Do the Math, Venture Capital Says. AI for Managed Services Is the Next Big Thing.

Top Down Ventures is just one of several VCs betting big on AI-for-MSP startups. Plus: N-able isn’t what you probably think it is any longer.

An estimated 20,000 people joined Microsoft in San Francisco last week for its annual Ignite conference. I wasn’t among them.

Instead, I was in Scottsdale, Arizona, seated in a small room at a beautiful hotel with a few dozen people discussing the same topic Microsoft was—AI generally and agentic AI specifically—but almost solely in the context of managed services. I’d argue that as well as Microsoft is performing financially these days, I was the one hanging with the smart money.

And Microsoft really is doing pretty well. The company grew revenue 18% and profit 24% in its most recent quarter, both off massive bases, thanks in large though far from exclusive measure to increased AI spending.

Yet Microsoft’s share price dropped nearly 3% the next day and was down a little over 10% since it reported those numbers as of market close last Friday due to nervousness among investors about the $35 billion the company spent on AI infrastructure in fiscal Q1 alone. That’s roughly $5 billion more than it had projected in July and big enough to have consumed 45% of its $77.8 billion of revenue for the quarter and practically all of its $38 billion of profit. And there’s lots more capex coming.

So sure, while I don’t share it personally, I totally get the nervousness.

The people I was with last week, however, are anything but nervous about AI. Indeed, that’s why they were attending Top Down Horizons, a two-day conference dedicated to investment opportunities at the intersection of AI and managed services and hosted by Top Down Ventures, the “VC unicorn” I’ve written about before.

Top Down is pretty bullish about those opportunities, partly because they don’t require billions in upfront data center spending and partly because the AI bubble being inflated by all that data center spending won’t much affect MSPs when it bursts, but mostly for reasons Top Down encapsulates in a white paper it published earlier this month that catalogs a series of what the company calls signals hinting that it’s a very good time to be funding AI-for-MSP startups.

“We talk a lot about signals because at this stage in the AI evolution signal is almost as important as some of the proof points,” says managing partner Joel Abramson (pictured).

Top Down isn’t the only VC firm encouraged by those signals. As we’ve written here just in the past few weeks, venture capital giants General Catalyst and Thrive are each funding AI-powered MSP rollups. Silicon Valley institution Y Combinator, meanwhile, has money in Everest, a managed AI vendor I’ll be writing about soon.

“Y Combinator has recognized that there’s opportunity in the MSP ecosystem, just as some other great investors have, and great founders,” Abramson says.

The result, as Channelholic readers have seen in story after profile after article, is that there are AI-native, MSP-focused, often VC-funded startups popping up all over the place right now. Which means that MSPs will soon have a lot of actual and supposed innovators to evaluate; incumbent vendors like ConnectWise and Kaseya will soon have a lot of new companies to compete with, partner with, or buy; and people with meaningful sums of money to invest will soon have a lot of reasons to consider buying into the venture capital firms funding all those young companies.

In fact, they do now due to these five trends, most of which Top Down notes in its white paper:

1. Global spending on AI—which is still in its infancy, by the way—will reach $1.5 trillion this year and $2 trillion next year, according to Gartner.

