AI Bubble? Don’t Worry, Be Happy, MSPs

Yup, there’s a bubble. Nope, per Omdia, that’s not bad news for MSPs. Plus: dual examples from Barracuda and WatchGuard of why less can be more in cybersecurity.

Are we in an AI bubble?

Yeah, I know, I’m hardly the first to ask the question. And it’s grown a little easier to answer, too, now that Sam Altman, the CEO who signed roughly $1 trillion worth of infrastructure deals in the middle of an estimated $13 billion revenue year, has said we probably are and fellow CEO Mark Zuckerberg has more recently called a bubble “quite possible” before offhandedly characterizing “misspending a couple of hundred billion” as no biggie.

Heck, even AI thinks there’s an AI bubble forming.

And this can’t be good, right? I mean, AI-related stocks are responsible for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth since the debut of ChatGPT just under three years ago, according to JPMorgan Chase analyst Michael Cembalest. Should those numbers begin moving in the opposite direction a lot of people previously feeling flush might feel less so when their next 401(k) statement arrives and start trimming back spending. Next thing you know we’re in a recession.

In fact, according to widely quoted figures from economist Jason Furman, spending on information processing equipment and software was the only thing that kept the economy out of recession in the first half of the year.

So MSPs should be somewhere between nervous and terrified about the prospect of an AI bubble burst, yes?

Not so much, according to Robin Ody, a practice leader at analyst group Omdia. “The strange thing is I think MSPs might right now be kind of walled off from it,” he said during a conversation at Omdia’s Canalys Forum event in Chicago last week.

Sure, Ody notes, they could suffer AI supply chain disruptions. If CoreWeave, say, overinvests in capacity and your favorite vendor overinvests in CoreWeave, your favorite vendor’s AI functionality may stop performing as well as it used to.

But beyond that, most MSPs needn’t lose sleep over the bubble that’s likely forming in AI, Ody says, “mostly because most of the big AI stuff is being done by the big, big corporations.”

