Fear Itself

Tariff and economic anxieties are slowing IT industry growth. Plus: Xurrent takes on service management for mature MSPs and GTIA says partners are more satisfied with (slightly) more vendors.

I wrote a little about tariffs and the economy last week, and am going to do it some more this week. But before I begin, please know that you should take everything I’m about to say with a king-sized grain of salt. It’s based on an interview I did with Carolyn April of GTIA two weeks ago and an IDC webinar I attended two days ago, and everything I learned in both places could be ancient history by the time you’re reading this.

Need I say why? The Trump administration’s trade policies were a wee bit unpredictable before it announced unexpectedly severe reciprocal tariffs early this month, sending stock markets around the globe into freefall. The president then paused those levies for 90 days a week later and raised tariffs on China to 145%. Just before exempting a wide range of finished IT goods from all but 20% of that. And then announcing two days later that the exemption is temporary.

All of that reminds IDC’s Rick Villars of the joke about various places that if you don’t like the weather wait five minutes. “In this world, what we’ll say is wait five minutes and it will either get better or it’ll get worse, but we can’t tell you which,” Villars observed during that webinar this week.

Indeed, no one knows exactly what the future holds at the moment, except that tariffs of some kind and severity will almost certainly be part of it. That has economists lowering global trade estimates for the year, banks raising prospects for a recession, and prediction markets (which called the presidential election better than professional pollsters) doing the same.

Consumer sentiment and small business confidence are both headed in the wrong direction as well, a fact reflected in the dreaded “beauty salon recession indicator.”

Pity the poor IT prognosticator who has to figure out what all this means for the tech industry. “This is not something that anyone, I believe, in this sector in the last 40 years has had to deal with,” Villars observes.

Despite this month’s turmoil, the year’s actually off to a pretty good start. Though hard data about Q1 spending is still in short supply, IDC says, what little we have suggests it held strong and may even have outpaced forecasts.

“We saw that in some of the preliminary PC data, which was released just last week by IDC, which showed higher-than-expected shipments of smartphones and PCs in the U.S.,” says Stephen Minton (pictured), the analyst’s group vice president of data and analytics and another speaker during this week’s webinar.

The problem is we don’t know why hardware shipments came in better than anticipated. Are businesses investing in AI PCs and belatedly preparing for Windows 10’s EOL later this year, or stocking up early on products before tariffs go into effect, a la Apple flying 600 tons of iPhones out of India last month?

Similarly, while 54% of U.S. CIOs surveyed last month said they’re increasing IT outlays in response to economic uncertainty, the likeliest reason why, according to IDC, is less encouraging: businesses don’t plan to buy more tech so much as spend more on previously budgeted products due to tariff-fueled inflation.

Meanwhile, 38% of participants in that same CIO study said economic concerns have them “aggressively” renegotiating existing contracts. A lot of that will affect hardware purchasing, IDC says, but not all of it.

“Businesses could look to start cutting back on new projects and external IT services engagements in the second half of the year if business conditions are deteriorating by that point,” Minton says.