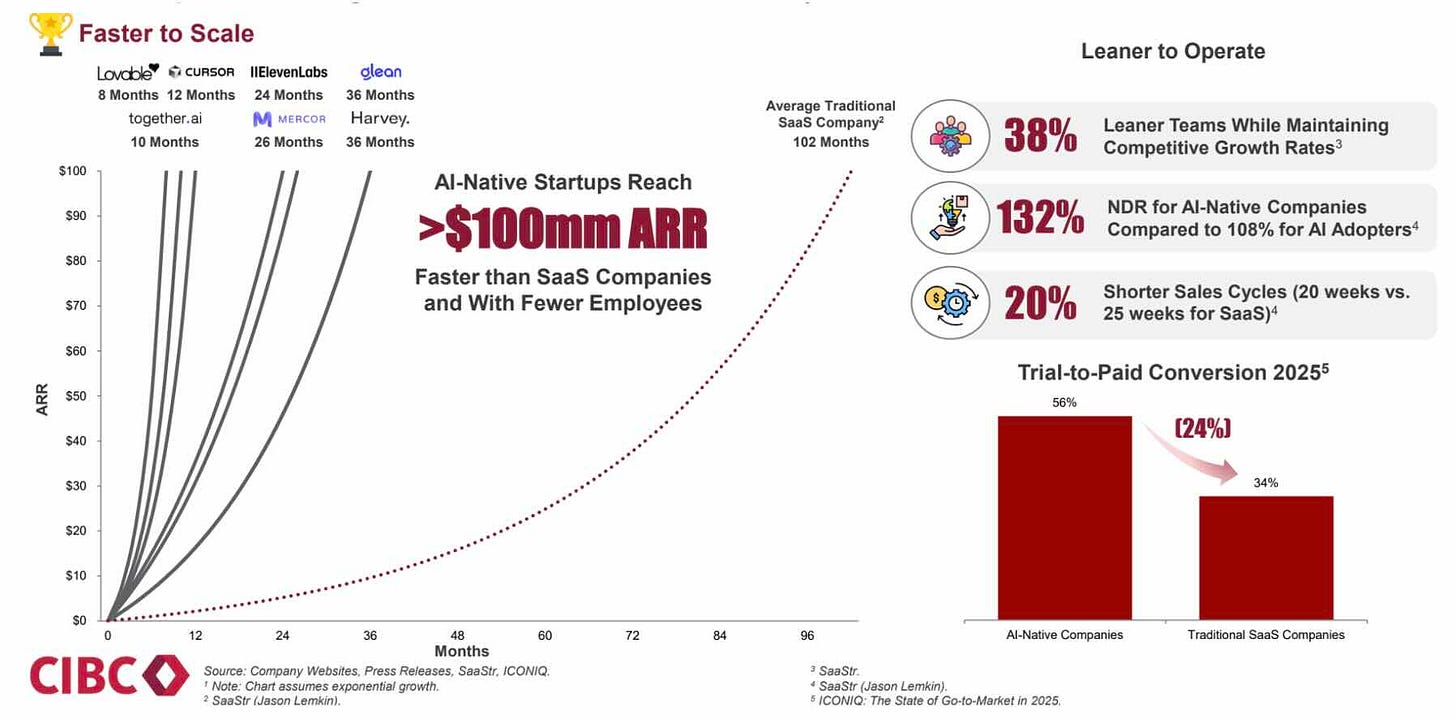

2. AI-native companies get to $100 million in ARR faster than traditional SaaS vendors and do so with smaller teams, shorter sales cycles, and higher trial-to-paid conversion rates, according to data compiled by financial institution CIBC.

3. According to preliminary Q3 data from PitchBook, VC exits in the U.S. of all kinds will decline by 8.5% this year. AI-related VC exits, on the other hand, will grow by about 15%.

4. Thanks to trends 2 and 3, CIBC says, AI-native startups trade at 10-12x next twelve month revenue, versus the 5x or so other SaaS software makers are getting.

5. And thanks to that, CIBC adds, VCs have poured some $440 billion into AI and machine learning companies between 2023 and today. According to PitchBook, furthermore, AI startups now account for nearly two-thirds of U.S. VC deal value.

But to really understand why Top Down, General Catalyst, Thrive, Y Combinator, and a lot of others are pouring capital into AI startups specifically for MSPs, you need to consider three more facts:

1. Global SMB IT outlays will exceed enterprise IT spending for the first time ever next year, according to Microsoft estimates based on data from IDC.

2. SMBs get their tech services mostly from MSPs.

3. MSP revenue will reach a projected $595 billion this year on its way to $950 billion by 2030, according to Omdia.

Tote that all up and it seems safe to assume that a lot of the $2 trillion Gartner says businesses will spend on AI next year will be spent by SMBs. No one, according to Abramson, is more likely to benefit than MSPs.

“We think that they’re extremely well positioned to be the trusted advisor to help small and medium businesses on their AI journey,” he says.

AI of the MSPs, by the MSPs, and for the MSPs

Top Down may not be the only VC with that thought, but it’s the only one I’m aware of run by former MSPs and funded primarily by current MSPs and MSP vendors.

“Two thirds of our limited partners are from the MSP ecosystem,” Abramson says. “It’s the industry reinvesting back into itself straight onto the balance sheet of software companies that are then investing those dollars in innovation.”

Top Down’s currently in the process of raising a projected $40 million for its Founders Fund, which it’s already begun deploying $500,000 to $3 million at a time in pre-seed, seed, and Series A funding rounds. Starting next year, the company plans to fill that pipeline with additional investment candidates through a startup incubator named Vibe Studio.

“We looked at what Y Combinator does and a couple of other accelerators and said, ‘why can’t we do that for the MSP space?’” Abramson explains.

