Bonus Post: When You Think Platform as a Service, Think AWS, Azure…and ConnectWise

The managed services software leader is using its next-gen application platform to link a giant vendor ecosystem and make some money along the way.

Note: This blog pretty much only appears in your inbox on Fridays. But I was at two events (Cisco Partner Summit and ConnectWise IT Nation Connect) last week, there was much to write about at both, and the ConnectWise event didn’t wrap up until after my last post went out. So here’s a rare bonus post on the ConnectWise show before I return to my normal publishing cadence.

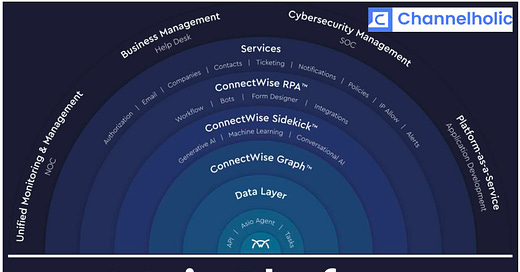

I’ve been intrigued by Asio, the next-generation application platform on the verge of hosting the entire ConnectWise portfolio, since its debut during the vendor’s 2021 IT Nation Connect event. You don’t have to be technical (and I’m not) to appreciate how access to a consolidated data layer and ready-made, plug-and-play services for functions like ticketing, alerting, and notifications could help developers build new products faster and enhance existing ones (by, say, building ChatGPT-based scripting functionality into an RMM system) more swiftly too.

By last year’s IT Nation Connect, I was starting to see Asio as a potential game changer for ConnectWise. Hidden in plain sight from me, however, was a critical dimension of that potential hinted at by Raghu Ram Bongula, the company’s CTO, during an interview during that show: The same foundation technologies that enable ConnectWise to accelerate development could do the same for other vendors too.

“Asio is almost like a platform as a service,” Bongula told me. “It’s a specialized cloud for our partners.”

By last week’s 2023 IT Nation Connect, the “almost” was gone and platform as a service was right there in Asio’s official diagram (see above), along with the newly unveiled AI and robotic process automation components that dominated headlines from the conference.

Those two new services will anchor the hyperautomation strategy ConnectWise is betting its future on, but don’t overlook the significance of Asio-based PaaS in the company’s forward thinking too. CEO Jason Magee touched on that topic during a press briefing last Friday.

“Think about the potential of what could be done with vendors that want to integrate, startups that want to build on top of existing technology in a platform where they don’t have to make the investment themselves,” he said. “That’s kind of where we’re going.”

Not a bad destination either. Sales of PaaS services will climb by just under 21.5% in 2024, slightly outpacing growth in public cloud spending overall, according to data just out this morning from Gartner. Only infrastructure as a service, the analyst says, will post better cloud numbers next year because, you know, AI.

ConnectWise has seen potential in PaaS right from Asio’s start however, even if it didn’t say so very often. “That’s always been there,” says Jeff Bishop (pictured), executive vice president and general manager of product management and Asio at ConnectWise. “We’re just now at a point where all the pieces are in place to really make this a reality.”

The strategic argument for that reality is obvious. Letting vendors use the same integration tools ConnectWise does encourages them to embed their functionality directly in the single panes of RMM and PSA glass ConnectWise offers its MSP partners.

But why think so small, Bishop asks. AWS and Azure aren’t integration platforms. They’re as-a-service innovation platforms for building solutions in the cloud. Why can’t Asio be an as-a-service innovation platform for building MSP solutions in the cloud?

“You absolutely could build a product and put it on top of [Asio] and go advertise on a website somewhere and set up your onboarding wizard that spins up an Asio tenant, and away you go,” Bishop says.

In fact, he expects to see a vendor do precisely that roundabout this coming summer. “We’ll see a company, maybe one of them here, that absolutely will build an entire product from the ground up on top of Asio and not have to talk to me or any of my teams,” Bishop says.

