Transformation, and Not Just the Digital Kind, is Catching on in the Channel

Data from CompTIA suggests that commoditization and vendors going direct are making smaller tech firms unusually open to embracing new business models.

I’m not a big fan of the term “lifestyle business,” at least when it’s used to imply lack of ambition. There’s nothing wrong with a business that chugs along steadily, allowing its owner and employees to lead happy, financially secure lives.

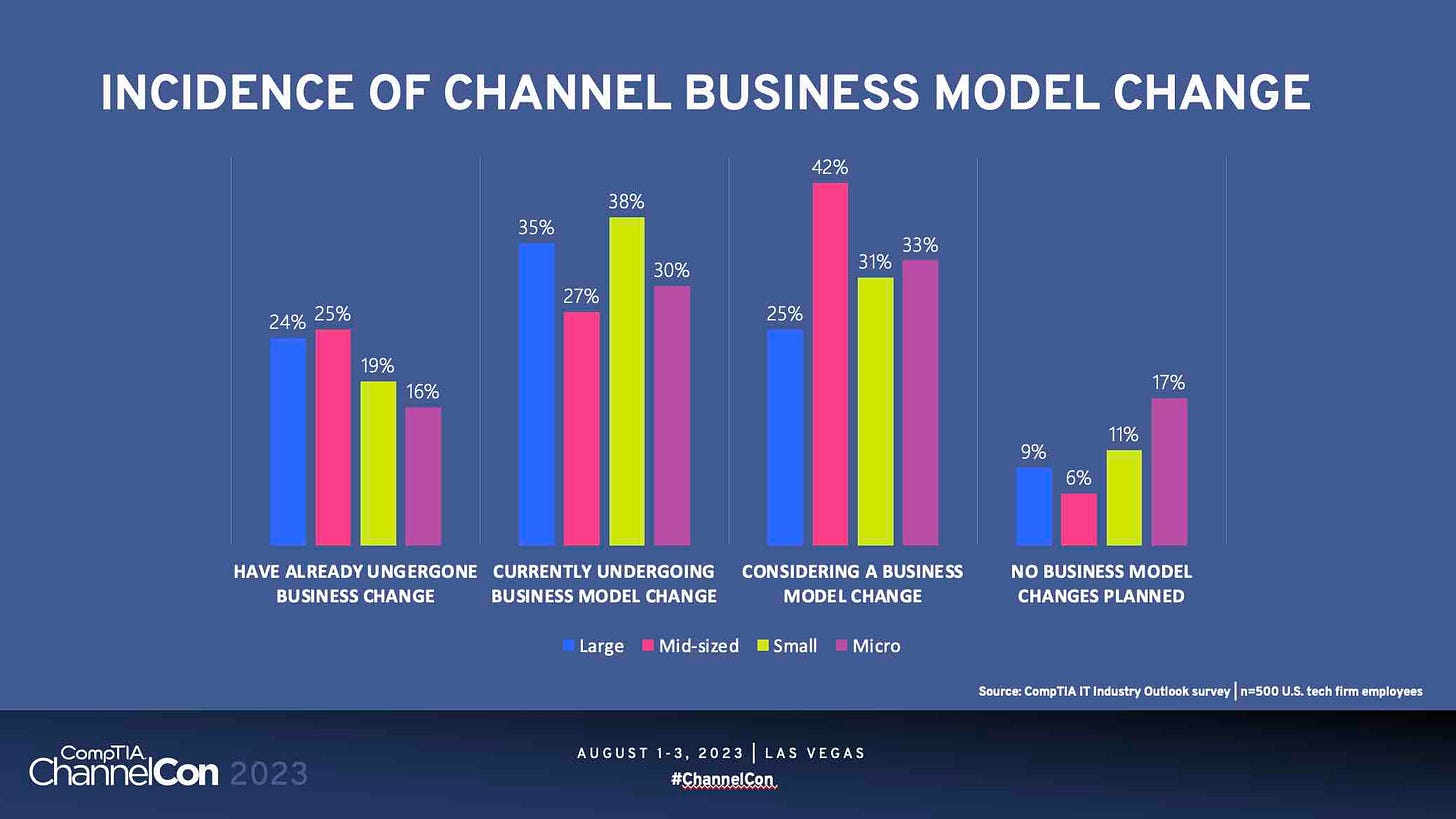

That said, if you’re an IT provider looking for something more than a lifestyle business—like rapid growth and a fat sales multiple when you exit—you’d better learn to adapt what you do and how you do it to changing times. Judging by data CompTIA presented at its ChannelCon event in Las Vegas last week during a panel on evolving channel business models, most solution providers and MSPs know it too:

Nothing in there about large firms surprises session moderator Carolyn April, CompTIA’s senior director of industry analysis. They have a long history of embracing transformation, plus the money pull it off. It’s the fact that everyone else is transforming at roughly equal rates too that caught her eye.