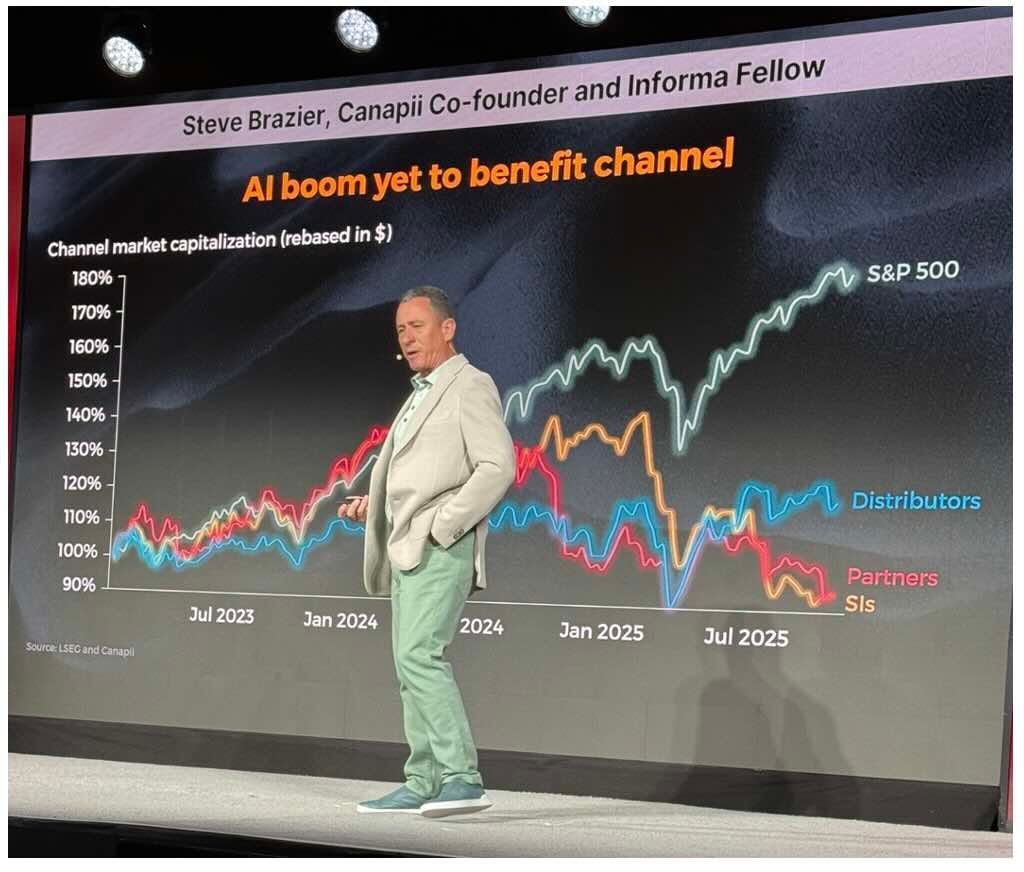

Corporations like AWS, Meta, Google, and Microsoft, which have committed to a collective $360 billion of data center spending in 2025 alone, an “astonishing amount of money” per Informa fellow Steve Brazier that looks only slightly less astonishing next to the $616 billion of infrastructure capex the IT industry as a whole has signed up for this year.

The thing of it is, though, if that money more or less evaporated tomorrow, MSPs would hardly notice, for reasons that bring a whole new dimension of irony to the term “silver lining”.

“This $616 billion of capex hardly touches the channel,” Brazier observes. Indeed, pretty much nothing spent on the AI boom to date has touched the channel.

“So far, I’m afraid to tell you, since the launch of ChatGPT at the end of 2022, the valuation of the partners in the room, at least the publicly quoted large channel partners, has not grown,” said Brazier (pictured in front of statistical evidence) during a Canalys Forum keynote. “You would’ve lost money had you invested in this community compared with the S&P 500.”

Which, paradoxically speaking, is the best news of all for MSPs and the vendors they buy from. Despite all the evidence of an impending economic storm, they’re arguably in exactly the right place at exactly the right time.

“MSP is probably still a top two, top three choice of an entrepreneur who’s just getting started or a seasoned person that wants to take it to the next level,” says Omdia chief analyst Jay McBain.

There are reasons to think he’s right. For starters, it may be nowhere near enough to justify $616 billion of infrastructure investment, but AI usage is growing crazy fast.

“AI is the fastest adopted technology of all time,” Brazier says. “We now have something like two billion monthly active users of AI services and it’s growing by the day.” Two billion people, for those keeping score at home, is roughly one fourth of everyone on the planet.

Second, people who buy AI services are renewing their subscriptions at a mounting rate and for bigger amounts, according to Ramp Economics Lab. And the reason for that, despite skepticism to the contrary, is that this AI stuff works. To cite two examples just from last week:

99% of organizations using AI for accounts receivables are collecting payments faster, and 43% report improved cash flow, according to Billtrust.

Companies using AI for IT system management are resolving incidents 17.8% faster, according to SolarWinds.

Businesses can’t achieve results like that without partner assistance, however, as Salesforce CEO Marc Benioff noted during the company’s recent Dreamforce event when he said there’s no DIY-ing your way to enterprise-grade AI.

“He was alluding to the fact that you need a team of experts, of partners, around you,” says Lisa Lawson, an Omdia senior analyst. “I think it’s very true.”

So do end users, apparently. “82% of end clients are outsourcing more this year than they did last year,” McBain says. “The same number plan to outsource more next year than they did this year.” As a result, he adds, managed services will continue to grow almost twice as fast as the tech industry, which itself is likely to outgrow the global economy three to four times over.

Good luck finding a better place to build an IT business. “It’s the fastest growing opportunity for partners of any of the $5 trillion of products and services in our industry,” McBain says. “There is no growth curve at 35.3% compounded up to 2030 that’s larger than this.”

And there’s nothing really new about the position channel partners are in now in relation to AI, he adds. Yes, it’s been an underwhelming phenomenon for most partners so far, but that’s because it’s just getting started.

“If you study the history of this industry from the UNIVAC in 1951 onwards, in every 20-year cycle the first couple of years have always been underwhelming,” McBain says. Yet a lot of folks in the channel have eventually done pretty well financially just the same.