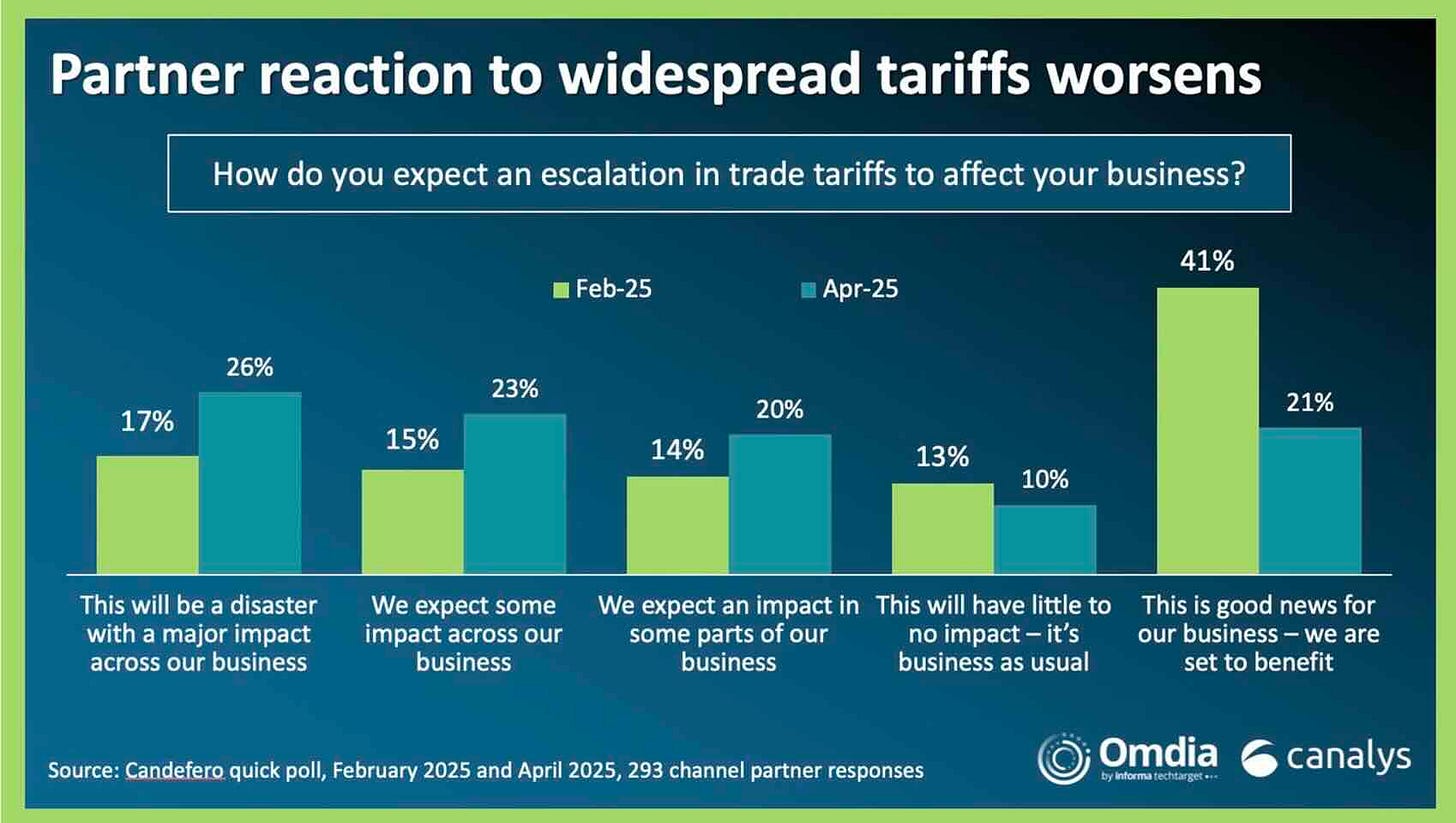

Including managed services engagements, a possibility very much on the minds of MSPs based on this data from Canalys:

It’s worth noting that ConnectWise’s Service Leadership unit predicts 12% growth for managed services this year, or most of it anyway. “At least the next few quarters, that’s probably what we’ll see,” says Peter Kujawa, executive vice president of Service Leadership and IT Nation at ConnectWise. 12% is solidly within the 10-14% rate at which the market grew for a long while in the happy years before Covid, so historically pretty normal.

But then again, Kujawa shared that data with me mid-March, which is starting to feel like a long, long time ago. In the here and now, IDC believes IT spending of all kinds in 2025 will come in significantly below the 10% it predicted at the start of the year.

“We could lose about half the growth that we currently project for 2025 in our baseline, and a pretty big chunk in 2026 too,” Minton says.

Turn that frown upside down?

Here’s the thing, though. 5% growth is a lot less than 10% growth, but it’s still growth.

“Spending is still pretty strong,” Minton says. “We’re just getting ourselves ready, positioning ourselves for the potential that things could start to head in a different direction, especially if many of those tariffs do come back and are implemented once we get into the middle of the year.”

