the channel, expects it to become an even more common strategy for coping with growing technical complexity and specialization.

“I think you’re going to start seeing more and more partnerships between MSPs amongst each other within the entire ecosystem, because it’s going to make more sense,” he says.

And there’s that word again. Microsoft has an ecosystem. Amazon has an ecosystem. N-able has an ecosystem. ConnectWise has an ecosystem. As far as Canalys is concerned, at least, every MSP should have one too.

Going premium

One last N-able detour before we jet back to the Canalys Forum. We know, courtesy of ChannelE2E, that ConnectWise might be on the verge of announcing a response to Kaseya 365, the disruptively-priced managed services solution introduced in April.

“Let’s just say good things happen at IT Nation,” said former CEO Jason Magee to Jessica C. Davis when asked about the matter, referring to the vendor’s imminent IT Nation Connect event.

Don’t look for N-able to follow suit any time soon, though, for reasons that demand a detour within a detour to July 4th weekend of 2021, when Kaseya’s VSA remote monitoring and management application was knocked offline by a cyberattack. Rick Jordan, founder and CEO of MSP ReachOut and one of several Kaseya partners I discussed the incident with at the time, told me it was no problem for him because his company keeps a second RMM system from a separate vendor on hot standby status at all times for precisely such situations.

Smart, I said, but also expensive. Yes, Jordan replied, but I only do business with companies willing to pay more for that kind of premium service.

N-able has similar thoughts about who it does business with. Cost, Pagliuca (pictured) argues, isn’t what the most profitable and mature MSPs prioritize.

“It’s more important that the software is delivering value, efficiency, and security to these MSPs, as opposed to the maybe three or four cents that they might get somewhere else,” he says.

Or to put it differently, in N-able’s view the MSPs best positioned to compete in the emerging age of managed service goliaths will be the ones willing and able to pay more, if that’s what it takes, to build a comprehensive lineup of premium services.

“This industry is going to become a haves and have-nots type of industry,” Pagliuca predicts. “The haves want best in class.”

Services are the place to be in IT

I share a lot of thoughts about industry trends and issues in Channelholic. One of the pleasures of attending the Canalys Forum is I get to sanity-check them with some of the smartest folks in the industry.

Good news, readers. When it comes to the scale and importance of the IT services economy, at least, I appear to be more or less sane. Let’s examine the evidence.

1. Services really are eating the world. I said as much back in January only shortly after TD SYNNEX and Cisco each encouraged MSPs to build their future around outcome-based, services-heavy solutions rather than selling boxes and managing devices.

McBain agrees, only his thinking is backed by a lot more numbers than mine. Businesses worldwide will spend $5.4 trillion on high tech next year, he says. About a trillion of that will go toward hardware, another trillion toward software, and the other roughly $3 trillion will be spent on (wait for it) services, which will command an even bigger share of outlays in the future.

“Services are growing faster than the hardware and software,” McBain says. “Partners are growing faster than the vendors they support.”

Compare publicly-listed service provider Insight to Microsoft, for example, he continues. The latter has grown its market cap an impressive 163% in the last five years. The former has grown its market cap an even more impressive 178% over the same span, and not by reselling software and hardware.

“They’re not cash registers,” McBain says. “They do the consulting, design, implementation, the full cycle, hundreds of services.”

2. SaaS services are an even better opportunity. SaaS vendors, or SaaS startups anyway, are catching on to the importance of partnering with service providers to grow sagging NRR numbers.

“Things like traditional sales, traditional marketing, traditional product-led growth aren’t giving these SaaS companies the type of growth numbers they’re used to,” said Lisa Lawson, a Canalys senior analyst, during a Wednesday morning keynote. “They’re having to go out and diversify their go-to-market routes, which is really good news for partners like you all in this room.”

How good? “For those partners who are successful, the long-term reward is big: Deeper customer engagements with line of business buyers, long-term recurring revenue, and faster growth,” Lawson says.

There can be nice fat buyout offers involved too. “We’ve seen a slew of private equity acquisitions of Salesforce partners,” Lawson says, “further showing just the significant future opportunity, the growth rate, the profitability, the customer stickiness, and the potential for future consolidation and M&A.”

3. Security services are a better opportunity still. Businesses worldwide will spend $87 billion this year on security hardware and software, according to McBain. “The services surrounding that $87 billion is $163 billion,” he adds. “There’s $2 in cyber services for every $1 in hardware and software.” And that services spend is climbing 12.9% annually, versus 9.9% for hardware and software.