They will have to pay for that privilege eventually, though, just as cloud software makers pay Amazon and Microsoft for access to their platforms. “We’re hosting the infrastructure. We’re running all the security scans. We’re building out everything. We’re going to make sure that it’s five nines from an uptime perspective,” Bishop observes. “There is some cost with all that.”

Make no mistake, though. ConnectWise has more than mere cost recovery in mind. “It won’t be a break even,” says Bishop of Asio’s PaaS offering. “We’re going to make some money off of it. It needs to make good sense to us from a margin perspective as well.”

Sounds a little like the ConnectWise Marketplace, an online storefront for SaaS products from integration partners that saves MSPs time while making real money for ConnectWise.

“We’re certainly in this business to make sure that we’re building a profitable company,” Bishop observes.

ConnectWise is to Kaseya as Microsoft was to Oracle

The contrast between ConnectWise’s vision for Asio and arch-rival Kaseya’s vision for IT Complete, its suite of solutions and services for MSPs, is fascinating. Just weeks ago, Kaseya CEO Fred Voccola reiterated a distinction between “cosmetic” and “workflow” integration familiar to long-time attendees of his keynotes.

“Cosmetic integration is very simple. It’s sharing data through APIs. This is the integration that the entire software industry has been talking about and doing for however long it’s been around,” he said.

“A workflow integration is when two products or two organizations, but it’s usually two products from the same organization, build the application inside of itself. They unify things like database structures, they unify things like architecture. They unify the entire experience. That can only be done…I don’t want to say only. It only is done when one vendor owns both of the products because when you go that deep with another product, you now become dependent on the release cycles of that product. It becomes one, and no two vendors on this planet, Kaseya included, will make that kind of a commitment to something that we don’t own.”

In other words, Kaseya will give you all the cosmetic workflows you can eat, MSPs, because you want them and they want you. But if you’d like to experience real integration and the productivity it enables, you’ll have to buy Kaseya products—preferably via multiyear contracts offering substantial discounts.

ConnectWise, by contrast, prides itself on a diametrically opposed strategy. “We’ve always had that open ecosystem concept,” says Chris Timms, the company’s EVP of growth. “That’s always been a key part of our DNA.”

There’s a reason why too. Kaseya wants to give you everything you need to do business as an MSP in one suite that it owns and operates end to end. ConnectWise believes that’s an impossible goal.

“We’re not going to be the best at everything,” Magee (pictured) says. “We’re sure as hell not going to own everything, and we need the vendors on the solution pavilion floor to continue to invest in partner success. We can’t do it by ourselves.”

According to Bishop, ConnectWise works hard not to reward MSPs for choosing its solutions or penalize them for choosing someone else’s. “Of course we want them to buy our products,” he says. “We think that our products are designed to work best with each other, but if you’re not going to buy our product and you want to use something else for some reason, let’s at least make sure that it’s a great experience.”

Or as great an experience as you’d get using only ConnectWise products anyway. Bishop admits that compliance isn’t perfect, but in-house rules say that ConnectWise developers must use the same APIs its partners do to integrate products. “The integration shouldn’t be cheating,” he says. “We shouldn’t hard code behind the scenes. We should use the APIs just like everybody else will.”

The logic here reminds me of my time at Microsoft 20+ years ago when the company was fighting its way into the enterprise server infrastructure market with a strategy built around assembling IT’s largest ecosystem of independent software vendors. Oracle and IBM might be formidable competitors, we used to say, but they can’t beat an entire industry single-handed.

That strategy worked pretty well for Microsoft in the end, but Oracle and IBM have done just fine in the years since too. Whose plan will prove smarter now, ConnectWise’s Microsoft-esque ecosystem play or Kaseya’s Oracle-esque end-to-end play? Place your bets now and get your popcorn while we all wait to see.

It’s a golden age for (some) MSPs

If you’re a conspiratorial sort, you might just think an MSP invented Covid. After all, the virus that shut down offices and trapped knowledge workers in their homes for months created an urgent, massive need for remote IT support, which is exactly what MSPs had been training themselves to provide for nearly two decades.

