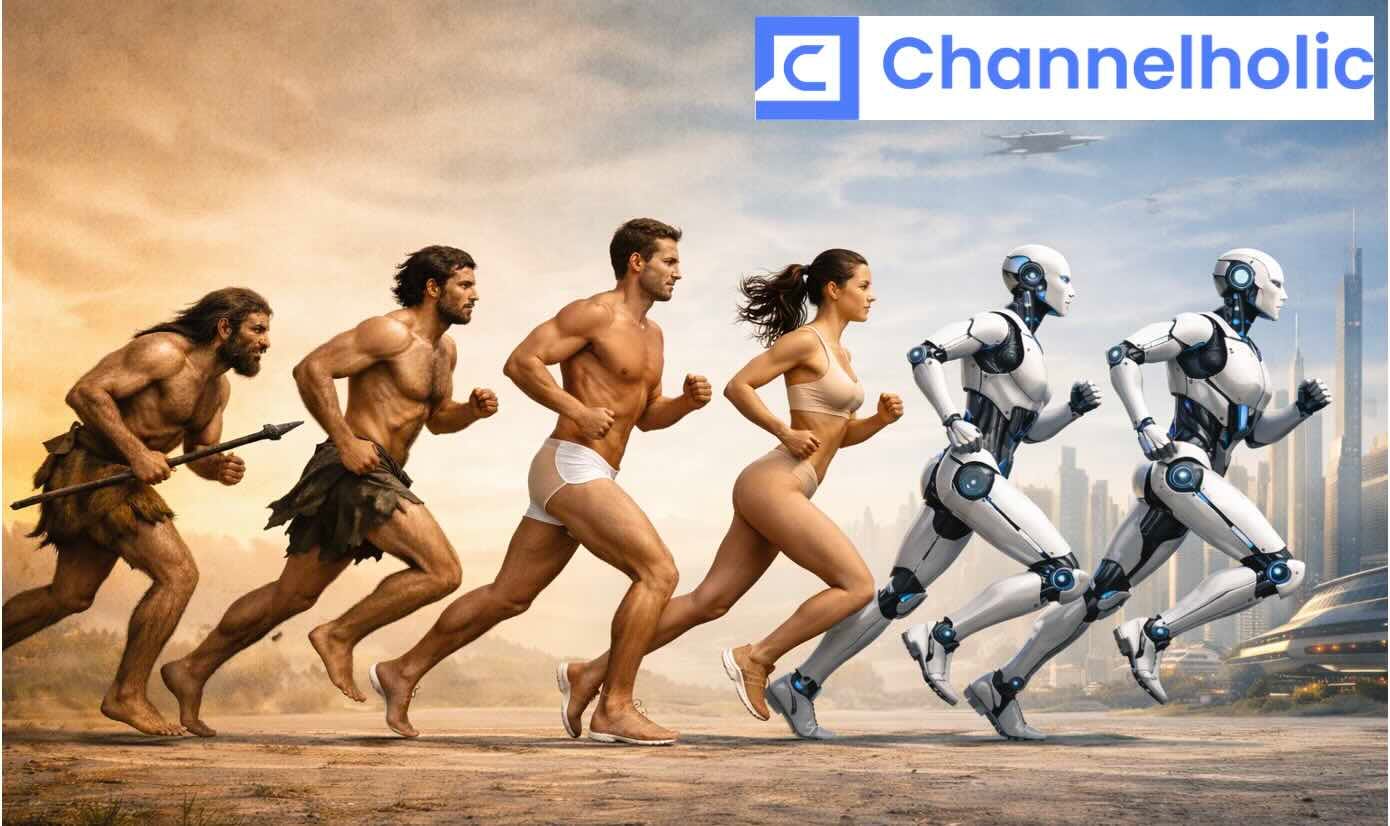

MSPs Need to Accelerate AI Evolution. Distributors Say They Can Help.

And that only they have everything MSPs need to embrace AI, from data to training to financing and more. Plus: How hackers are using AI and weak MCP servers to get faster and more dangerous.

It took somewhere between 2,750 years on the low end and perhaps 8,000 on the high end for evolution to grant Tibetans the ability to breathe comfortably above 14,000 feet.

Unfortunately, no one in the tech industry has that kind of time to evolve for the demands of AI. We don’t even have the half decade or so we normally get to adjust to something big, like the arrival of cloud computing last decade.

“The pace of partner transformation is accelerating beyond anything experienced in prior disruptive shifts,” write Futurum analysts Tiffani Bova and Alex Smith in new research on the matter. “AI-native delivery models, agent-driven workflows, and automation-first operating structures collapse learning curves and execution cycles simultaneously. As a result, the window to reposition is likely 12 to 18 months, not three to five years.”

