Cork’s Superconnector Cyber Strategy

Once a cyber warranty provider that collected endpoint app telemetry to verify compliance, the company’s now an endpoint telemetry vendor that also offers warranties.

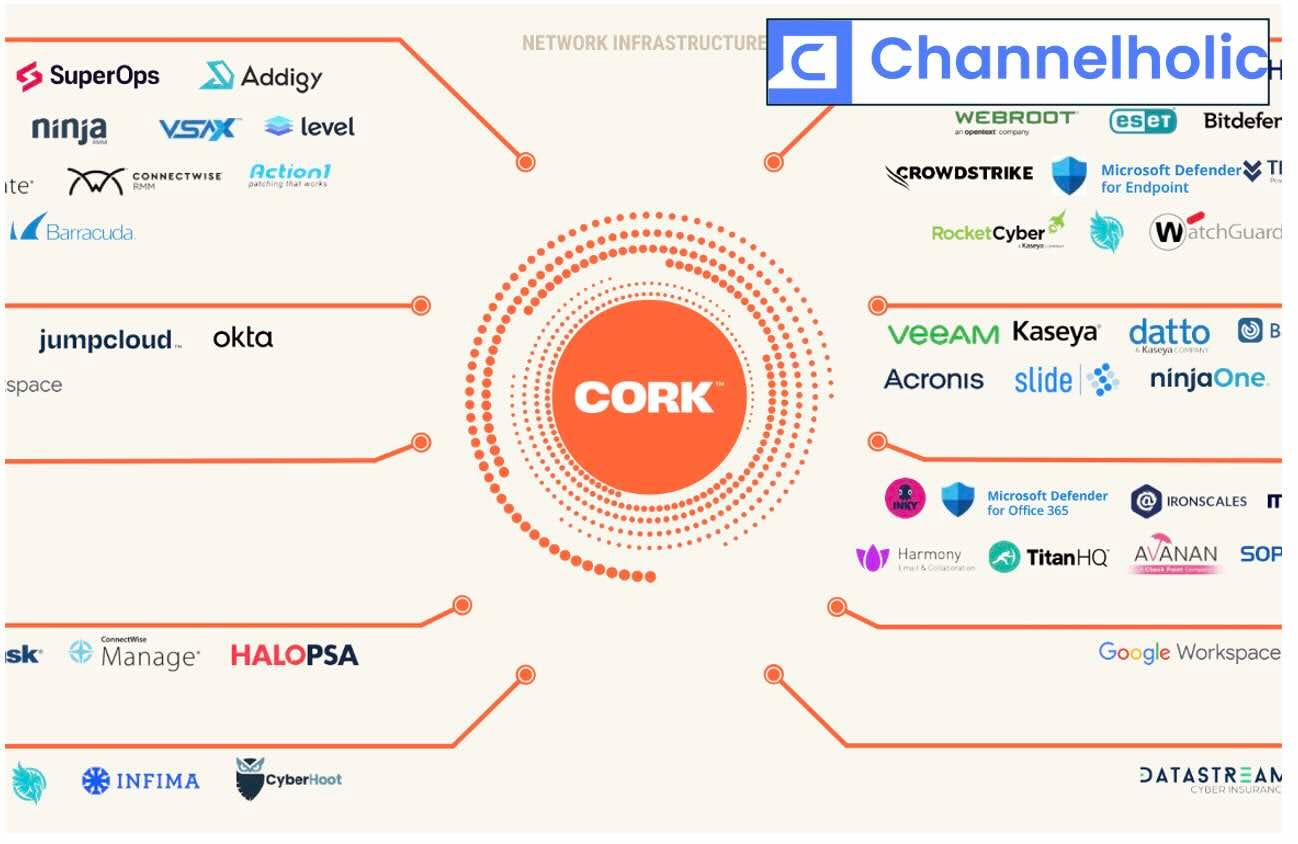

When Cork first opened for business two years ago, it was a cyber warranty provider with an interesting real-time endpoint monitoring tool. When Dan Candee (pictured) took over as CEO about a year later, he saw an opportunity to build something even bigger by promoting that tool—which currently integrates with 93 third-party applications—from supporting player to star of the show.

“I would describe us, especially over the last twelve months, as a superconnector for risk insight technologies wrapped up with financial protection,” says Candee. Cork’s mission has always been to mitigate the impact of cyber incidents, he notes, and warranties help. But the company’s greatest impact happens elsewhere.

“There are very few companies like ours that have the ability to see as clearly as we do what the true security posture is of every single endpoint,” Candee says.

Clearly and thoroughly, it seems. Cork recorded 2.9 million insurance or warranty compliance issues between June 2024 and last month, 2.4 million of which were subsequently fixed by the appropriate MSP. Such numbers have made the company an attractive alliance partner to vendors like Barracuda and OpenText as well as cyber insurance providers like DataStream and now UKON.

The latter deal, announced last month, reflects a strategic pivot on Cork’s part. Early in its history, the company stressed the advantages of cyber warranties, which pay out in days, over cyber insurance policies, which pay out in months if they pay out at all. These days, Candee says, Cork tells a “better together” story about insurance instead.

“I don’t sell cyber insurance, never will, but I know it’s part of the journey for modern businesses,” Candee says.

Hence the free, AI-powered cyber policy analyzer tool Cork rolled out in April, which is designed to expose coverage gaps buried in indecipherable insurance contracts automatically.

“Now what took hours or days takes about a minute and a half,” Candee says. “We’ve created the easy button for partners to now be able to talk about cyber insurance.” And do so without engaging in risky conversations about regulated topics, he adds, by directing customers straight from their report to a licensed broker.

Warranties are still very much in the picture too as a source of nearly immediate financial assistance in the event of a breach. “Within an hour, I’m handing over a virtual credit card of either $5K or $10K,” Candee says. “Within fourteen days, I’m reimbursing partners and clients for all of their out-of-pocket, including wire transfer fraud.” No one has to fight for those funds either.

“We’ve said yes to 100% of the claims,” Candee says.

MSPs appear to appreciate it. Cork doubled its partner count in 2024, according to Candee, and then tripled it in just the first half of 2025.

“It’s been a wild year,” he says.

Meanwhile, in MSP M&A…

Former MSP and vendor exec Juan Fernandez joined me and my co-host on the latest episode of MSP Chat, our podcast, to discuss his new venture, the MSP Owners Group, a newcomer to the mergers and acquisitions landscape. Tune in here.