A Useful Reminder from TD SYNNEX: AI Starts with Infrastructure

New enablement resources from the distribution giant aim to help partners leverage familiar skills to get started in AI. Plus: Why loyalty programs are the latest trend in partner incentives.

Look back at my AI coverage last year and you’ll see lots of writing about the server, storage, power, and networking infrastructure businesses were going to need to turn their AI visions into reality. Review my more recent coverage and you’ll see much more discussion of agents and applications.

That’s not so unusual, actually. Like me, most AI observers have devoted way more of their attention to the software side of the AI equation than the hardware side. Is it possible we’ve all been neglecting the same underappreciated market, though?

I ask not because of the 420% quarterly revenue growth AI infrastructure provider CoreWeave just reported, or the 33.3% growth in AI-fueled spending on cloud infrastructure that IDC forecasts for 2025, or the 161% growth Dell’Oro Group recorded in 2024 on AI training infrastructure alone. It’s what I learned at TD SYNNEX’s High-Growth Conference in Los Angeles last week, rather, that has me thinking I may have strayed too far too soon from the AI infrastructure story.

That show, a new addition to the distributor’s event calendar dedicated entirely to cloud computing, security, and AI, featured a keynote presentation by IDC president Crawford Del Prete about what tariffs and recession anxiety foretell for IT budgets this year. Per an IDC webinar I wrote about last month, the analyst firm is now projecting an uptick in purchasing somewhere between 5% on the low side and 9% on the high side, down either way from the 10% growth it came into the year anticipating.

Yet while spending will drop across the board in a worst-case scenario, IDC says, it will drop relatively less in a few key segments, including servers/storage and infrastructure as a service. Both, according to Del Prete, are among the last budget line items businesses tend to cut.

“I’ll back off on IT staff and training, but I’m still going to invest in infrastructure,” he says. Especially AI infrastructure, which of necessity comes before AI applications, a fact responsible for what Del Prete—invoking a technical term familiar to analysts—calls “bananas” servers and storage growth last year on the order of 55%.

Power infrastructure vendor Eaton Corp. has direct experience with those bananas. “We’re seeing massive consumption rates in the white space of the data center” where the servers and storage arrays sit, says Steve Loeb, the company’s vice president of marketing for IT distribution. The result, he continues, has been trickle-down CAGRs in the grey space where the power gear resides in the “high teens, low twenties, mid-twenties.”

None of this has escaped their notice at TD SYNNEX. Generative AI is an infrastructure-intensive technology, observes Ed Morales (pictured), a rock star with a day job as the distributor’s vice president of AI and digital transformation business development.

“Without the infrastructure, you really can’t deploy it fully and actually realize the full opportunity that the AI application will provide,” he says. “We believe that there’s an opportunity in developing that infrastructure.”

And unlike application development, Morales continues, AI infrastructure is a relatively easy entry point to AI for most solution providers. “You’ve got resources in these areas of infrastructure for storage and networking,” he says. “Build a practice around that.”

Hence the additions TD SYNNEX announced last week to its Destination AI enablement program, which place a particular emphasis on infrastructure generally and selling infrastructure especially. Most partners already have more than enough technical expertise to implement AI-ready infrastructure, Morales observes. Articulating why businesses should buy it, on the other hand, is more of a struggle.

“Once you can help them understand the why, they’ll be more confident to have those conversations,” Morales says.

And then “sell up the stack” over time toward the apps, he adds, something that companies like TD SYNNEX with deep solution expertise and a broad set of vendor relationships are well positioned to accelerate.

“We’re aggregating the channel for scale and speed,” Morales says. “That’s where our benefit is.”

TD SYNNEX brings B2C rewards to B2B relationships

It’s a lame joke that I used elsewhere just a few weeks ago, but in my book three instances of anything is all you need to declare a trend in effect. And by that standard, partner loyalty programs are now officially a trend. Instance one in this case was the loyalty program announced by Pax8 late last year. Instances two and three came last week from TD SYNNEX and Sophos.