“The small guys are doing it as much as the large guys, or at least they’re thinking about it,” she says.

High up on the list of factors driving that trend is customers buying technology directly from vendors. Indeed, when CompTIA asked IT providers (of all sizes) to list their primary competitors, 46% said “vendors going direct” and 49% said “online marketplaces,” which from a channel partner’s perspective usually amounts to the same thing.

For purposes of comparison, just 35% said “other firms like mine.” Yet declining margins on traditional offerings in an increasingly crowded and commoditized market is a problem for channel partners as well. “They may still provide the service, but they’re not making money off it anymore,” says April (pictured).

So there are good reasons for small and midsize tech firms to change up their business model, and April sees them doing so in several ways. The biggest is becoming an MSP. Hard to believe so many resellers and solution providers have yet to start that process some two decades into the modern managed services era, but only half of the companies CompTIA recently surveyed have managed services in their portfolio at present.

April sees other transformation strategies emerging as well. Some partners are going deep on security or cloud computing, building expertise in vertical industries, or focusing exclusively on clients of a specific size, like mom-and-pop SMBs. Others are developing software or workflows for handling processes like onboarding in especially efficient, customer-pleasing ways. “It’s like they have their own IP,” April says.

The savviest partners though, she continues, are finding ways to co-exist with threatening trends rather than fight them. You’re unlikely to put marketplaces out of business any time soon, for example, but can make good money advising people what to buy there. “They go on to one of the big marketplaces and start looking around and it’s overwhelming,” April notes of SMBs. “They don’t know what to do and there are too many choices.”

Helping businesses customize and integrate applications they buy direct remains a great opportunity to build sticky, strategic customer relationships too. “It’s also lucrative,” April observes. “It’s more consulting type work where you can charge higher margins.”

Don’t let the word “transformation” trip you up either, she adds. It’s perfectly acceptable to start slow and change gradually. “Don’t feel like you have to dive into the deep end of the pool and swim the first day,” April says. “Look at what you’re good at now, and build on it.”

Besides, not doing so won’t necessarily doom your company to destruction, but will make selling it at a price you like harder.

“Not every company has to evolve greatly,” April says, “but I think if you want a successful company, you have to do some forward thinking at all times.”

SkyKick’s going deep on data

I think it’s safe to say that SkyKick, the cloud automation and management vendor, agrees with April, and has a pretty strong take on which of the forward-thinking opportunities she talked about is most worth pursuing.

“If there’s one really big thing that’s going to happen in the channel it’s going to be the mainstreaming of security as a practice,” predicts Harpreet Duggal (pictured), the vendor’s senior director of product marketing. “Three years out, there aren’t going to be mainstay managed service offerings that are not going to have a good security core to them.”

Skeptics, he notes, need only look at how well security software and services have been selling lately in a wobbly economy. And indeed, while worldwide IT spending of all kinds grew just 2.7% last year thanks to high inflation and recession fears, according to Gartner, spending on security climbed 15.8% overall and 16.1% through the channel, per Canalys.

“That’s a statement about where that next opportunity zone is in a market where the mainstream MSP services might have gotten mature enough that they’re getting slightly commoditized,” says Duggal, echoing April’s thoughts.

My conversation with Duggal this Monday came just over a week after SkyKick announced a giant, portfolio-wide wave of enhancements it called “the biggest platform update in the company’s ten-year history.” Two new features in particular jumped out at me, though, not just because they reflect the upside the vendor sees in cloud security but because they also reveal SkyKick’s plans for helping its partners harvest the customer data they’ve amassed over the last decade to avoid the commoditization trap.