That would be hard to pull off if we were talking about a stationary target, but we’re not. “AI is changing weekly,” Bova says. “The capabilities are always extending and getting better and faster.”

Indeed, as if to underscore the point, Google dropped a new model more or less in the middle of Bova’s stage appearance during last week’s Global Technology Distribution Council (GTDC) Summit in Oceanside, Calif. Dealing with change that continuous for the foreseeable future, Bova (pictured right) told her audience sympathetically, is a sobering prospect.

“Change is really hard,” she said. “Change is hard personally, and it’s hard in an organization.”

And if this particular change is hard for us in IT, imagine what it’s like for end users. “Many years ago, we might ask our clients to do two to three digital transformations a year,” Bova observed. “Now that’s up above 10 or 12.”

That presents MSPs, solution providers, and their vendors with both a massive opportunity and a massive challenge. The opportunity, of course, is capturing a piece of the $267 billion a year businesses globally will be spending on AI services by 2030, according to Omdia. The challenge is completing an evolutionary process that takes thousands of years in nature and three to five normally in our fast-paced industry in a matter of months.

“It’s happening fast,” says GTDC CEO Frank Vitagliano (pictured left above) of AI evolution. “It’s happening faster than anybody can even imagine. That’s one of the reasons I wanted to get the topic introduced at this event.”

Which he did, by embedding it right in the theme for this year’s show: “empowering the digital evolution”. Despite being decades older than generative AI, Vitagliano contends, distribution is uniquely qualified to do that empowering.

“Distributors are the orchestrators of the ecosystem,” he says. “They’re really the only one that touches all pieces of the ecosystem,” meaning the software vendors, hardware makers, MSPs, solution providers, and resellers who must come together to bring AI solutions to life.

“Nobody else can do that beyond the distributor,” Vitagliano says.

Not surprisingly, the GTDC members I spoke with at the conference emphatically agree. They also, however, make a pretty good case for themselves. Distributors have a long history of providing services that AI solution providers badly need right now:

Enablement: Every vendor on the planet provides technical and sales training for their own products. Distributors tend to do a more thorough job of teaching partners how to build a service practice around products from multiple vendors through offerings like TD SYNNEX’s Destination AI program, Ingram Micro’s Xvantage Enable AI program, and D&H’s Go Big AI program. The last of those educated over 5,000 partners last year, according to Colin Blair, the company’s vice president of cybersecurity and emerging technologies, and this year’s objectives are even bigger.

“We’re going to put a really strong push on AI literacy,” he says.

Discovery and validation: AI solutions involve a lot more than just LLMs, which is why startups in categories ranging from data labeling to security to voice and video generation and beyond are appearing constantly in numbers too big for IT providers to process.

“It’s difficult enough for a partner to keep track of vendors within a space that they know really well, let alone a new and emerging subcategory like AI,” observes Jason Beal, Americas president at security and networking specialist Exclusive Networks.

Even Cheryl Day, SVP of new vendor acquisition and global solutions at TD SYNNEX, struggles with it, and it’s a huge part of what she does all week. “The great news and the challenging thing is we get a ton of vendors coming to us,” she says. “We’re getting overwhelmed.” Separating the contenders in that horde from the pretenders is one of the most useful functions distributors perform in AI right now, Day adds.

“If we’ve already added them to the line card, [partners] know that we’ve already done the vetting, making sure that they’re a real company, making sure that they have a channel program and that they have protection and profitability for the channel community.”

That’s long been bread-and-butter work for distis, Beal notes. “We do a really good job of doing the research, understanding the landscape, and bringing more of a curated portfolio of companies and capabilities to the partners to save them a lot of that legwork.”

Services: Engineering AI solutions takes people with specialized skills. “I don’t think there’s a lot of that resource necessarily running around looking for jobs,” Vitagliano observes drily, and the few who are at any given time demand huge salaries that only the largest IT providers can afford. Distributors can help level the playing field a little by providing access to AI talent on an outsourced basis.

“I think there’ll be a continued push for talent, and I think the distributors have the ability to help,” Vitagliano says.

Financing: Underwriting technology purchases is one of distribution’s most venerable functions. It’s also more needed than ever, Beal notes, at a time when breakthrough AI innovations appear out of nowhere all the time.

“That drives a lot of unbudgeted demand,” Beal observes, which in turn produces demand for financing options that let businesses deploy now and pay later.