Furthermore, while lower spending on hardware is a very real possibility, according to IDC, so is higher spending in newer, less capex-heavy markets.

“Economic uncertainty often triggers faster adoption and transition to new technologies,” Villars observes. “There’s a very clear message that this could accelerate the pace of the use of AI and automation, especially agents.”

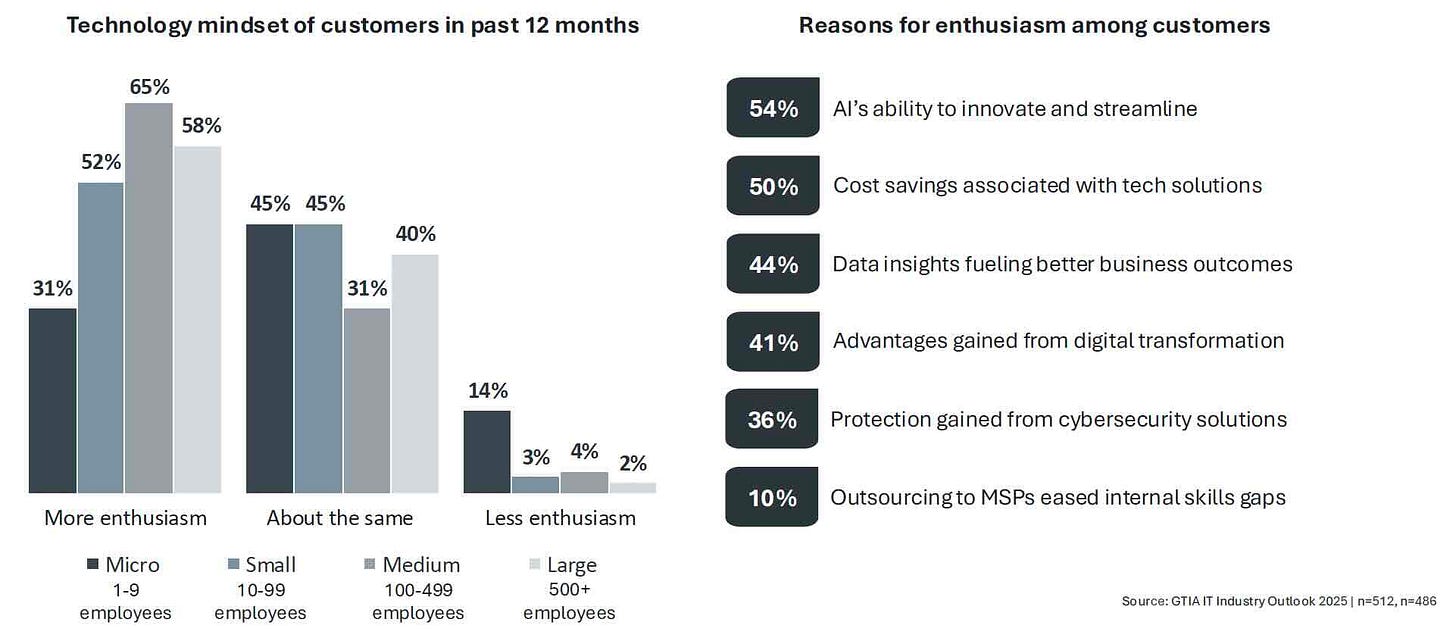

Which is precisely what I discussed with Carolyn April, GTIA’s vice president of research and market intelligence, two weeks ago amid the closing hours of a genuinely miserable week for leading stock indices. According to research she and her peers published in January, end users were enthusiastic about technology last year, and AI was the top reason why.

Two months later, GTIA’s 2025 State of the Channel report suggested similar enthusiasm for AI among channel partners, 53% of whom expect AI services revenue to rise significantly, versus just 41% each for cloud and security services.

Of course, that big increase is off a small base, April notes. Most IT providers weren’t delivering AI services meaningfully in 2023 or 2024. “They were trying AI out internally, seeing if they could automate things,” she says. Some were selling Microsoft Copilot seats and rolling out pilot projects for clients (with mixed results) as well.

