Cisco Shares Two of the SMB Channel’s Top Priorities: Managed Services and Security

It’s pouring money into both markets, and winning hearts and minds among giant MSPs in the process. Will smaller MSPs follow?

Note: I could have attended the Cisco Partner Summit in Miami this week and called it good. Because I’m an unrepentant channelholic, however, I started the week at the Cisco Partner Summit and ended it at the ConnectWise IT Nation Connect event in Orlando. I’ll have much to say about the latter conference, but given that it will still be in progress when this week’s post goes live, you’ll have to wait a day or two for my bonus coverage containing those thoughts. Besides, as you’ll shortly see, I have plenty to say about Cisco.

Prior to this week, the last time I attended a Cisco conference was 17 months ago. I came home from that trip with both Covid and enormous interest in what the future held for Cisco and its partners in managed services.

That was based mostly on a conversation I had with Alexandra Zagury, Cisco’s vice president of partner managed and as-a-service sales, who led me through a series of investments the company had planned in pursuit of what it believed would be a $113 billion revenue stream by 2025.

If anything, Cisco’s enthusiasm for managed services has only grown in the nearly year and a half since that interview, and as evidence one need only consider that none other than Chuck Robbins (pictured), Cisco’s chair and CEO, devoted quality time to the topic during his keynote at this week’s Cisco Partner Summit.

“It’s a huge opportunity and it’s growing,” Robbins said. “It is going to be a significant percentage of the TAM for all of us over the next few years, $161 billion by 2027 and over half of that coming in networking and security.”

Cisco shared some other impressive figures about managed services this week too. That $161 billion total addressable market, for instance, swells to $357 billion when you factor in partner services. Cisco’s MSP partners are growing at a more than 33% CAGR presently, and 46% of everything Cisco sells will be delivered as a managed service four year from now.

Zagury and her team have been hard at work building products and programs aimed at capitalizing on that opportunity since I last saw her. Cisco now has 18 managed offers for MSPs in areas like cloud networking, intelligent workspaces, and SD-WAN, not to mention a managed firewall service shipped this week and a managed XDR service now in preview.

Available specifically for SMB partners, moreover, is a new collection of collateral, reference architectures, and go-to-market kits called MSP Express that, according to Zagury, helps newcomers to managed services get practices off the ground up to 74% faster. An advanced support program for MSPs of all sizes is due in the second quarter of 2024.

Cisco’s investment in managed services spans beyond sales, marketing, and support as well. “We’re building technology from the get-go with the concept of you delivering it as a managed service, as opposed to you having to figure it out after the fact,” said Robbins during his keynote.

Toby Alcock, CTO of global managed services and solution provider Logicalis, has felt the impact of all that activity. “There’s a lot of investment, actual dollar investment, happening,” he says.

Of course, Logicalis is a significantly bigger company than most MSPs, even in an age of PE-funded giants, and my sense is that the same was true of MSPs at the Partner Summit more generally. Will their smaller peers see, feel, and benefit from Cisco’s managed services push too? I’m still waiting to see.

Security is a suite market for Cisco and MSPs

By its own admission, Cisco was a bit of a laggard in security not that long ago.

“We were losing share. We had not innovated for a while,” said Jeetu Patel (pictured), the company’s executive vice president and general manager of security and collaboration at this week’s event.

So the company did what a $57 billion a year tech leader is uniquely positioned to do in that kind of situation. It pulled out its checkbook and invested, in people (the security organization’s revamped leadership team includes recruits from Palo Alto, Fortinet, and VMware, among others) and products (via deals like the $28 billion acquisition of SIEM, SOAR, and observability vendor Splunk two months ago).

There’s been a lot of in-house development too, including the creation of the XDR service Channelholic told you about some months back and a Security Service Edge solution, each of which went from drawing board to GA in roughly nine months.

“This is a very different Cisco,” Patel said this week. “We have innovated more in the past 18 months than we have in the decade prior.”

The company’s feeling pretty confident coming out of those 18 months too. “I think it’s going to be a three-horse race,” said Patel of the security market, referring to Cisco, Microsoft, and Palo Alto. “Everyone else is a point solution aspiring to be a platform right now.”

And platforms—as in tightly integrated, multi-function suites—is very much what both channel partners and corporate IT departments want, Cisco believes. The vendor’s biggest security-related news at this week’s event, in fact, was the introduction of three tightly integrated, multi-function suites for user protection, cloud protection, and breach protection.

Best-of-breed alternatives to such bundles, according to Cisco, offer nothing but chaos, complexity, and overhead. There are some 3,500 security vendors right now, the company says, and 50 to 70 solutions in a typical customer’s stack. “It’s frankly going to be untenable to continue with the number of vendors you have,” Patel predicts.