4. AI may be the best services opportunity of them all. As I’ve noted in the past, there’s good money to be made in AI infrastructure. And indeed, cloud hyperscalers alone will spend some $200 billion on mostly AI-related IT equipment this year, according to former Canalys CEO and current Informa Fellow Steve Brazier (pictured). Microsoft, to call out one hyperscaler in particular, reported an over 77% year-over-year capex increase in its latest quarterly financials, from $10.7 billion to $19 billion.

Peanuts compared to where services spend is headed though, according to Canalys, which expects the global TAM for AI services to climb at a 59.3% CAGR through 2027 to $158 billion. Others I’ve written about in the last year have similarly rosy projections.

The AI resale opportunity, by contrast, is close to zero. “Because it’s a feature, not a product,” McBain explains.

Sophos matches the services pattern

By now, there’s not a lot of reporting I can add to the news that Sophos has acquired Secureworks, mostly from Dell. Given the $859 million in cold hard cash changing hands, though, it’s literally and figuratively a big deal, and I do have a few thoughts about it. Or one in particular: Why didn’t we see this coming? After all:

Dell had reportedly been shopping Secureworks around since the summer.

Sophos told us back in May that the top two cyber risks on the minds of MSPs and their clients are stolen credentials and the giant shortage of in-house security skills. Buying Secureworks (which rolled out an identity detection and response solution in August) helps in both areas.

Sophos CEO Joe Levy told me just a few weeks ago that private equity firms like Thoma Bravo, which owns Sophos, are “pattern seeking machines” that look for what works and fund more of it. Security services have worked very well for Sophos. Its MDR service in particular is among the fastest-growing products in the vendor’s history. Buying Secureworks opens the door to more such offerings.

“Specifically, this is going to strengthen our security operations services—for both customers that need additional help augmenting their in-house SOC or need a fully managed service,” said Levy in an email interview this week.

One more thought: This is an ever so slight baby step away from the strategy Levy discussed in our earlier conversation to target the “vast underserved segment” of the market beneath the enterprise.

“While Sophos sells mostly to the midmarket and below, we also have enterprise customers, and this will help our expansion into this segment,” said Levy via email of the Secureworks deal.

Also worth noting

OpenText Cybersecurity has rolled out a major update to its Secure Cloud platform for MSPs. Stay tuned for a lot more on this from Channelholic based on an interview at the Canalys Forum this week.

N-able has launched a major new compliance initiative aimed at cybersecurity frameworks, including CMMC 2.0.

Liongard has added cyber asset discovery/inventory and advanced automated documentation to its attack surface management platform.

Among other updates, SailPoint has added an identity security platform for bots and other machines, privileged task automation functionality and an agentic AI preview.

Kaboom! DNSFilter has rolled out integrations with six top PSA solutions all at once.

Security heavyweights CrowdStrike and Fortinet are allying on endpoint and network security.

Sectigo and Fortanix are partnering on supply chain security, which is a pretty big problem

1Password software is now available through TD SYNNEX.

Want to mimic KnowBe4’s success in preventing North Korean hackers from joining your payroll? They’ll now teach you how for free.

The latest updates to Pia’s hyperautomation platform look, dare I say it, agentic.

Moovila has integrated its project management solution for MSPs with Kaseya’s Autotask PSA.

Google has made AI-driven enhancements to Chrome Enterprise and ChromeOS and is previewing a new Enterprise Web Store for extensions.

GoTo has introduced AI-enhanced integrations between its RMM solution and third-party CRMs.

Lenovo has rolled out five “partner journeys” for MSPs and global system integrators plus hot markets like AI and data management.

From the people who brought you SIMjacking and cryptojacking comes LLMjacking, and it’s expensive.

Speaking of expensive, New Relic says “the median annual downtime from high-impact outages is 77 hours,” and each hour costs the victim up to $1.9 million. So, ouch.

Object First has discovered arguably the only thing 93% of IT professionals agree on: immutable storage is critical for BDR.

Sherweb has expanded its lineup of solutions from Veeam.

AppDirect’s marketplace now includes software from email security vendor Trustifi.

Alternative Payments has launched an educational initiative aimed at a topic most MSPs should know more about: financial management.