“Now we’re seeing the third year of really diving into AI, and finally the channel’s starting to see the possibilities of revenue attainment,” April says. In fact, 30% of partners believe AI will drive higher revenue this year and another 36% foresee it driving both greater revenue and efficiency.

Or at least they did back in December. Is that optimism still merited?

“I find myself in a very difficult position with making any sort of predictions in the current environment,” April says. “I don’t know what’s going to happen.”

And neither, let’s face it, does anyone else. We’d all better get used to it too. “That’s just going to be our reality for the next at least three months and probably longer,” Minton says.

More partners are more satisfied with (slightly) more vendors

One last interesting bit of data from GTIA’s latest State of the Channel study. Last year, the percentage of channel partners satisfied with their vendor relationships was 88%. This year it’s … 88%.

OK, that actually isn’t so interesting until you look closer and see that the percentage of partners very satisfied with their vendor relationships has risen from 30% in the 2024 report to 39% in the new one.

“It almost went up 10 points, which is significant,” April says, “and it had gone up from the 2023 to 2024 in that category as well.”

The reason why, she believes, is an issue she and I discussed last summer. Partners are doing business with fewer vendors lately and enjoying the results.

“Fewer relationships by definition will be better for you because they’re easier to manage and you’ve chosen the ones that you know work best for you,” April says, noting that vendors benefit too.

“The partner’s more invested and loyal to this smaller number of vendors, and so the vendors are getting more out of the partners,” she notes. “It’s kind of a win-win for everybody.”

And will probably continue to be, she predicts, despite the ever so slight uptick in vendor relationships revealed by this year’s data. The number of partners working with 5-9 vendors, for example, has risen from 25% to 28% and the number working with 10-14 has grown from 16% to 20%.

“AI accounts for a lot of that,” April says. New technologies often require new vendors, a fact that partners who prefer fewer vendors to more are discovering.

There’s no ServiceNow for MSPs. Xurrent aims to close that gap.

Large (and even mega) MSPs with hundreds of employees across multiple states are nothing new. It was inevitable, in retrospect, that tools designed specifically for their needs would eventually become available.

Like the one from Xurrent, for example, a name that’s probably new to most of Channelholic’s readership, mostly because it’s a Dutch company that did business under the name 4me from its founding in 2010 to last September.

“We’re kind of the best-kept secret, especially for the U.S. and the North American market, for service management platforms,” says Bryce Roberts, who became the vendor’s global vice president of marketing last month.

Roberts, unlike Xurrent, might be familiar to some of you from his time as VP of marketing first at Axcient and then at ConnectWise after Axcient’s sale to that company last September. That his new employer was looking for a new head marketer and that it chose someone from this side of the pond with deep managed services experience is no coincidence. Xurrent is in the early stages of a big push into what it feels is an underserved segment of the channel—MSPs that have outgrown their PSA platform.

Funded by PSG Equity, which made a strategic investment in Xurrent just shy of two years ago, that effort is the brainchild of CEO Kevin McGibben (pictured), another name that might ring a bell from his ten-year stint leading LogicMonitor to nearly $200 million of ARR. Much has changed for MSPs during and since that time, he notes.

“They’re getting larger, scaling, trying to become more mature, or providing managed services to the mid-market or enterprise,” McGibben says, and many need a broader set of more sophisticated services than PSA systems provide.

“That’s where Xurrent fits,” McGibben explains. “Everything to the right of observability, I like to call it, from incident management through service delivery all the way to the back office.”

Good tools exist for all of those functions, but from multiple vendors. “It’s a really fragmented industry,” McGibben says. More integrated options, like ServiceNow, aren’t optimized for MSPs. Xurrent’s mission is to close that gap.

Getting there, despite the foundation provided by 4me’s software, will take a lot of building and more than a little buying. Early acquisitions include incident management software makers StatusCast last April and Zenduty this February. More, according to McGibben, are coming. In the meantime, Xurrent is integrating the code it already owns and equipping it with an expanding set of AI features in areas like ticketing and sentiment analysis.

