The Leap from Automation to Hyperautomation is Coming to MSPs

A new generation of AI-inflected robotic process automation solutions is increasingly performing complex technical processes with minimal human assistance.

Automation is nothing new to MSPs. Since the earliest days of managed services, makers and users of RMM software have understood that productivity is the key to profitability, and automation of technical processes is the key to productivity.

Yet the kind of automation that’s quickly become possible in the last several years is both more profound and more significant than the earlier variety. Drawing on artificial intelligence, machine learning, robotic process automation (RPA), and related technologies, a still young generation of products from equally young vendors like MSPbots, Pia, and Rewst is increasingly performing not just tasks (such as resetting a password) but complex technical processes (such as analyzing and closing tickets) with minimal human assistance.

Gartner calls them “hyperautomation” products and expects businesses worldwide (in managed services and beyond) to spend just over $1 trillion a year on them by 2026. And while they’re making little use so far of headline-grabbing generative AI platforms from OpenAI, Google, and others, those systems have similarly realized just a fraction of their ultimate potential to date.

“We’re very, very early,” says Pia CEO Christian Pacheco.

How early? Pacheco estimates that maybe one to two percent of MSPs globally understand hyperautomation and are on a path to using it effectively. “There’s probably a decent chunk of about 30 or 40 percent that’s sort of trying but have lost their way or given up,” he says. The rest of the market isn’t event talking about it yet.

“There’s still a big opportunity,” Pacheco observes.

Big enough that despite those relatively low adoption numbers, Rewst recently closed a $21.5 million Series A funding round. Charlie Tomeo (pictured), the company’s CRO, and others cite a confluence of factors to explain why MSP automation has begun attracting investments like that:

1. MSPs need it. Mostly because they can’t find enough flesh-and-blood technicians to do the work. “They’re struggling to hire people and keep people in those seats,” Tomeo observes. Indeed, tech industry unemployment in the U.S. was just 2.0% in May, according to data from CompTIA this morning, well below the broader economy’s 3.7% jobless rate.

In addition, private equity investors increasingly view automation as a critical tool for achieving the efficiencies required to justify deals like last month’s $100+ million acquisition of Canadian managed service provider MSP Corp. Younger MSPs, for their part, see automation as a way to accelerate their path to sale prices like that.

“They’re looking at their business and they know they’re never going to be able to scale it by throwing bodies at it, so they’re trying to automate as much as possible,” Tomeo says.

2. It’s easier to use. The automation made possible by RMM solutions has traditionally relied on scripts written by coders. The new managed service automation tools typically come with low-code and no-code development environments. Rewst and Pia both include pre-assembled automations with their solutions as well.

3. It’s easier to integrate with the rest of an MSP’s tool stack. “The main vendors in the sector have significantly improved access to their products with their APIs,” says Pacheco, noting that Pia presently has over 70 integrations in place.

4. The underlying resources it requires are finally available. Delivering hyperautomation remotely without painful latency takes serious IT horsepower not readily available in the past. “The combination of cloud infrastructure and processing power has made it very, very doable now,” Pacheco says.

And all of that is fueling progress at a time when automation solutions rely mostly on RPA versus AI. Pia’s aiDesk solution, for example, uses artificial intelligence chiefly for tasks like chatting with end users, diagnosing tickets, and routing work to engineers. The company aspires to offload entire managed services workflows to AI engines someday though.

“That’s the hard piece, and that’s where we really want to focus,” Pacheco says.

That said, there are limits to how far Pia thinks automation can go even with help from AI. The system handles Level 1 chores today, and is getting increasingly good at Level 2 tasks as well. Going beyond that, though, will be difficult.

“We think that L3 will be really, really hard to automate because of the complexity and usually what’s required from the engineer at that level,” Pacheco says. “But we think we can do a really, really big chunk of L1, we can do a decent chunk of L2, and maybe a little bit of L3.”

The next frontier: NOC and SOC automation

Pia announced new functionality for aiDesk this week that allows users to modify the system’s pre-packaged automations, along with a tool for requesting new features called Pia Ideas and a revised partner portal. The company’s longer-term plans, however, are more ambitious.

“The next big automation piece we’re working on is NOC automation,” says Pacheco (pictured), citing server management and re-running corrupt or failed backups as examples of what that will enable. AI-based surrogates for SOC analysts and firewall admins are slated to arrive as well in a loosely estimated 24 months.

“When your SOC manager’s out for a cigarette or a coffee when an alert comes in, he misses it on his phone, and a particular port is open at a customer’s location, Pia will pick that up, identify it, isolate it, and basically resolve that problem for you,” Pacheco explains.

It’s a rough time to make PCs but a good time to buy them

It just can’t be fun to roll out of bed in the morning knowing that in a few hours’ time you’re going to tell the world that net revenue at the company you help lead dropped 21.7% in its most recently completed quarter. So I’m guessing executives at HP have had better Tuesdays than they did this week.

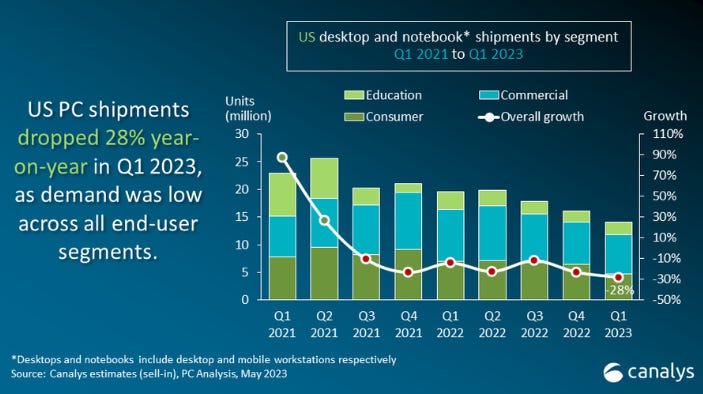

At least they weren’t the only major hardware maker to post brutal financials lately. Dell reported a 23% decline in client device revenue and an 18% decrease in infrastructure revenue yesterday. All of that’s in keeping with even grimmer data from Canalys this week showing PC sales in the U.S. plunging 28% in the first quarter of 2023.

And yet: Canalys thinks we just might be nearing the end of a downward trajectory in PC shipments that dates back to early 2021.

“U.S. PC shipments in Q4 2023 are expected to grow 6% year-on-year while full-year shipments in 2024 are forecasted to be 13% higher than in 2023,” the analyst says.

That’s good news for PC manufacturers but perhaps less good for PC users. Vendors eager to make sales at present may prove less willing to bargain once demand revives. If any of your clients has a refresh coming up late this year or early next year, moving it forward a bit could save them a little money.

Also worth noting

Look ma, no passwords. Cytracom’s ControlOne SD-WAN/SASE solution now keeps users securely behind the firewall all the time and everywhere they go without manual authentication.

CrowdStrike is the newest addition to Pax8’s line card.

Bitdefender now offers a mobile edition of its GravityZone endpoint protection solution.

Proof that crypto isn’t dead just yet: Trend Micro has partnered with SecuX on a “cold wallet” pre-loaded with Trend’s ChainSafer blockchain reputation service.