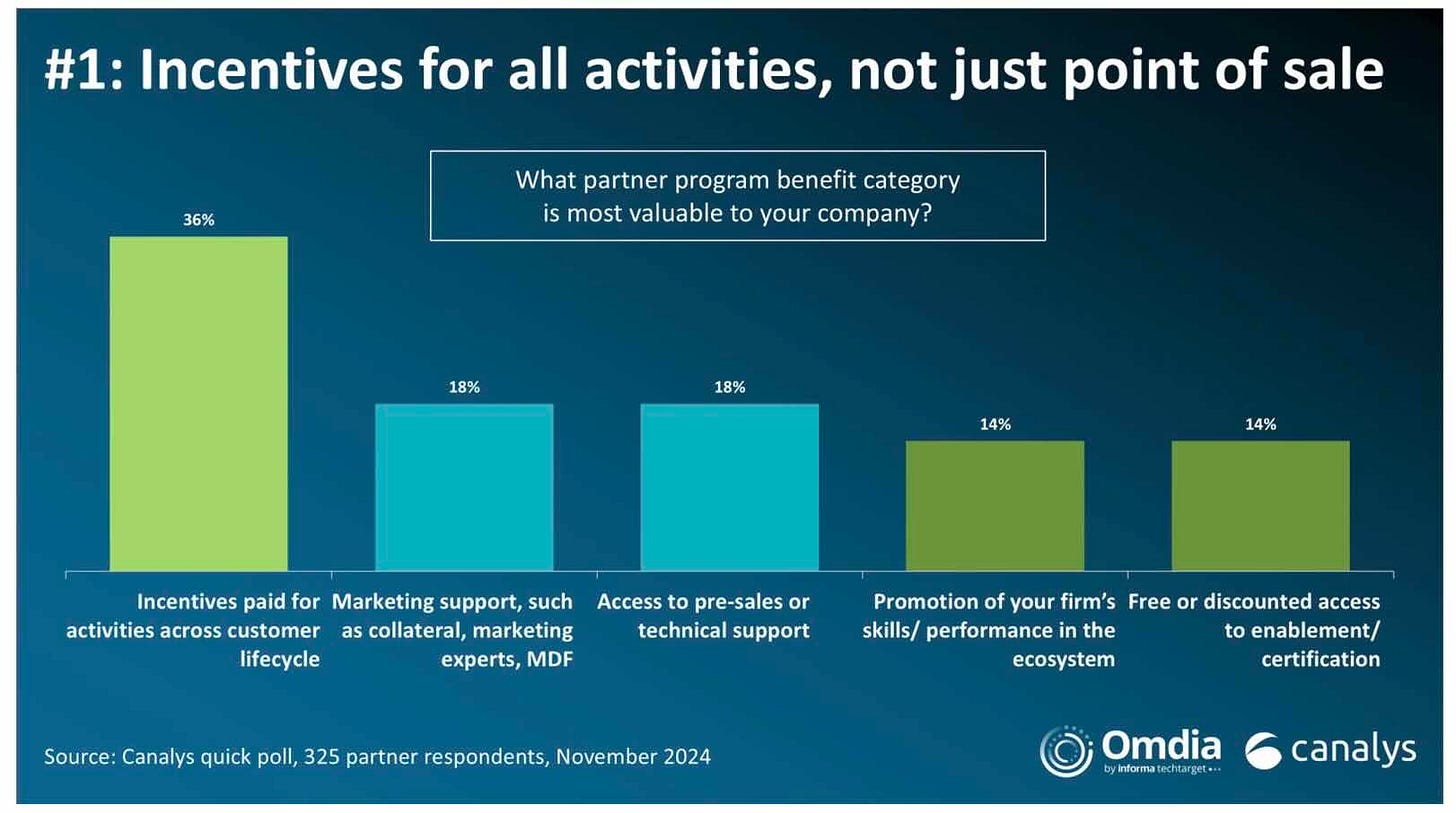

Before we dive into the details, a little context: Partner programs, obviously, are as old as partnering itself in the channel. Partner loyalty programs are a much newer phenomenon specifically designed to reward partners, financially and otherwise, for their contributions to mutual success before, during, and after a sale. Per data shared on LinkedIn by Omdia analyst Devan Adams, in fact, partners currently value incentives of that kind more than any other vendor benefit, including MDF and pre-sales or technical support.

Marketplace operators like Pax8 and TD SYNNEX have even more reason to heed such data given that a large and growing amount of business flows through marketplaces these days and partners have no shortage of marketplace options.

“Especially in an industry like ours where there’s a lot of choice, they want to feel that the investment of their time and dollars is valued,” says Calhoun McKinney (pictured), TD SYNNEX’s vice president of North American go to market. The distributor’s new Partner Loyalty program aims to demonstrate appreciation, she continues, in the manner an emerging generation of B2B managers has grown accustomed to via airlines, retailers, and other B2C businesses.

“There’s kind of this massive state of change with who’s in those roles, and as we look at data and profiling on those decision makers, they value things like loyalty programs,” McKinney says.

