Happy Days Are Here Some More!

New data from CompTIA suggests 2025 will be a good year for IT, a better year for IT service providers, and a better year yet for AI service providers with the skills to turn products into solutions.

Welcome to 2025! Baby New Year is just a few days old as this post reaches you, but the little guy already has great expectations for anyone in IT. Global tech spending will grow 9.3% in 2025 (versus 7.2% in 2024) to $5.74 trillion, according to Gartner.

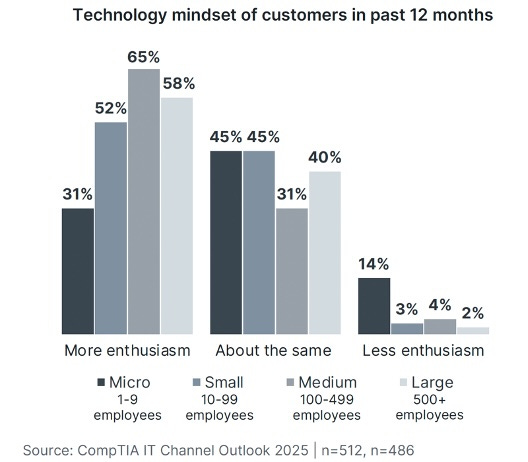

Those numbers align nicely, moreover, with results from CompTIA’s recently published IT Industry Outlook report suggesting that all but the smallest businesses exited 2024 with an even more enthusiastic mindset toward technology than they entered it with.

The net result for the channel, the same study shows, is what can best be described as overwhelming optimism, with 75% of partners reporting a strong or good outlook on the year ahead and just 6% reporting an uneasy one.

That attitude isn’t terribly new either. Pretty much everyone in IT has been upbeat about the future for several years now, according to Seth Robinson, vice president of industry research at CompTIA and a fellow panelist with me last month during a live streamed episode of the Business of Tech podcast.

“Whether we’re talking to IT professionals in any industry or IT channel professionals focused on the products and services that they’re trying to get to their customers, there’s been a pretty high degree of optimism,” Robinson said on that show.

And why not? Worldwide spending on digital transformation is on track to reach nearly $4 trillion by 2027, according to IDC. “They’re using technology for strategic purposes,” says Robinson of end users. “There’s a lot more investment happening.”

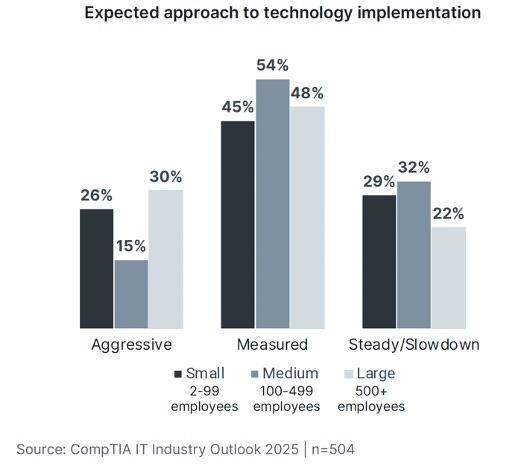

Yet somewhat paradoxically, that same increased investment is responsible for one of the few shadows from CompTIA’s data hanging over an otherwise bright new year. Businesses across the board plan to take a “measured” approach to IT implementation in 2025.

Robinson thinks he knows why. Businesses have bought a lot of software and hardware in recent years, but have yet to integrate it all.

“Any given company has applications all over the place. They’ve got their data all over the place,” he says. “What they’re trying to do is stitch all of this stuff together.” And until they do, buying more stuff is going to hold less and less appeal.

“The environment where all of these technology professionals are operating is getting a little bit more challenging because the decision makers, I believe, are starting to want to know with a little bit more certainty what return they’re getting on all those technology investments,” Robinson says.

Or, in other words, it’s show me the money time. After throwing a lot of budget at a lot of products in the last few years, end users want to see some actual results.

Which brings us, in a roundabout way, to AI. Because if businesses have spent heavily on anything in the last two years without generating clear returns it’s AI, and perhaps AI copilots most of all. According to a September blog post by Forrester analyst Ted Schadler, in fact, 51% of global information workers are employed by a company that’s adopting Microsoft 365 Copilot, ChatGPT Enterprise, or both.

“But so far, leaders tell us, there’s something missing: They seek a clear payoff, and they tell us that they want to know the true ROI in AI copilots in the form of a hard-nosed business case,” Schadler writes.

Findings like that partially account for all the talk lately about the AI bubble that may or may not be forming (depending on which Goldman Sachs you believe), as well as a marked slowdown in spending on data center infrastructure. That’s a category dominated over the last two years by AI-related server and storage procurement that Gartner predicts will grow 15.5% year over year in 2025, a very healthy number that’s nonetheless way down from 2024’s 34.7%.