Top Down plans to invest $250,000 apiece in eight pre-seed automation, workflow intelligence, and data infrastructure companies across the next two years. Each one will get a 12-week crash course in building new products quickly and launching them successfully, plus access to tutoring and advice from Top Down LPs through a new offering modeled after GTMfund called MSP Leaders. Top Down, in return, will get the right via SAFE notes to receive up to 10% equity in studio graduates.

At the opposite end of the spectrum, the company is also hatching plans for a forthcoming Innovators Fund that will invest up to $100 million in slightly more mature versions of the startups it’s nurturing now.

“These companies are going to grow and scale, and we want to be able to support them down the road with future capital as well,” Abramson says. “We’re not looking to be one and done on this.”

Want to hear from Abramson directly?

He and fellow Top Down managing partner Mark Scott were guests on MSP Chat, the podcast I co-host, not too long ago. The latest episode, meanwhile, features interviews with two senior Ingram Micro executives. Lots more conversations with industry leaders where those came from too. Check them all out here.

AI in-the-business versus as-the-business

Horizons attendees included both current and potential LPs. To offer the current ones a sense for where their money is going and the potential ones a taste of what they’d be investing in, Top Down gave speaking slots to nine of its portfolio companies.

One of them, zofiQ, which you’ve read about here before, makes agentic help desk automation software. Another, named Lexful, makes … something. It’s in stealth mode for a little while longer and not talking all that specifically about its solution, but judging by its website, what its CEO said during Horizons about building a “God-mode” service for MSPs, and the fact that “lex” is Latin for “word,” I’m guessing it’s an intelligent knowledge management solution of some kind. We’ll see if I’m right in a few months.

Neither business, however, offers managed AI software as N-able’s Robert Johnston (pictured) defines it.

There are two fundamental ways for MSPs to employ AI, he said during a sideline conversation at last week’s show—in the business and as the business. In-the-business uses are about increasing operational efficiency. As-the-business uses are about helping end customers increase operational efficiency, or revenue, or something else that yields accelerated growth.

They’re also where the real money is in AI for MSPs, according to Johnston, the GM in charge of N-able’s Adlumin MDR service. The TAM for AI-in-the-business products is something like 100,000 MSPs globally, he says. The TAM for AI-as-the-business products is pretty much everyone else on Planet Earth, which is to say many tens of millions of businesses. At present, Johnston continues, most MSP-oriented, AI-native startups are doing AI-in-the-business.

“We’re probably two years away from significant as-the-business traction and opportunity.”

The biggest opportunity when that day arrives, Johnston predicts, will be in services that manage resellable AI services for MSPs on an outsourced basis much as MDR offerings like Adlumin’s manage security for MSPs, and for the same reason: the skills needed to do either job in house are in desperately short supply.

“There’s just not enough security talent out there for every MSP to build its own security practice,” Johnston observes. “You have the same thing even worse in the AI function.”

Indeed, when PSA software maker Certinia asked service providers to name their top barriers to AI adoption earlier this year, “lack of internal AI skillsets” tied with compliance concerns as the number one response. “AI as a service” solutions will fill that gap, Johnston predicts, much as managed SOCs have in security, except that the “OC” in what I’m tempted to call AIOCs will have a different meaning.

“In the security category, it’s an operations center,” Johnston says. “In AI, it will be an orchestration center.”

That’s exactly what Pax8 is building toward at present through the agentic marketplace it’s constructing. Johnston’s impressed.

“Pax8 is making a ton of strides in that area,” he says, noting as well though that it has a lot more work still ahead of it, and not just in software development. Most MSPs don’t yet understand what Pax8 is building or why it matters.

“The market’s not ready,” says Johnston, who knows exactly how hard readying the MSP market for something new can be.

“You used to have to educate people about MDR,” he notes.

By the way, what is N-able?

Even people with fewer gray hairs than me can remember a time when people in and around managed services referred to ConnectWise, Kaseya, N-able, and Datto as “the big four”. Then Kaseya bought Datto, NinjaOne went unicorn, and the big four had a slightly different composition. But the term still referred to the industry’s largest RMM/PSA vendors, and N-able was still one of them.

Except that it wasn’t, or isn’t, and not because its market share slipped behind Ninja’s last December. According to the company itself, N-able isn’t an RMM/PSA vendor anymore.

“We’re no longer in the endpoint management business,” Johnston says. “We’re in the security business.”