The first is an addition to the company’s Security Manager product called “SecurityRadar”. A reporting tool, the new system uses concrete real-world data to show companies how well they’re handling fundamental best practices, user access and permissions, mailbox security, and more, both in absolute terms and in relation to peers. The goal, according to Duggal, is to help MSPs expand cloud security revenue by turning what would otherwise be sales pitches into “richer, intelligent, adult conversations” focused on business risk and business value.

“We’re finding that partners who are taking this more data-driven approach to engagement rather than selling are actually succeeding more, ironically, in opening sales,” he says.

A similar feature called “SmartInsights” lets users of SkyKick’s cloud backup solution quickly prepare QBR-ready analyses of what kind of data clients are producing, how fast they’re producing it, and where they might benefit from some extra data protection spending.

Couple both tools with labor-saving automation functionality that reached market alongside it and you have a recipe for “reducing your cost footprint where the economic headwinds broadly are strong and opening more revenue doors in areas where the data is saying, despite the macro headwinds, people want to invest,” Duggal says.

“We would absolutely want our partners to reduce the tax that they have to pay in just the basic day-to-day grind, and then use that time to have these elevated, more meaningful customer conversations,” he continues. And differentiate themselves from less sophisticated competitors along the way.

Pax8 invests in experience

Allow me to quote CompTIA’s Carolyn April one last time, about marketplaces: “Who the customer is buying from has changed dramatically and has really upped the need for smaller companies to become very good at customer experience and put less emphasis on the sales, the transactions, themselves.”

The same logic applies to larger companies, of course, and perhaps even marketplace operators, including Pax8. As we discussed at length here in Channelholic back in June, the cloud distributor is painfully aware of the increasing tendency among businesses large and small to buy direct from SaaS vendors employing “product-led growth” strategies to scale rapidly. At its Beyond conference, Pax8 outlined a big and extremely bold plan to build a cloud marketplace capable of uniting MSPs, vendors, and end users in a symbiotic win-win-win relationship so mutually beneficial that none of them will see the point of buying direct anymore.

There’s a lot riding on that relationship, and Pax8 knows that technology alone won’t determine how strong it is. “It all has to be grounded in creating this differentiated experience for the stakeholders within our ecosystem,” says Craig Donovan (pictured), who was named the company’s first-ever chief experience officer this week.

Donovan, who joined Pax8 in 2016 and previously led its services organization, is now charged with ensuring that all three constituencies not only use the new marketplace but enjoy doing so collaboratively.

“The role of the chief experience officer is to understand not only each of their discreet and very personal experiences as vendor, customer, and partner, but how that interplay starts to happen and how we can drive a better experience for everybody by working together,” Donovan says.

Collecting feedback via advisory councils, focus groups, and other mechanisms and then sharing that input across the company is a big part of how he plans to fulfill that mission.

“One of our primary roles is to sort of be the voice of those three stakeholders within design sessions,” Donovan says.

N-able’s Q2 financials

We got them yesterday, and you’ve got to like the trend line. The company, which reported 7% year-over-year revenue growth in Q4 of its last fiscal year and 10% growth in Q1 of the current one, racked up 14% growth on an annualized basis in Q2.

Encouragingly, N-able’s revenue growth projections for all of fiscal 2023 keep rising too, from 10-11% two quarters ago to 11-12% one quarter ago, to 13% now.

Broadly speaking, of course, none of this matters a whole bunch to you if you’re not an N-able shareholder, but as we’ve written before N-able is currently the only publicly traded top-tier managed services software maker, which makes it a kind of profoundly imperfect bellwether for managed services as a whole. For the moment, at least, the market looks healthy.

Also worth noting

Very much in keeping with comments here from its CEO in June, Syncro is investing in high-growth MSPs through a new premium Team plan.

Solutions from RMM vendor Atera and sales acceleration vendor Zomentum are now integrated with one another.

RingCentral has a new CEO and new generative AI functionality for its VoIP platform.

Speaking of generative AI, IRONSCALES has shipped a beta release of its GPT-powered Phishing Simulation Testing.

Ryan McCurdy is the new senior vice president and president for North America at Lenovo.

Seceon has acquired big data vendor Helixera and named its founder, Waldek Mikolajczyk, VP of cybersecurity solutions architecture.

Konica Minolta now sells commercial scanning solutions from Epson through its channel partners and office equipment dealers.