Why You Hate Private Equity

According to Syncro CEO Michael George, it boils down to all the debt your favorite vendors are servicing at your expense instead of innovating.

I’ve never seen an opinion poll measuring how partners of vendors owned by private equity feel about private equity, but I suspect that if one's ever taken the results won't be pretty. Broad generalization, I know, but MSPs by and large hate private equity.

Why MSPs hate private equity was the first question George tackled during a main stage Q&A at the MSP Summit conducted a little after our podcast interview. And it turns out, he said, that as hard as it is to believe now there was once a time when you didn’t hate private equity.

“You all loved private equity until you didn’t,” George said.

Those happier days were maybe 10 to 15 years ago, when PE firms, having just discovered managed services, began pouring money into managed service software makers. George remembers that time well. In 2011, when PE firm Summit Partners bought Zenith Infotech’s RMM business, it named George CEO of the business subsequently named Continuum, and gave him plenty of capital to spend on R&D.

“Our financial partner invested a lot,” George recalls. “They didn’t really focus on profits. They focused on us driving, leading the market, and coming out with very innovative things, which we did.”

So did a lot of other PE-owned vendors back then, which is why if you were an MSP at the time you probably, whether you realized it or not, loved private equity.

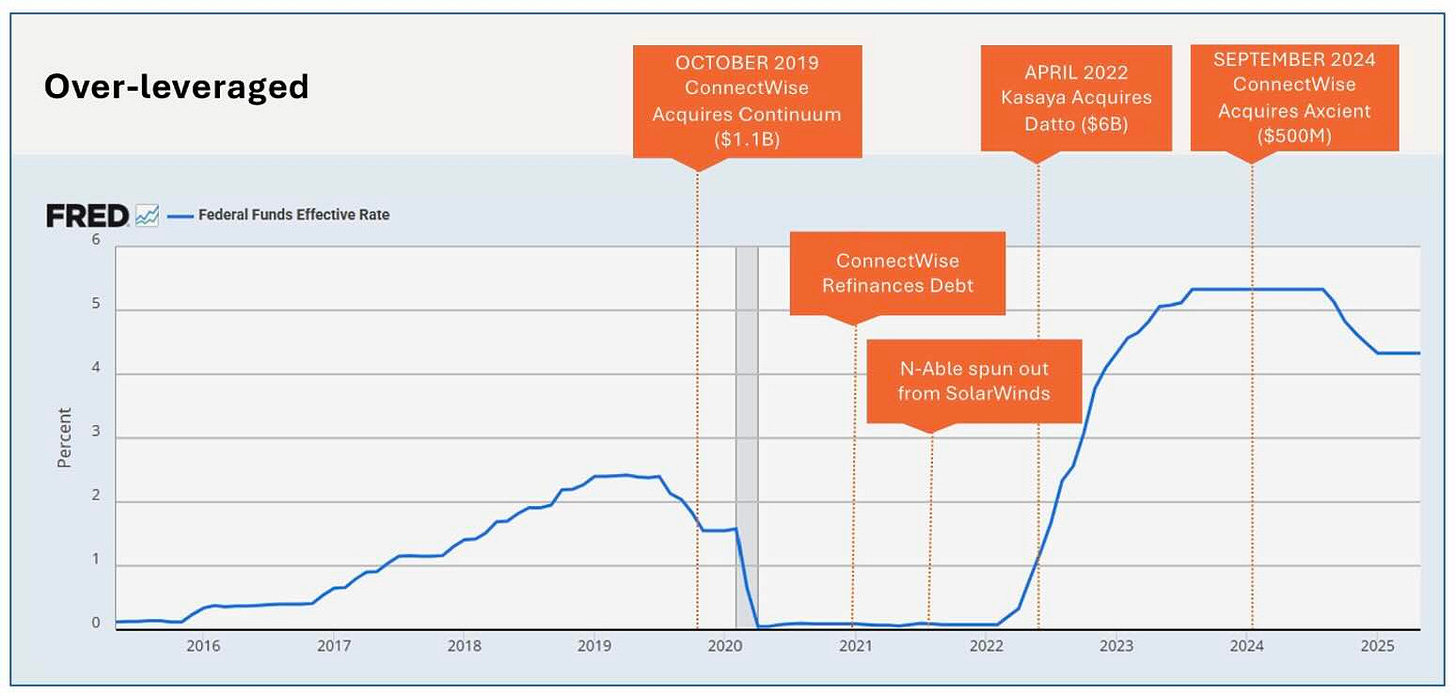

You may well have loved private equity back then too if you sold a smaller managed services vendor to a larger one, as lots of smaller vendors did during an era from the Great Recession through Covid when the Federal Reserve, fearing economic collapse, kept interest rates at 0%.

“Money was free,” George observes, and managed services were hot, so why not spend borrowed money on acquisitions? The answer became apparent early in 2022, when the Fed’s chief concern shifted from stagnation to inflation, and interest rates began climbing.

“When money’s free, that’s great, but now you’re paying 9½, 9¾, nearly 10%,” George says. Kaseya borrowed $4 billion to buy Datto, he adds, which means it “has to throw off $400 million of free cash flow just to service the debt.” ConnectWise, which according to George was sitting on $1.7 billion of debt when interest rates started rising, is in a similar boat, per this slide from his deck:

The upshot, George says, is that the money you pay ConnectWise, Kaseya, and everyone else private equity bought cheap in the go-go days isn’t driving innovation anymore. It’s paying down debt.

“Don’t think the CEOs don’t want to innovate. They do. They just don’t have any capital to do it,” George says. “That’s why you don’t like private equity.”

It’s worth noting that the view from inside private equity, on debt and many other things, is a little different, and that the CEOs of at least some private equity-owned businesses have nuanced takes on the topic too. You’d be hard pressed, though, to find anyone in the audience of an event like the MSP Summit looking to cut private equity many breaks.

Speaking of ConnectWise, is anyone else hearing it has layoffs coming soon?

I’m talking a lot of layoffs, and potentially very soon. Can’t verify that this is for real, unfortunately, but trust me when I say I’m not just passing along standard-issue show floor rumors. Credible people say there’s something big coming, possibly in conjunction with a separate bombshell involving the ConnectWise Marketplace.

Time will tell, but write me if you know something.