Five near-term steps toward long-term AI success

Remember when I said MSPs are in exactly the right place at exactly the right time before? I left off an exactly. They’re in a great position if they pursue the AI opportunity in exactly the right way. The analysts I spoke with last week had some thoughts about that:

1. Follow the data. AI, as we know, is all about data. According to McBain (pictured), however, most of the data AI could and should be feeding on is currently sitting on aging storage arrays and other places where AI can’t get to it.

“99% of the world’s business data has yet to be trained or tuned in the models,” he says. “83% of that sits in cold storage at the edge.”

Migrating it all to more accessible locations will take years of effort and produce heaps of revenue for IT providers. So too will securing that data and ensuring nothing confidential leaks into a public LLM.

“We think it’s kind of crazy right now that people are going to start forklifting this 99% into models, and it’s not. It’s just going to happen,” McBain says. “The amount of work there, we’re talking in the trillions of dollars of services.”

2. Specialize. This has been good advice for growth-hungry MSPs since well before AI.

“You ask any cloud customer, how do you pick a partner and 87% of them will tell you specializations are in the top five criteria,” says Peter Bryant, an Omdia practice leader. The same will be true, Lawson predicts, in AI.

“Specializing has never been more important,” she says. “You can’t boil an ocean and you can’t provide outcome-based services to every industry out there and every customer out there with every vendor partner.”

And that means you have to focus. “It’s about picking one or two or three things and vendors and partners that you are best at in the industries that you know most about and going at it from that angle,” Lawson says.

3. Make friends. According to Canalys, solutions delivered through the channel involve seven different partners on average. AI solutions are no exception, which means AI specialists will need go-to-market collaborators with complementary skills.

“Once you specialize, you need to understand and be able to do that co-sell, co-deliver motion as well,” Bryant says. “Just being a vendor and a single partner is ancient.”

4. Start coding. According to Brazier, every corporation in the Magnificent Seven writes its own software and is led by a CEO who codes. Maybe MSPs should follow that example by getting into the business of writing AI software, or more specifically agentic AI software.

“44% of partners in the world are building agents right now, and that’ll be 64% when we stand up on stage next year, and probably 84% the year after that,” McBain says. They’ll be applying their handiwork to their customers’ most painful pain points and most strategic opportunities too.

“This isn’t just coding. This isn’t just some custom software dev,” McBain says. “This is rethinking our customer’s business.”

Better yet, it doesn’t even matter if you, unlike those Magnificent Seven CEOs, can’t code. Thanks to AI itself, even I can write code these days, and I barely know how to spell Python.

5. Sell what you write. Pax8 and the hyperscalers have begun standing up agent marketplaces that vendors and MSPs alike can use to buy and sell custom-written agents, notes Lawson.

“So you do a big project for a customer in healthcare, in pharmaceuticals, and you build an agentic AI solution. Now partners can actually take what they’ve built for a customer that was customized to that customer and list that on a marketplace through AWS, Google Cloud, Microsoft,” she says. “That’s a new way to monetize what you’re doing for customers that partners have never had before.”

Think telco too, MSPs

How about an old school revenue opportunity for MSPs now? Like, Alexander Graham Bell old school? The device Bell invented just shy of 150 years ago, it turns out, still has plenty of life in it yet.