Not coincidentally, I’d argue, Gartner expects spending on something else—IT services—to head in the opposite direction, from 5.6% growth last year to 9.4% in 2025. Which makes sense, really, if you think about how much was going on in the average IT environment even before genAI came along.

“One of my favorite things to talk about is the complexity of the technology stack,” Robinson says. “It’s gotten very, very complex and so something like AI comes in and everyone thinks, ‘oh, here’s this cool new thing.’ But what AI is trying to do is insert itself into a very complex technology stack and that creates ripples all over the place.”

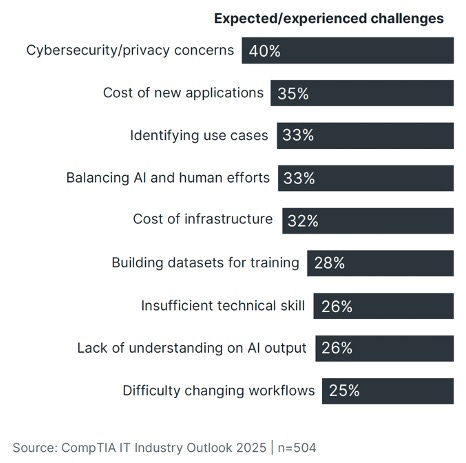

And who better to address technology ripples than a qualified IT service provider? Indeed, at a time of mounting IT complexity, services are the place to be. Just look at CompTIA’s list of the top nine expected or experienced AI challenges:

Two have to do with costs. The other seven all require help from a service provider.

Which, in yet another roundabout way, leads us to the one and only prediction I intend to make for 2025: channel partners who know how to turn a bunch of LLMs, copilots, GPUs, and data lakes into a fully integrated solution that delivers a meaningful business outcome will have been correct to enter 2025 in an optimistic mood.

Before we move on…

Here are three more observations inspired by CompTIA’s report:

1. Data management is a good place for service providers to focus. AI is all about data, and the businesses CompTIA polled need a lot of help with data management. Just 17% of them—regardless of size—are exactly where they wish to be with their use of data, and the list of challenges they’re facing is lengthy:

2. Complexity breeds ecosystems. We’ve been talking a lot in recent months about how almost no one in the channel can be all things to all customers these days, and why the rise of partner-to-partner ecosystems is an essential result of that fact. CompTIA’s data reinforces the point. Fully 90% of the channel firms it surveyed are doing at least a little peer-to-peer partnering, and 81% of those companies are pleased with the results.

3. There are more partners doing business overseas than I would have guessed. We’ve written before about why many MSPs are leveraging offshore labor these days. CompTIA’s research helps quantify how many. Some 46% of the channel firms surveyed in that report used an overseas outsourcer of some kind to augment their workforce in the last year.

But that’s not the only way partners are going global. According to CompTIA’s data, 47% of channel firms did business with an overseas end customer in the last year and 52% worked with an overseas vendor. A look at the reasons why partners are operating globally, moreover, suggests that making money is a bigger priority than saving it.

The emerging class of mega MSPs we wrote about last year has been operating internationally for a while, but they’re clearly no longer alone. At a time when small as well as large businesses increasingly work with suppliers or customers around the world, the potential disadvantages of not thinking globally are something the roughly half of partners who think only domestically should ponder.

A man of my word

I said earlier that I’d have only one prediction for 2025, and I do. Resolutions, on the other hand, are a totally different story. I shared three in the latest episode of the podcast I co-host.

Happy Old Year!

I’m excited about 2025, but will have fond memories of 2024 for a long time to come. Channelholic grew its subscriber base just under 110% last year, and even won an award. In case you’re curious, here are the five posts most responsible for that momentum, stack ranked by page views:

Also worth noting

The Alliance of Channel Women is accepting nominations for an expanded slate of awards through February 7th. You know someone who deserves one of these, and probably several someones. Get in there and nominate.

Speaking of partners thinking globally, World Wide Technology has acquired Softchoice, in part, according to WWT’s founder and chairman, because the acquisition “strengthens our access to Commercial, Small and Medium business customers while expanding WWT’s position in the U.S., Canada, and around the world.”

And speaking of acquisitions, Xerox has purchased Lexmark.

When all the numbers are in, Canalys says, U.S. PC shipments will have grown 6% last year, “a slower rate than previously anticipated, due to weaker momentum in the Windows refresh cycle and headwinds related to macroeconomic policies.”

AI PCs to the rescue? Could be, ABI Research says.