Relationships: Distributors and companies like Pax8 talk a lot about self-serve online marketplaces these days, and for good reason. Worldwide spending through hyperscaler marketplaces alone will grow 29.1% through 2030 to $163 billion, Omdia projects, of which 59% will flow through channel partners. All well and good and necessary, according to Beal, but not sufficient.

“I’m telling you, the partners want somebody to talk to,” he says. “They still want relationships.”

Which is why, he continues, Exclusive Networks is a big believer in striking a balance between AI and AIR, as in “authentic interpersonal relationships”.

“We’re still investing in people,” Beal says. “We still want dedicated account management and white glove service, because partners still want to talk to somebody.”

Same goes for TD SYNNEX, moreover, and for Ingram Micro, which is using the time freed up by its self-serve Xvantage platform to forge closer, more personal connections with its partners.

The data moat

As many GTDC Summit goers observed, distributors have one more thing partners badly need in the age of AI.

“The entire thing is dependent on data,” Bova says. “That’s where distribution has a huge advantage, because where does the data live? Data lives with distributors.”

Paul Bay (pictured) agrees, and has been capitalizing on the breadth and depth of data at his disposal pretty much since he became Ingram Micro’s CEO four years ago.

“It’s been an enterprise strategy for us,” he says. Indeed, just two months after he stepped into his current role he and then chief digital officer Sanjib Sahoo hired Mukund Gopalan to be the company’s chief data officer, a title that doesn’t exist at most of Ingram’s competitors.

“That first year,” Bay says of his new job, “was all about getting the data right.”

That effort paid off last year when Ingram launched its Intelligent Digital Assistant (IDA), an AI-powered, data-driven tool that uncovers otherwise hidden partner sales opportunities. Ingram, which reports Q4 financials soon, outperformed the market for the first three quarters of 2025, according to Bay. “A lot of that’s because of what we’re serving up from IDA.”

Which is only one example of multiple ways Ingram is putting its four-plus decades of carefully cleaned data to work and will continue doing so, he adds, in a manner neither hyperscaler marketplaces nor product-led growth enthusiasts can match.

“It’s our competitive moat,” Bay says.

Speaking of data and AI…

Many of you will remember a story about AI system of record startup Lexful several weeks ago that touched on both topics. You know my take on that company’s strategy, but if you want a take from inside the company I encourage you to check out the latest episode of MSP Chat, the podcast I co-host, which features an interview with Lexful CEO Pinar Ormeci.

Sorry, but I still have no idea where tomorrow’s L3s will come from

It’s not easy to stump Constance Hunter (pictured), chief economist at the Economist Intelligence Unit, who during a GTDC Summit speaking appearance guided attendees through a tour de force encapsulation of current financial, geopolitical, and technology trends. Then she took audience questions, the last of which concerned where businesses will get experienced employees once AI has made entry-level employees obsolete. Her reply:

“We don’t have the answer to that puzzle yet, unfortunately, and I think it’s one of the biggest friction points as we go through this technological transition.”

Especially for MSPs, who are increasingly using AI automation tools to do work Level 1 techs used to do. That’s a great way to boost profits, but leaves one wondering where tomorrow’s Level 3 techs will come from once Level 1s become a bygone memory. Which is why I’ve been asking everyone from PE-backed MSP CEOs to expert industry analysts the same question that the guy at the conference asked without once getting a convincing response.

Not that any of those people should be the slightest bit embarrassed by that fact. If Hunter doesn’t have an answer, folks, I’m prepared to say nobody does.

(Unless you do, in which case drop me a line.)

Hackers. They’re just like us.

Still way too early to declare victory, but evidence that AI investments really do pay off is starting to mount. Recent data from Morgan Stanley, for example, suggests that organizations using AI for at least a year are seeing an 11.5% productivity increase on average.

Unfortunately for us, however, criminal organizations are seeing the same benefits.

“Threat actors are using AI and code-generation tools to move faster, speeding up reconnaissance, automating scripting tasks, and standardizing intrusion workflows so that a single operator can operate at much greater scale,” says Alessandro Di Carlo, a product manager at Malwarebytes unit ThreatDown.

The resulting impact is “game-changing”, adds his colleague Kendra Krause (pictured), who became general manager of ThreatDown last August. “We used to report on dwell times in terms of months,” she says. Now it’s more like days.

“It doesn’t take them long to get in, move laterally across the network, figure out what they need to do to encrypt, and set out ransomware or whatever they’re there to do,” Krause notes.