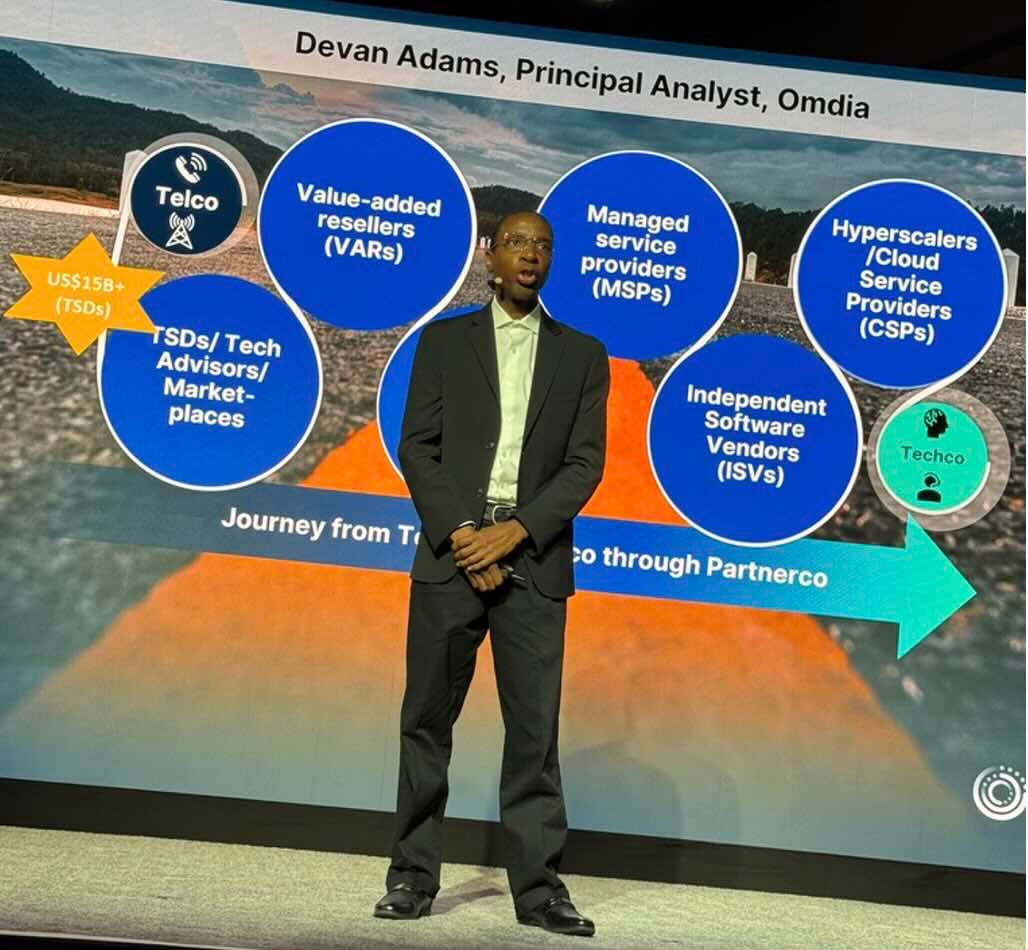

“The perception is that telco services have become a commodity,” says Devan Adams (pictured), a principal analyst at Omdia. “The truth is they’re a necessity and play a major role in all of IT spend.”

In fact, telco services account for roughly 18% of all technology spending in North America at present, and the market’s growing. Telco outlays will climb 6.1% in 2025, according to Omdia, versus 6.3% for IT overall, but there are pockets within the sector growing far faster. Sales of fiber services, for example, are climbing 16% year over year and fixed wireless access subscriptions are rising 32% year over year.

Fixed wireless is an easy add-on for MSPs to boot, according to Robert Holley, head of channel and new routes to market at Aeris, a provider of cellular IoT services. “Instead of buying broadband or fiber, which may take time, you’re able to deploy faster with a 5G solution because it comes boxed and ready.” Just plug it in and go.

Aeris offers more sophisticated solutions as well, including connectivity and secure service edge products for IoT-enabled edge computing deployments, which MSPs can enhance and white label.

“They can actually create their own solution and wrap more services around it, whether it’s managed NOC, managed SOC, kitting and tagging, or professional services,” Holley says.

Aeris, which introduced a new partner program for MSPs, VARs, and others last week, is actively growing its channel. So too are technology service distributors like AVANT looking to make the transition, in Adams’s words, from telco to techco by supplementing bread-and-butter connectivity with IT services.

“It doesn’t make up as much of their revenue as connectivity, but they’re offering cybersecurity, they’re offering networking,” Adams says.

All told, Omdia predicts, 95% of channel-led telco sales will have IT services attached by 2028. The only question is whether the portion of the channel leading those sales will be MSPs or telco agents. The answer is likely to be TAs, as it long has been, until MSPs show more interest in the space.