He may be on to something too. According to Datto’s latest Global State of the MSP report, just out this week, 74% of managed service providers would like to reduce the number of vendors they work with, up sharply from last year’s also substantial 64%. “Managing too many cybersecurity products,” moreover, was the third biggest security-related concern among survey participants.

Count Jon Jensen, vice president of cyber security sales at managed services heavyweight Presidio, among that vendor-fatigued cohort. “We have six to seven thousand active customers in the U.S. in any given year,” he says. “I can’t take 3,500 different security vendors to that base of customers.”

Logicalis shares the same view. “I think you will see a massive simplification of vendors in our customer space,” says Toby Alcock, the company’s CTO. “Simplifying ultimately leads to reduced cost, reduced cost of ownership, reduced cost of operations, and higher reliability and availability.”

It might yield better protection too, Patel adds. “We spend enormously more money on security than we did 10 years ago, and we have enormously more volume of ransomware attacks than we did 10 years ago,” he says. “Clearly something’s not working, and the reason it’s not working is because it was all point solution based.”

Does only doom lie ahead for the makers of all those point solutions, then? Not necessarily, according to Alcock, noting that point solutions sometimes make financial sense for managed service providers. “MSPs have a slight luxury in that we can do things with automation and at scale,” he says. “If it supports multi-tenancy and we can automate it and we can build into it, I can get return on investment.”

That said, Alcock thinks Patel might well be right about Cisco soon being one of three dominant names in security. “It feels like a pretty safe bet,” he says.

And now, a few obligatory words about artificial intelligence

Because you couldn’t very well expect Cisco to hold a Partner Summit in 2023 without addressing that topic, or expect me to attend a show like that without getting into AI as well.

The biggest AI-related headline out of the show was the introduction of Cisco Validated Designs for AI use cases, which the company developed in partnership with NVIDIA, Intel, AMD, NetApp, and Nutanix, among others. Patel also previewed the arrival starting next month of “AI assistants” for SOC analysts, policy administrators, and others, noting that AI-augmented detections and workflows are in development too.

“We are injecting AI across the entirety of the portfolio,” he said.

I was more intrigued, however, by a point multiple Cisco execs made about what the company more or less considers its secret AI weapon in security, one that buying Splunk will only make more powerful when that deal closes as expected roundabout next September: data.

“You can’t be a credible networking company if you’re not a great security company. You can’t be a great security company if you’re not a great AI company. You can’t be a great AI company if you’re not a data company, and Splunk allows us to be a great data company,” said Patel this week. “There’s no one else in the market that has this kind of data and telemetry in security.”

The impact of all that data, he continued, could be massive, and it’s not just Cisco’s data he has in mind.

“I’ve been in business for 30 years. During the past three decades, every single time when you started thinking about the balance between an adversary and a defender, it always tipped in favor of the adversary. And that was because they had to be right once. You have to be right every single time,” he said. “I think that is tipping now in favor of the defender for the first time, and it’s because we will have a data advantage. You’ll fundamentally have more data that can have better insights generated because of AI that you just simply did not have in the past. And you will be able to outsmart the adversary because you will have more data than the adversary.”

I suppose I could pause here to quote IDC analyst Danielle Ibran, who shrewdly observed during a hallway conversation that data can be a mixed blessing in AI. Businesses have too much of it as often as they do too little. But I think I’ll leave you on an upbeat, sunny, Miami-appropriate note, at a time when the world could use a few, instead.

“I’m actually more optimistic about security today than I have ever been,” Patel says.

Further confirmation that solutions trump plain old services

My last post a week ago drew on research by TD SYNNEX to show how savvy MSPs are using outcome-based solutions to avoid commoditization. That Datto study I referenced above and comments from Cisco Partner Summit attendees both underscore the same point.

First, the commoditization. According to Datto’s survey, 83% of MSPs offer cloud infrastructure design and management, 81% sell office productivity software services, 73% support networking, and 69% provide help desk and BCDR services. You’ll have a hard time standing out from the herd if that list pretty much defines what you do.