Indeed, in one instance documented in new research from Barracuda, it took a mere three hours for an Akira ransomware attack to go all the way from initial breach to encryption.

Bad enough, but it’s about to get much worse, because threat actors are beginning to take advantage of another productivity tool gaining popularity with legitimate businesses: AI agents.

“We are no longer just seeing humans assisted by AI, but AI agents acting as primary operators,” says Marco Giuliani, vice president and head of research at ThreatDown, adding that they do more than write code. “They manage the entire end-to-end attack stack.”

Or as ThreatDown’s recently published 2026 State of Malware report concisely puts it, “cybercrime has entered its machine-scale era”.

Which is why companies like Exabeam, JumpCloud, Rubrik, and Cisco are rolling out agentic security functionality at an accelerating clip, and companies including Palo Alto, CrowdStrike, and Proofpoint are buying agentic security vendors. ThreatDown, by contrast, sees good old-fashioned managed detection and response services staffed by good old-fashioned experts as a better countermeasure.

“I’ve seen some companies try and talk a little bit more about how they’re implementing AI to offset some of the AI-driven attacks,” Krause says. “I personally think we’ve seen more success where you have more of that human-led MDR. The intelligence that you get out of AI right now from that level of protection isn’t there yet.” As its competitors invest in agentic-specific features and acquisitions, therefore, ThreatDown will invest in expanding the capabilities of its MDR service instead.

“You’ll see us get more into identity and the X [in XDR] levels of MDR throughout this year, as that becomes more and more important,” Krause says.

MCP exploits are no longer theoretical threats

Before we set AI security nightmares aside for the moment, let me feed you one more: Remember when Bitdefender warned us all a few months ago about the theoretical dangers posed by MCP, the wildly popular AI data-sharing protocol? Turns out they’re not so theoretical anymore.

“It’s allowing people to get in and see real, live data,” Krause says. “We’re all kind of relying on and trusting it a little more, and the attackers are finding ways to utilize that and get into networks much more easily than before.”

For example, Di Carlo notes, attackers are successfully using MCP to fool agents into querying internal systems and running administrative commands by sending them instructions through data sources they trust.

“In other cases, poorly secured MCP servers or overprivileged tool connections can allow an attacker to turn an AI agent into an automation layer for lateral movement, credential validation, or large-scale data collection,” he adds.

That MCP enables attacks like that isn’t what worries Di Carlo most, however. “The real issue is speed and scale, because MCP enables attackers to chain multiple actions together and execute them at machine speed, so familiar weaknesses suddenly have a much bigger impact.”

Ultimately, however, the real real issue isn’t MCP itself or even the threat actors exploiting it, because exploiting vulnerabilities is kind of what threat actors do for a living. It’s all the vendors and end users utilizing MCP without securing it properly.

“MCP itself isn’t inherently dangerous,” Di Carlo says, “but when it’s deployed without strong security controls, it can be abused in very practical ways.”

Also worth noting

CrowdStrike has integrated Falcon Shield with the Qualtrics XM Platform to provide automated protection for user activity, configurations, permissions, and data access.

Proofpoint has launched a new partner program designed to provide a simplified structure, stronger incentives, and enhanced deal protections.

FutureSafe is drawing on cyber risk visibility from Cork to provide $500,000 of financial protection to MSPs using Full Stack Heimdal, up from $100,000 previously.

The newest edition of Compliance Scorecard’s flagship solution aims to provide audit-ready, editable, and version-controlled AI outputs rather than “black box” responses.

ManageEngine has added new causal intelligence and autonomous AI capabilities to its Site24x7 full-stack observability solution.

Rubrik has shipped Rubrik Agent Cloud, a governance and security platform for AI agents.

Keeper Security has added centralized privileged access management and credential rotation for Google Cloud Platform to its KeeperPAM product.

AI-driven attacks and organized “cyber cartels” are compressing exploitation windows from days to hours, according to new research from Cynet.

Same issue here too? WatchGuard’s latest Internet Security Report says new malware variants spiked 1,548% between Q3 and Q4 of last year.

Channel media legend Joe Panettieri is now a strategic advisor for SMB security vendor CyberFOX.

Yuneeb Khan is the new CFO at KnowBe4.

Mike Evans is the new COO at mega MSP Ntiva.

Also mega MSP Evergreen says it completed 16 acquisitions in Q4 last year and 47 in 2025 overall, including 33 MSPs.

Backblaze’s new Flamethrower program is designed to get startups the storage they need to move and grow faster.

Scale Computing is acquiring Adaptiv Networks to add cloud-native SD-WAN and SASE capabilities to its managed networking platform.