“Many of those partners just don’t see big value in working in the telco space,” Adams says, noting that many don’t view the learning curve entailed in adding unfamiliar services to their lineup as being worth the effort. Yet there isn’t actually much effort required, he continues, when MSPs forge alliances with TAs instead of fearing them as potential competition.

“Agents have very strong customer relationships with a lot of different customer types,” Adams says, and they’re generally about as eager to master managed services as the average managed service provider is to master telco. A good TSD can even make introductions.

“That’s a key advantage that relationship with the TSD can bring,” Adams says.

One last forecast from Omdia

This one is courtesy of principal analyst Jessica Davis, who says that by 2028, managed services innovation will shift from vendors to venture capital-backed MSP rollups building AI into their service desks. Two of the rollups I’m sure she’s thinking of are Shield Technology Partners, which I wrote about last week, and Titan, which I wrote about last month. You can learn more about that latter company straight from its co-founders on this week’s episode of MSP Chat, the podcast I co-host, right here.

Less is sometimes more in cybersecurity

As I say fairly regularly here, MSPs want fewer interfaces, vendor relationships, and partner programs to juggle these days. Yet when it comes to cybersecurity, they don’t want fewer layers of protection for their customers, even at a time of slowing growth.

Which is to say less is more for a lot of things in cyber these days, but more for less remains a winner too, as two recent announcements I’m finally getting around to discussing illustrate.

The first, from Barracuda, doesn’t appear to have much to do with less of anything at first glance given that it involves adding more functionality (in the form of a bulk email remediation feature) and integrations (in the form of connections to six leading PSA platforms from ConnectWise, Kaseya, HaloPSA, and Syncro) to its BarracudaONE platform.

But the whole point of BarracudaONE since its introduction earlier this year has been to consolidate more of the tools MSPs use to secure clients in one place, something Barracuda has prioritized in direct response to partner feedback.

“What we started hearing pretty routinely was that the challenges for an MSP being able to manage the plethora of tools they had were killing them when it came to efficiency, and it was hurting the effectiveness of the tools,” says Brian Downey (pictured), the vendor’s vice president of product management.

Future additions both to BarracudaONE and the Barracuda portfolio, he continues, include new risk assessment functionality.

“You’ll see us focusing more on being able to ensure MSPs have simple visibility into that security posture and using different lenses to be able to understand, based on what they care about, what their biggest risks might be, and then helping provide the guidance to how they can start mitigating those risks,” he says.

Third-party integrations beyond PSA solutions are on the roadmap too, according to Downey. “Whether those are Barracuda-branded tools or third-party tools, we want to have an open ecosystem where people can plug into BarracudaONE and get a holistic picture of their overall security environment.”

That effort is part of a larger effort at Barracuda to treat MSPs as “customer zero,” meaning the primary focus versus an afterthought, according to Michelle Hodges, the company’s senior vice president of global channels.

“Many other vendors create a product and then create the MSP version,” she says. “We are creating and building products purpose-built for that audience.”

Merging those tools into BarracudaONE, moreover, isn’t the only example of less being more in Barracuda’s view either. “We’re combining at every level of the business, not just in go-to-market,” Hodges says. “It’s being done in product and marketing and everywhere to be sure that we’re treating our partners as holistic entities as they service their customers.”

The next big manifestation of that campaign, she adds, will be in partner programs. “We’re combining our two programs and two routes to market,” Hodges says, which will result in a single program for both resellers and MSPs.

Less money for more functionality works too

WatchGuard’s latest news is arguably a case of less is more too, as in more functionality for less money.

The vendor’s recently introduced Endpoint Security Prime solution combines its next-generation antivirus and EDR products with vulnerability management, web filtering, anti-phishing, and other attack surface reduction tools at a price low enough to prevent MSPs from entrusting endpoint protection to antivirus alone.

“Our goal here was to raise the floor, if you will, on endpoint protection,” says Michelle Welch (pictured), WatchGuard’s CMO and SVP of business strategy. “It should never be price prohibitive for you to make the best decision for your business.”