To be clear, N-able does offer endpoint management solutions, but mostly, Johnston says, because patching software and eliminating vulnerabilities are important security functions. The company’s hottest sellers and true calling cards right now are its Adlumin MDR/XDR business and Cove, its data protection solution. As a result, N-able views companies like Barracuda and Sophos as its truest rivals and regards ConnectWise and Kaseya as competitors when they’re selling security services and integration partners when they’re not.

“You can call them frenemies,” Johnston says.

The latest example of N-able’s security-first mission came on the second day of the Horizons conference when it announced that a CMMC 2.0-compliant version of its N-central endpoint management solution is now in public preview before going GA sometime in Q1 next year. According to Johnston, the update came in response to requests from its MSP partners.

“It’s important to our customers because it’s important to their customers,” he says. “MSPs support a huge part of the Defense Industrial Base.”

Those that don’t meet CMMC requirements risk losing DIB clients. “It’s an immediate churn risk,” Johnston says, adding that it’s a sales opportunity as well for providers who are CMMC-compliant.

“They’re going to be able to hoover up a lot of those customers that came from less progressive MSPs,” he notes. In time, he continues, the rest of N-able’s portfolio will be CMMC-ready too.

“The whole company will be on a path to achieve CMMC compliance,” Johnston says. “There’s no hard date, but we’re actively working on it.”

Also worth noting

Huntress has acquired Microsoft 365 security vendor Inside Agent in connection with longer-term plans to introduce an identity security posture management solution. More on this coming in a future post.

The cyber resilience features in Veeam’s new Data Platform v13 are the vendor’s latest step toward combining data protection and security in a single portfolio. More on this to come too.

Arctic Wolf has integrated Abnormal AI’s email threat detection and response solution with its Aurora Platform.

Palo Alto is acquiring real-time observability vendor Chronosphere to augment its autonomous AI remediation capabilities.

The new PartnerFirst Digital Bridge AI Assistant for Microsoft Teams is the latest addition to a TD SYNNEX tool you read about earlier here.

Pia’s Automation Hub gives ecosystem partners a shared space to access, install, and exchange pre-built automations.

AvePoint’s new AgentPulse Command Center aims to give organizations more visibility and control over agentic AI security risks and costs as deployments scale.

TeamViewer has introduced an AI agent named Tia that’s designed to autonomously find, fix, and prevent IT issues across digital workplaces.

I’ll assume you’re familiar with what Microsoft announced at its Ignite conference last week. Here are some highlights from its partners:

Pax8 is all-in on the new Microsoft Marketplace. The new Pax8 Labs, meanwhile, will invest in emerging technologies that help MSPs deploy and manage AI agents for SMBs.

Nerdio has introduced new support for Microsoft Azure Virtual Desktop in hybrid environments.

NinjaOne has integrated its RMM solution with Microsoft Intune.

NinjaOne is also now a Microsoft RMM partner for Windows 365 Business.

Proofpoint has released the Satori Emerging Threats Intelligence Agent for Microsoft Security Copilot.

Sophos has integrated its Intelix solution with Microsoft Security Copilot and Microsoft 365 Copilot.

Check Point is partnering with Microsoft on security for Microsoft Copilot Studio.

Rubrik Agent Cloud now integrates with Microsoft Copilot Studio.

Rubrik has also introduced new recovery capabilities for Microsoft 365 and new DevOps Protection for Azure DevOps and GitHub.

ServiceNow has announced new and forthcoming integrations with Microsoft’s agentic platforms to deliver seamless AI orchestration, governance, and productivity.

Devolutions has launched an MCP server designed to connect AI assistants with its Remote Desktop Manager offering.

Dell has announced expanded Azure Local support for Dell Private Cloud and PowerStore, shipped Dell PowerScale for Azure for data-intensive workloads, and enhanced its Azure-based PowerProtect Backup Services.

Big week for Dell. It also unveiled new enhancements to its AI Factory portfolio and new support for NVIDIA processors in Dell AI Factory.

BitTitan has a new partnership with PowerSyncPro and two new additions to its migration portfolio named Directory Sync and Migration Agent.

Tanium has unveiled new AI-powered platform advancements designed to expand its agentic AI capabilities.

AppDirect has acquired NXTSYS Consulting to strengthen its MSP-focused service distribution capabilities

Fred Voccola, former CEO and current vice chair of Kaseya, has a new book on AI.

Cynomi has named Erin McLean its new CMO.

Reinvent Telecom has appointed Caleb Waack its new chief AI officer.