Like Pax8’s Voyager Alliance program, the TD SYNNEX Partner Loyalty program provides tiered benefits customized by partner size and specialty. Unlike Pax8’s still forthcoming Voyager Alliance Rewards program, TD SYNNEX’s benefits are tied to sales performance (initially in the distributor’s advanced solutions portfolio) rather than a consumer-like points system. Sales figures, growth rates, and other variables determine who qualifies for membership in the new program as well, according to TD SYNNEX partner enablement management leader MK Fisher.

“We want to make sure you’re investing in us and we’re going to invest back in you,” she says.

McKinney, without providing specifics, suggests that partners can expect more to come from its Partner Loyalty program, as well as more offerings like it.

“We’re excited about what’s happening in the channel right now and we’ve got a lot on tap for the year,” she says. “You’re going to continue to see things like this come forward that are evidence that we’re really making big investments in our partners.”

Sophos rewards MDR partners with network security incentives

Strictly speaking, the MSP Elevate program announced by Sophos last week isn’t a loyalty program. But from the cheap seats I occupy it sure looks like one.

Sophos “is committed to enabling our MSP partners to further grow their business and reward their success,” says Chris Bell (pictured), the SVP of global channels, alliances, and corporate development you met here recently, in emailed remarks. MSP Elevate supports that commitment through discounts, rebates, training, and exclusive access to the premium service tier of Sophos MDR Complete, a subscription offering 24/7 incident response, one-year data retention, network detection and response services, and more.

MDR revenue at Sophos is growing over 37% a year at present, according to Bell, and will climb 16% industry-wide in 2025 to $10.3 billion, according to Canalys. Big numbers poised to get even bigger given that Canalys also says 52% of MSPs don’t yet offer MDR.

Other MSP Elevate benefits include access to five discounted “network-in-a-box” bundles of Sophos firewalls, switches, and wireless access points. Participants in the vendor’s 2024 MSP Perspectives report estimated that consolidating on a single security platform would cut day-to-day management time by 48% on average, a fact “underscoring how managing multiple cybersecurity platforms snowballs into a major overhead for MSPs, and consumes valuable billable hours,” Bell says. Elevate’s network bundles are designed to address that challenge by enabling partners to manage the full network stack through the Sophos Central platform.

“Taking a platform approach with open access to all of a customer’s security investments, and tying those integrations back into a unified platform, creates security operations efficiency, and ultimately creates efficiency and profitability for an MSP’s business,” Bell says.

Like TD SYNNEX, Sophos has more coming for its partners. “MSP Elevate is the first of many business-driving MSP programs,” says Bell in the press release announcing the program. That’s about as far as he’s willing to go for now, however, on how many additional programs and what kind.

“MSP Elevate is the latest of many programs and initiatives we’ve introduced to uplevel partners’ ability to focus on their business instead of being bogged down by management headwinds” is all Bell’s saying for the moment.

TD SYNNEX isn’t the only distributor I’ve spoken with recently

I also interviewed executives from Exclusive Networks about the changing role of distribution in an age of services-first partner business models on the latest episode of MSP Chat, the podcast I co-host. That show and 74 others are available here:

Also worth noting

Big week for Proofpoint. First it introduced a digital communications governance platform. Then it bought SMB security vendor Hornetsecurity.

Palo Alto and T-Mobile are partnering on a new managed SASE offering for wireless devices.

Speaking of SASE, Cato Networks has added an AI-powered policy analysis engine to its SASE Cloud Platform.

Arctic Wolf has a new retainer service that combines proactive incident readiness with full-scope incident response.

A new set of connectors for Tenable’s flagship exposure management platform aims to extend visibility to a wide collection of third-party tools.

Good to see vendors like Fortra investing in much needed cloud security functionality through acquisitions like this one.

Good as well to see vendors like LastPass investing in much needed SaaS monitoring and security functionality through product launches like this one.

AWS and Microsoft are the biggest names in hyperscaler marketplaces, but Google’s pretty big too and it’s just announced multiple partner-friendly incentives.

Also from Google: new cyber insurance options, new coverage for emerging AI risks, and other additions to the cloud giant’s Risk Protection Program.

Michelle Hodges, formerly of Ivanti, is the new SVP of global channels and alliances at Barracuda Networks.

Risk insight vendor Cork Protection, formerly known as cyber warranty vendor Cork, has new automated remediation links to Rewst’s RPA platform.

Monica, the AI-enabled automation platform from IT management vendor SuperOps, now offers a mix of augmentative, semi-autonomous, and fully autonomous features.