“When people are super irate or when their mood is changing, you can view it at the ticket level,” Roberts says. “That gives you a little bit more context as a service professional.” The system’s “workflow wizard,” he adds, generates business processes automatically based on natural language prompts.

“You just say it in plain English and it will show you the workflow that’s going to happen,” Roberts says. “It’s kind of mapping out a canvas.”

Xurrent sells both to partners and through them to corporate IT departments. “For MSPs looking to differentiate and expand margin, Xurrent becomes a high-value extension of their services portfolio,” McGibben says, adding that the system “is perfectly suited for MSPs looking to add co-managed IT projects.”

Truly scrupulous Channelholic readers may recall encountering Xurrent in last week’s post in connection with an expansion of N-able’s Technology Alliance Program. That announcement illustrates what McGibben says is the complementary rather than competitive nature of Xurrent’s current or potential relationship with leading names in managed services software despite its PSA replacement potential.

“There are a number of toolsets that those companies offer that we don’t offer and we don’t plan to offer,” says McGibben, pointing to remote monitoring and management as an especially prominent example.

For the moment, N-able is one of just two vendors Xurrent integrates with. The other (not surprisingly, given that McGibben is still on its board) is LogicMonitor. More will be arriving “in the coming quarters,” the company says, along with a lot of functionality.

“In the mid-summertime, you’re going to see some pretty big product announcements,” McGibben says, followed by big internal integration news in September. Stay tuned here for further details in the months ahead.

For your podcast listening pleasure

I can’t be certain, but McGibben may be the only interesting channel executive who has yet to appear on MSP Chat, the podcast I co-host. Don’t believe me? Check out our recent conversations with Sanjib Sahoo, president of Ingram Micro’s global platforms group, Huntress CEO Kyle Hanslovan, and Sophos CEO Joe Levy. Or listen to the episode that just went live today, which features an interview with Sectigo channel chief Mark Bloom inspired by this recent write-up.

Also worth noting

News came in twos this week. ESET, for example, announced an integration with open-source security platform Wazuh and another with Kaseya VSA X.

ConnectWise named Prakash Talreja its new EVP of engineering and Russell Humphries its new EVP of product management.

Kaseya named Jim Lippie its new chief product officer and rolled out a bunch of new management and security features.

DocuSign introduced a new partner program and AI-powered contract management agent.

Schneider Electric rolled out a new data center consulting service and prize program for students and young entrepreneurs.

I wonder why Nerdio waited until the week after its recent conference to introduce version 6 of its Manager for MSP product.

IT and IoT monitoring vendor Paessler, a pretty big name overseas, now has a North American partner program.

Stellar Cyber has a new partner program for MSSPs.

New Relic has added new incentives, resources, certifications, and customer acquisition opportunities to its already existing partner program.

Better late than never? Mandatory MFA is coming to Microsoft Azure and Microsoft 365 admin center.

Beachhead’s new ComplianceEZ solution documents 68 controls required by NIST CSF, CIS, CMMC 2.0, the FTC Safeguards Rule, HIPAA, and more.

The Veeam Data Platform now offers integrated support for Scale Computing’s edge, virtualization, and hyperconverged solutions.

Darktrace has added new features to its CyberAI Analyst.

Sherweb partners can now protect endpoints from dangerous websites and content using DefensX browser security software.

Cyware has added compromised credential management functionality to its Intel Packaged Solution.

ConnectSecure, a maker of vulnerability and compliance management software for MSPs, has a new Google Workspace assessment feature.

Ketan Tailor is the new chief customer officer at Barracuda.

Longtime Sophos exec Scott Barlow is now the company’s chief evangelist and global head of community.

Torq acquired Revrod, an Israeli AI startup that makes multi-agent retrieval-augmented generation software.

Speaking of agents, cyberfraud vendor DataDome has new security software for them.

Speaking again of agents, Oasis Security, a specialist in non-human identity management, has launched its first partner program.

Add Converge to the list of solution providers offering strategic AI consulting.

Zyxel’s USG Flex H Series Firewall family now combines network and cloud security in one device.