As a result, 2020, 2021, and 2022 were three of the best years for managed services in its history, and 2023 is shaping up to be a fourth, according to Peter Kujawa (pictured), vice president and general manager of ConnectWise’s Service Leadership division and one of the industry’s most authoritative sources of MSP benchmarking data.

“It’s a golden era for the managed service industry,” he told me last week at IT Nation Connect.

Yet significantly more golden for some than others. MSPs in the top quartile grew profits by numbers approaching 30% in Q3 this year, Kujawa says. Those in the bottom quartile lost money. All of them. A small portion of the firms in between were underwater too, and a lot of the others saw profits rise 1-3%.

“This is the best time ever for our industry financially,” Kujawa notes. “If you’re not going to make money now, when are you going to make it?”

So why are best-in-class MSPs doing so much better at present than worst-in-class ones? Kujawa has lots of answers to that question, but called particular attention to these five:

1. They’re selling the “full meal deal.” Top quartile MSPs have over 70% of their clients on their biggest, most inclusive service bundle, Kujawa says, versus about 52% of their bottom quartile peers. Sounds like a modest gap, but it’s not.

“There’s a material difference in the efficiency you gain running your operation if 72% of your clients are on your full meal deal versus only half of them,” Kujawa observes.

2. They’re emphasizing managed security. Top-performing MSPs sell more security services to more—if not all—of their customers than lesser performers.

“It wasn’t long ago that advanced managed security was an add-on cafeteria style feature,” Kujawa notes. “There was a menu that the client could select from or not select from. Today, the best in class are way past that. Their fully managed offering includes a ton of managed security services in it, and the client doesn’t negotiate those out.”

3. They’re charging what they’re worth. “The number one mistake that the bottom quartile makes is underpricing their offerings,” Kujawa says. “There’s a belief that if we’re less expensive, we’ll sell more and we’ll be able to outrun any profitability challenges by the volume of new business that we get, and it doesn’t work.”

Top quartile MSPs, in fact, sell comparable services for about 50% more than the bottom quartile, and reap a multitude of rewards as a result. “They’re able to deliver higher quality to their customers because they have better profitability,” Kujawa explains. “They can invest more in tools and the training of their people and all of these things that help you drive quality in your organization.”

4. They’re selective about new clients. According to Kujawa, the best MSPs want only the best customers. “They’re looking for about 20- 25% of the buyers out there,” he says. “Those are buyers that are focused on using technology to achieve strategic goals in their business. They value higher quality IT, they understand the impact if they have a security incident on their business, so those buyers are going to listen to you more as an MSP and they’re going to pay more for the equivalent services.”

The bottom quartile, by contrast, happily signs anyone with a checkbook and a pulse, and suffers the consequences. “You will grow,” Kujawa says of that approach, “but you’re going to lose a lot of customers out the back because you’re bringing in lower-quality customers and you’re not able to deliver the higher quality of services, because you’re not making money.”

5. They’re trusted IT advisors, not techs. We’ve written a bit here recently about the trend toward delivering business consulting expertise versus commoditized management services to managed services clients. Service Leadership’s data further underscores why every MSP should be joining in.“If you’re going to be able to charge top dollar for your services and you’re going after buyers who value IT and the benefit of IT, then you better bring a strategic view to that business and help that business achieve their strategy,” Kujawa says.

It would be unfair to call any of the items on his list a cakewalk for underperformers. It would be equally unwise for underperformers to put off embracing those five best practices. If you’re losing or barely making money now, Kujawa asks, where will you be when the next recession comes, potentially in 2024?

“If you’re bottom quartile or median, you’ve got to focus on one thing and one thing only for the foreseeable future, and that’s fixing profit,” he says. “The knowledge of how to do it is there. It’s just a matter of making the commitment.”

Stay tuned for extensive coverage of my conversations last week with IT Nation Connect expo hall exhibitors, coming soon to www.channelholic.news.