Prime is designed to conserve labor as well as money, Welch adds. “When you’re looking at the MSP and what they’re able to afford, cost isn’t just what they’re paying for it and what they’re able to sell it for. It’s how much time they have to spend managing and monitoring it.” Prime’s AI functionality reduces the “noise” EDR solutions often introduce.

“Our self-learning agents continuously analyze behavior across the endpoint to detect anomalies, investigate the suspicious activity, and then respond automatically,” Welch says, allowing MSPs to provide enhanced security without additional headcount.

Prime is a new addition to the WatchGuard portfolio that sits in between the company’s EPP next-gen antivirus product and its EPDR solution, which combines antivirus with EDR. Unlike Prime, EPDR includes a zero-trust file attestation feature. An advanced edition of EPDR adds SecOps functionality as well.

“People who have and manage their own SOC and are fully staffed there and want to be more involved in that process can set custom rules, custom notifications, and custom configurations,” explains Welch, who expects Prime to eventually be the company’s most popular offering.

“This is the flagship product in the endpoint security portfolio,” she says.

Officially in an early access release at present, Prime is currently available to all WatchGuard partners in North America.

“The intent is for it to be generally available for the rest of the world in Q1 of next year,” Welch says.

Also worth noting

Kaseya’s Fall 2025 release includes AI-driven automation, secure password sharing, advanced EDR analysis, streamlined integrations, and simplified contract updates.

GoTo has added mobile-first features to its Grasshopper virtual phone system, including AI call transcription, unified conversation histories, and simplified mobile admin.

JumpCloud has acquired identity threat detection and response Breez.

Gartner could have said most or the vast majority of IT work will involve AI by 2030. It opted to say all IT work will involve AI by 2030 instead.

Nearly 75% of IT and industry leaders now view AI as a revenue driver versus cost cutter despite infrastructure and skills gaps, according to data from ePlus.

Veeam has acquired DSPM vendor Securiti AI to enhance the security capabilities of its data protection and resilience portfolio.

Sophos has launched an identity threat detection and response solution that integrates dark web monitoring and AI-driven detections. More on this, I hope, next week.

Bitdefender has partnered with CYPFER to provide incident response, digital forensics, and rapid recovery capabilities across the attack lifecycle.

ESET has added encrypted backups, improved scam protection, and new privacy and website inspection tools to its small office/home office portfolio.

Snyk has introduced Evo, an agentic security orchestration system designed to secure AI-native applications.

Axonius AI, from Axonius, is designed to replace passive assessment of threats with automated recommendations and response.

Cyware has new integrations with Microsoft Sentinel and Defender designed to provide streamlined, bi-directional threat intelligence.

Keeper Security, similarly, now has native integration with Microsoft Sentinel for faster, more precise detection and response to credential- and privilege-based threats.

Illumio has introduced Insights Agent, an AI-powered cloud detection and response feature designed to reduce alert fatigue and accelerate threat detection and containment.

Mimecast has introduced new AI-driven human risk platform innovations, including the Mihra AI investigation agent.

Rubrik’s new Agent Cloud aims to accelerate secure, large-scale deployment and management of AI agents.

Elastic says its new Agent Builder enables developers to rapidly build and operationalize custom AI agents on top of their data in Elasticsearch.

Aisera has rolled out its third-generation Agentic Engine, enabling autonomous IT service and operations via closed-loop AI agents.

The latest updates to Dell’s AI Data Platform include enhanced storage and analytical engines, deeper integration with partners like NVIDIA and Elastic, and more.

Lenovo has introduced agentic AI capabilities across its workforce portfolio.

Meanwhile, Lenovo’s new AI-powered ThinkCentre neo Gen 6 desktops use AMD Ryzen AI processors to provide accelerated AI performance to SMB users.

Telarus and SoundHound AI have inked a strategic partnership to bring SoundHound’s Amelia 7 and Autonomics AI platforms to Telarus’ network.

Great roundup! The SoundHound and Telarus partnrship at the end caught my attention. Getting Amelia 7 into the hands of technology advisors and their enterprise customers could be a smart distrubution strategy for SOUN. I've been watching them try to scale their voice AI solutions, and this partnership model seems like a faster way to reach more enterprise clents than direct sales. Curious how many Telarus advisors actually start pushing it.