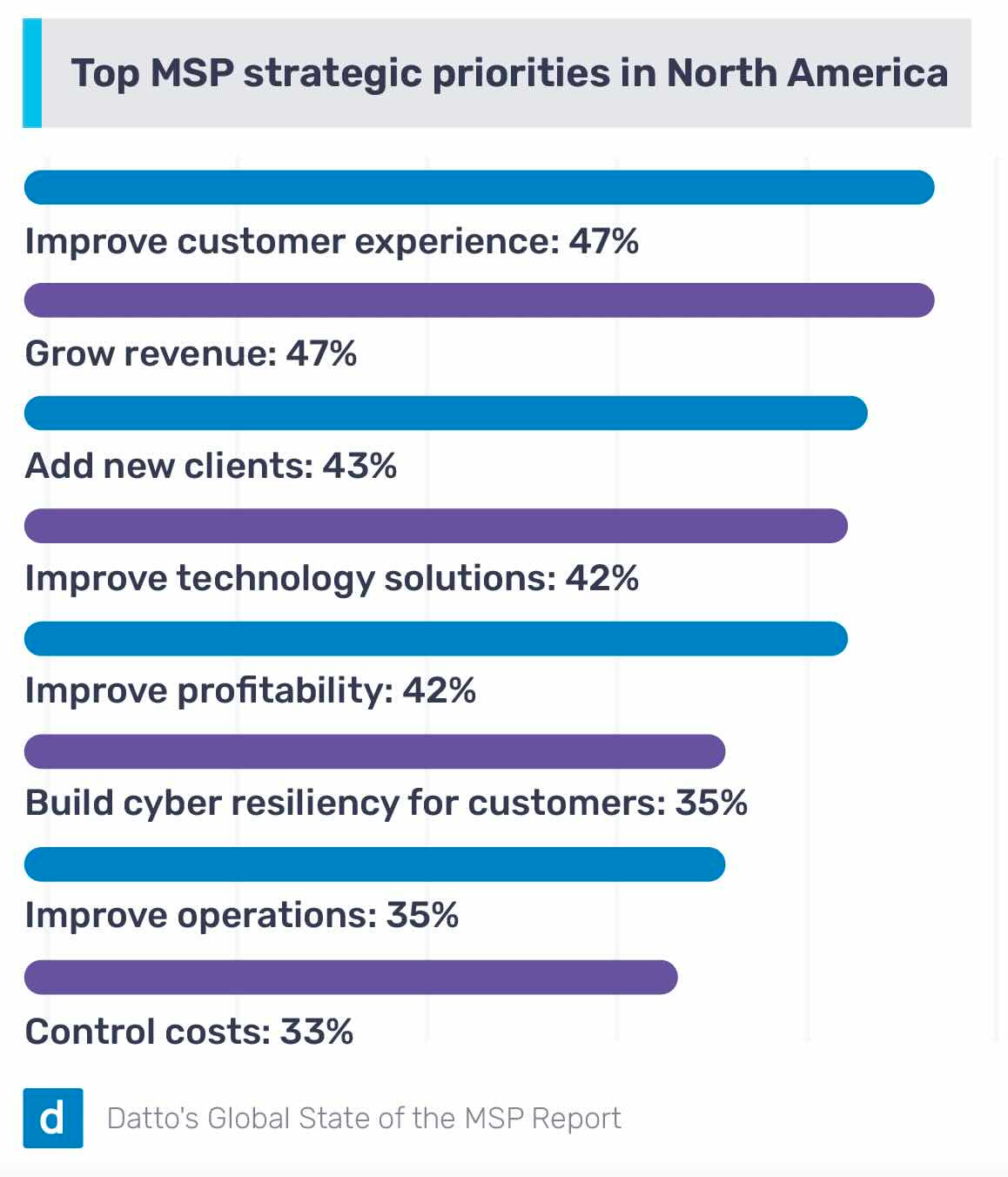

One way to avoid that trap, we’ve long held, is to deliver a stellar customer experience, so it’s encouraging that 47% of respondents to Datto’s poll called improving customer experience a strategic priority. That answer tied for first place with growing revenue, in fact, on a list of priorities that included adding clients, improving profitability, and controlling costs.

Providing solutions instead of generic products or services, however, is at least as potent a route past commoditization. According to Alcock, of Logicalis, it’s also what customers increasingly want.

“When we talk about managed [services] today, our customers are less and less interested in the technology and the speeds and feeds of that,” he says. “They want to know about outcomes.”

Cisco holds the same conviction based on the design of the new SMB partner specialization it introduced this week. “SMBs don’t care about Wi-Fi 6 and zero trust,” said Andrew Sage, Cisco’s vice president of global distribution and small business sales. “They want to know about outcomes, and so the specialization really focuses on outcomes.”

MSPs interested in lasting success should probably focus there too.

Also worth noting

Somehow, I got all the way to the end of a mostly-Cisco post without noting that Rodney Clark, formerly Microsoft’s top IoT champion and (more controversially) channel chief, takes over as Cisco’s channel chief in January.

Not as big as buying Splunk, but one of Cisco’s other three horses in security, Palo Alto, has bought Talon Cyber Security for an undisclosed sum.

Just in time for IT Nation Connect, Nodeware has achieved certified PSA integration with ConnectWise.

SaaS Alerts has rolled out a mobile app for its cloud cybersecurity platform.

Joint partners of Liongard can now get $100,000 of cyber warranty coverage from Cork (who I’ve written about now and again) for as little as $129 a month.

ManageEngine has a brand new cloud-based RMM solution.

LogicMonitor has added a generative AI tool to its observability platform to help users sift through masses of data more easily.

Keeper Security has integrated Keeper Secrets Manager, its storehouse for API keys, database passwords, and the like, with ServiceNow.